JHVEPhoto

While up 10% over the past year, shares of Discover Financial (NYSE:DFS) have had a volatile journey. Management turnover and rising credit losses weighed on shares in mid-2023 and January 2024, but this was upset by the surprising news that Capital One Financial (COF) would acquire DFS, sending shares rallying. I last covered DFS before Q4 earnings, rating shares a “sell.” While they did indeed fall on the earnings report as expected, the COF bid later caused shares to rally. As such, shares are up 22% since January vs the market’s 17% gain. With Discover poised to report Q2 earnings on July 17th, now is a good time to preview results and review shares.

Capital One Acquisition Overview

Now given the fact that DFS has agreed to be acquired by COF, there may be a tendency to discount DFS’s own results. Indeed, I would expect the company’s shares to exhibit less volatility to results than they have historically. However, this deal does have meaningful antitrust regulatory scrutiny. In the event the deal is blocked, DFS’s stand-alone value is critical to understand.

Under the terms of the deal, DFS shareholders will receive 1.0192 shares of COF for every share they own. With COF trading near $138, that would make the deal worth about $140.40. As of this writing, DFS is trading at about $130.60, meaning there is still about 7.5% upside. This implies that investors are assigning some regulatory risk to the deal’s closing.

While there is a $1.38 billion termination fee in the event either party voluntarily walks away, there is no fee if regulators block the deal. This is somewhat unusual as acquirers typically agree to pay a fee if the deal is blocked when confident in its closing, as HPE (HPE) agreed to with Juniper (JNPR) for instance. COF’s unwillingness to agree to such a termination is likely due to its recognition there will be scrutiny and DFS’s limited bargaining power.

Given COF is almost entirely a US business, it is US regulators, not overseas ones, who matter the most. As of Q1, COF has not altered its expectation for a late ‘24/early ’25 close. It has already submitted its applications to the Federal Reserve and the OCC. Those regulators extended comments through May and will likely take several months more to review the deal. While several politicians have spoken against the deal, I would note that the combined company would have just 13% market share within credit cards, which is not a monopolistic position.

Discover also operates a payments network, which has always been much smaller than Mastercard (MA) and Visa (V). By moving COF onto that network, it will significantly gain heft. As a consequence, it could actually be in a better position to compete against MA & V and increase competition. COF may have to offer regulators a concession of not giving itself preferential treatment on the network over other card issuers, but that is not inconsistent with COF’s goal of growing DFS’ network.

As such, I do view it as highly likely this deal is approved given the credit card market is still very fragmented, and the COF/DFS network is still likely to be smaller than either V or MA. Deals of this size do typically take at least one year to close so I would expect a closing in late Q1’25 or Q2’25.

Discover Financial’s Q1 Results Were Messy

Before considering what DFS may report in Q2, it is worthwhile to review its most recent results. In the company’s first quarter, Discover earned $1.10, down from $3.55 last year. This was almost entirely due to a $799 million reserve for card misclassification remediation. Last week, DFS reached a settlement on its card misclassification issue, which led it to overcharge merchants. This settlement is covered by its $1.2 billion in reserves.

Excluding this item, earnings would have been about $3.30, down less than 8% YoY, as $355 million in incremental net interest income (NII) was offset by a $395 million in provisions for credit losses. Charge-offs rose by $806 million, while its reserve build was $410 million lower than last year.

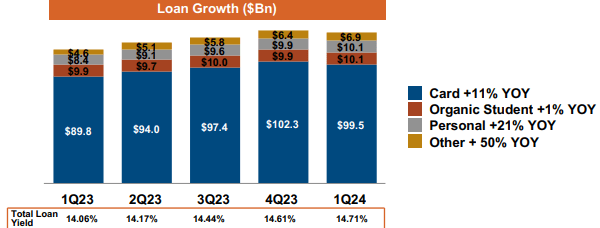

Discover’s net interest margin (NIM) rose by 5bp sequentially to 11.03% as loan yields rose by 10bp and funding costs rose by 5bp, the smallest increase in a couple of years. Deposit betas have slowed meaningfully as flows stabilized after last year’s regional banking crisis. With the Fed set to lower rates later this year, we are likely near a peak in funding costs. As you can see, loan growth has been strong as consumers borrow more on credit cards, which drove most of the NII increase.

Discover

I would not extrapolate the Q1 sequential decline in balances forward. Balances typically fall in Q1. Consumers borrow during the Holidays and then spend loss in Q1; tax refund payments are also typically used to repay balances. These factors mean in Q1 we typically see balances and delinquencies fall. Indeed, delinquencies dropped by 4bps to 3.83%, still 107bp above last year. Frankly, this was a very modest decline given historic seasonal patterns.

In my past write-ups on DFS, I have singled out concerns over its delinquencies as it appears underwriting in 2021-2023 was unduly loose. This very modest decline QoQ has not erased my concerns. During Q1, credit card charge-off rates were elevated at 5.66%.

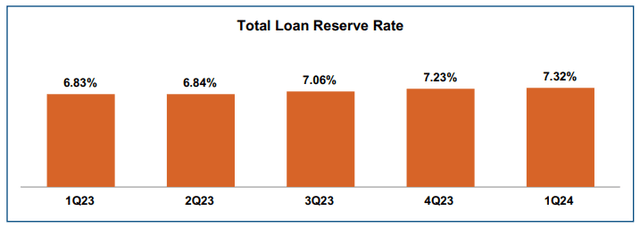

Discover also continues to build reserves. It now has $9.26 billion in reserves. At 7.32% of loans, this is up 9bp sequentially. These reserves provide about 217% of delinquencies. Ideally, I like to see 250% coverage, which would require up to $1.4 billion of incremental reserves. As such, I continue to expect incremental reserve builds.

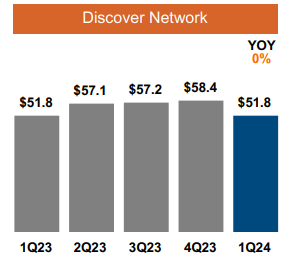

One weak point last quarter that stood out to me was that payment volumes on DFS’s network were flat YoY at $52 billion. With positive inflation and consumer spending growth, this was a surprising performance. By comparison, Visa saw 8% volume growth over its network. This suggests that Discover’s customers are pulling back on spending more than consumers as a whole, likely given a lower-income tilt, a cohort of consumers more burdened by inflation. This pullback in spending is a sign of weakness that may also point to ongoing delinquencies.

Discover

Finally, in Q1, Discover reported a 10.9% common equity tier 1 (CET1) capital ratio from 11.3% in 2023, given its large reserve for card misclassifications. As part of its agreement with COF, DFS cannot buy back stock and its dividend is capped at $0.70. This should allow it to build some capital in coming quarters.

Focus on Credit Trends in Q2

Currently, analysts are expecting $3.07 in EPS in Q2. Now, Discover has missed over the past five straight quarters. As seen by its large legal reserve last quarter and settlement last week, there is a sense Discover is “clearing the deck” ahead of its COF acquisition, essentially completing any negative financial actions to enable a clean path for the combined company post close. There are not likely to be significant legal costs remaining after last quarter’s action, but I do see ongoing risk to credit trends.

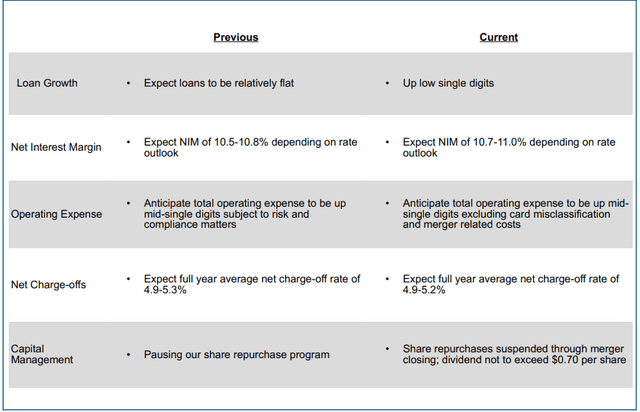

Alongside Q1 results, DFS did refresh guidance. As you can see below, it raised its loan growth estimate, which in turn is widening NIM slightly. Alongside this, it slightly reduced the top-end of its charge-off estimate.

Now in the credit card space, there are two primary reasons for higher loan growth. First, consumers could be spending more and paying it back at the same pace, which increases average balances. Conversely, consumers could be spending about the same but taking longer to pay it back, increasing average balances. The second scenario can be more of a warning sign, as consumers may be taking longer to pay back debt, even as they curtail spending, when facing financial stress.

Given the weakness in Q1 payment volumes, we are not seeing DFS consumers spending more, so loans are rising due to slower payback timing. This is a reason I am concerned delinquencies have not yet peaked for DFS and that we are likely to see a sequential rise. Accordingly, I am less confident in a lower charge-off rate.

With reserves already appearing a bit light and with delinquencies potentially rising again, I expect to see DFS build more reserves in Q2, likely at least $200 million, especially as management may seek to bring reserves up ahead of the COF acquisition, rather than have to make a large reserve adjustment post-close. With such a reserve build, I expect to see earnings in the $2.80-$3.10 area, depending on non-interest expenses and tax rates.

Alongside delinquency trends, I will also be closely tracking network volumes to see if DFS’s consumers continue to spend less than consumers on other networks, which may point to ongoing questions about the health of its consumer. Investors will also be listening for any commentary on the merger timing, but I do not see a shift from the already-announced timeline as likely. I do see risks skewed to a downside surprise in earnings, but results may also be in-line. Given the likely need to build reserves, I would be surprised by a large beat.

Conclusion

At the start of the year, I warned consensus for DFS to earn about $12.50 was likely too high, and consensus has since come down to about $11.40. Assuming two Fed rate cuts and charge-offs at the high end of guidance, I see DFS earning $11-$11.50 this year, depending on how much further it builds reserves. Given my ongoing concerns about the credit risk among its customers, I struggle to value DFS at more than 10x earnings, similar to where many regional banks trade.

This implies a stand-alone value of ~$112, so if the COF deal fell apart, investors would loss about 14% whereas they stand to return about 9% (both returns include dividends) if the deal goes through. I view the deal as highly likely to get approved, but not a complete certainty, so assuming an 80% approval probability, the weighted return is just 4.8%. A one-year treasury bond yields about 4.9%.

Given these risks, that appears to be an unattractive risk-adjusted return. While I expect the deal to go through, the downside if it doesn’t is a reason for investors to be cautious. Additionally, if I am correct that DFS’s credit problems are still increasing, that could begin to weigh on COF shares, which is why I downgraded COF in May.

I view Q2 results as unlikely to provide a positive catalyst but potentially remind investors of the negatives Discover has struggled with. The COF deal likely mutes volatility, but I still view shares as unattractive, and I would be a seller into earnings.