Dogecoin has prolonged its seven-day losses into the previous 24 hours however some holders continue to remain strong. On-chain information has revealed that regardless that Dogecoin’s value has plummeted by 21% within the final seven days, many long-term holders of the meme coin are nonetheless turning a good revenue. Significantly, profitability information from IntoTheBlock exhibits that 83% of pockets addresses holding DOGE are nonetheless within the inexperienced regardless of the recent price downturn.

Dogecoin Profitability Stays Excessive

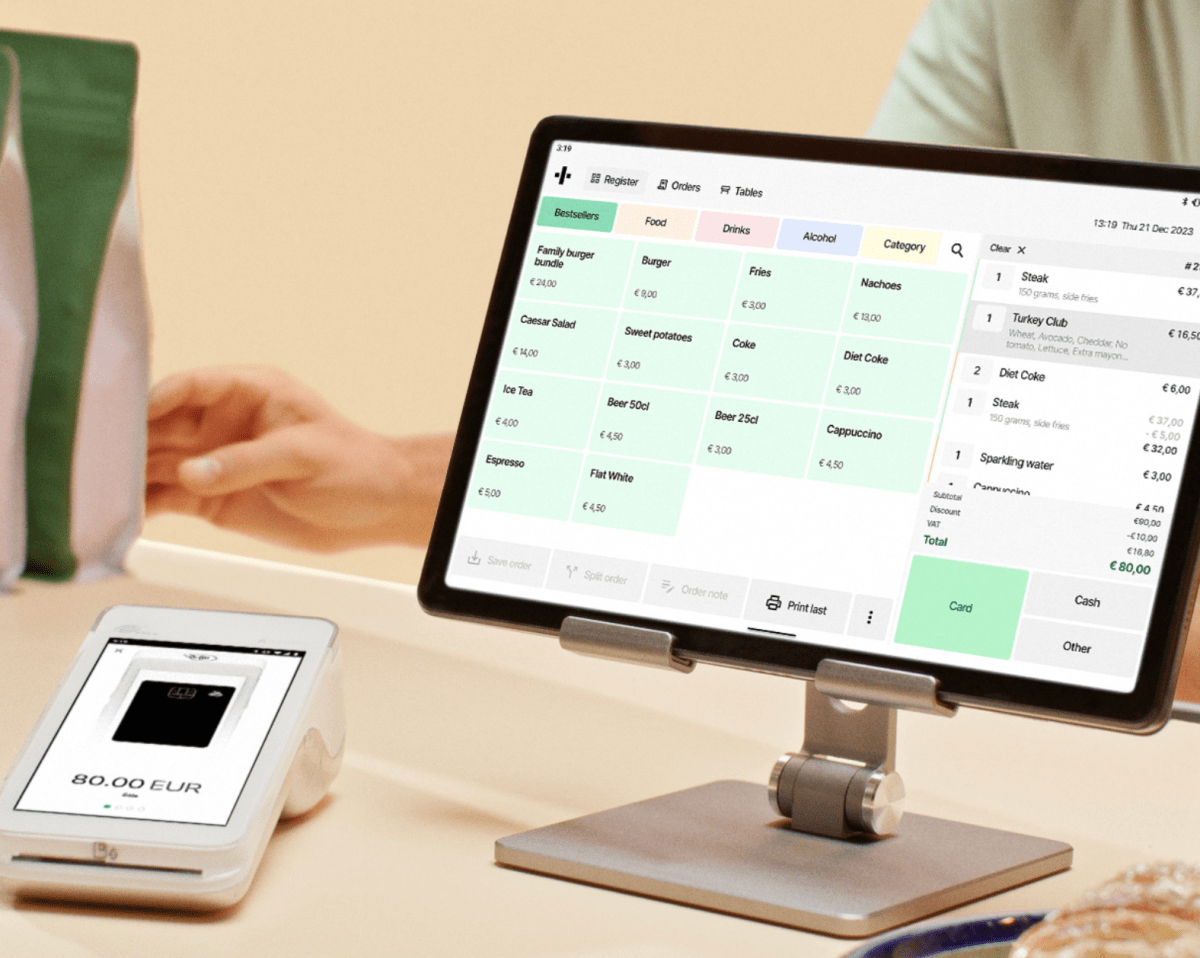

IntoTheBlock’s “In/Out of the Money” metric has proven an attention-grabbing dynamic relating to Dogecoin’s value. The metric measures the variety of addresses nonetheless making a revenue on the present value ranges, giving a glimpse into what is perhaps the sentiment among holders.

On the time of writing, this metric exhibits that 5.18 million DOGE addresses are nonetheless in revenue, representing 82.72% of the full addresses. That is compared to 870,290 addresses at the moment in loss, which signify 13.9% of the full addresses. Apparently, 211,600 addresses, representing 3.38% of complete addresses, are at the moment within the cash, that means they’re neither in revenue nor loss.

Nonetheless, you will need to take into account that this measure seems to be in any respect the addresses. Which means that nearly all of these in revenue are those that purchased into Dogecoin very early on, as demonstrated within the image beneath. A better variety of addresses who purchased in the course of the recent DOGE bull run in March are out of the cash.

Supply: IntoTheBlock

The “In/Out of the Money Around Price” helps to point out the profitability higher, particularly when contemplating the shorter time period. Apparently, a majority (55.26%) of addresses who purchased between $0.132243 and $0.179879 are nonetheless in revenue.

What’s Subsequent For DOGE?

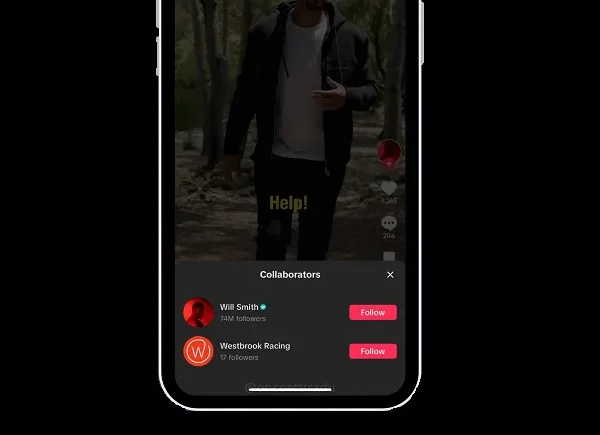

On the time of writing, Dogecoin is buying and selling at $0.1587, down by 4.81% prior to now 24 hours and 21% prior to now seven days. Nonetheless, the excessive profitability regardless of the current downturn signifies that almost all of DOGE holders are nonetheless holding on regardless of the value downturn, which is a optimistic indicator.

DOGE whales have upped their activities with massive transactions amidst the decline. IntoTheBlock data exhibits that $744.62 million price of DOGE has left crypto exchanges prior to now seven days, in comparison with $671.61 million inflows in the identical time-frame. The upper outflow means that there are extra traders nonetheless accumulating in the course of the value dip than these promoting off.

The “In/Out of the Money” metric additionally reveals the variety of addresses that purchased in at a given value vary, serving to to know help and resistance ranges. At the moment, this metric exhibits 111,280 addresses purchased in between $0.169 and $0.189, contributing a minor resistance that DOGE bulls can break easily.

Though a break above this selloff may provoke a minor selloff as some patrons look to take income, the most important hurdle is above $0.18. A full bullish reversal and break above $0.18 would give DOGE a transparent path again to $0.22, which is the best it has reached up to now within the present bull cycle.

DOGE value succumbs to bearish strain | Supply: DOGEUSDT on Tradingview.com

Featured picture from FinSMEs, chart from Tradingview.com