The U.S. Division of Justice filed a lawsuit against Apple Thursday, accusing the corporate led by CEO Tim Cook dinner of participating in anti-competitive enterprise practices. The allegations embrace claims that Apple prevents opponents from accessing sure iPhone options and that the corporate’s actions influence the “flow of speech” by its streaming service, Apple TV+.

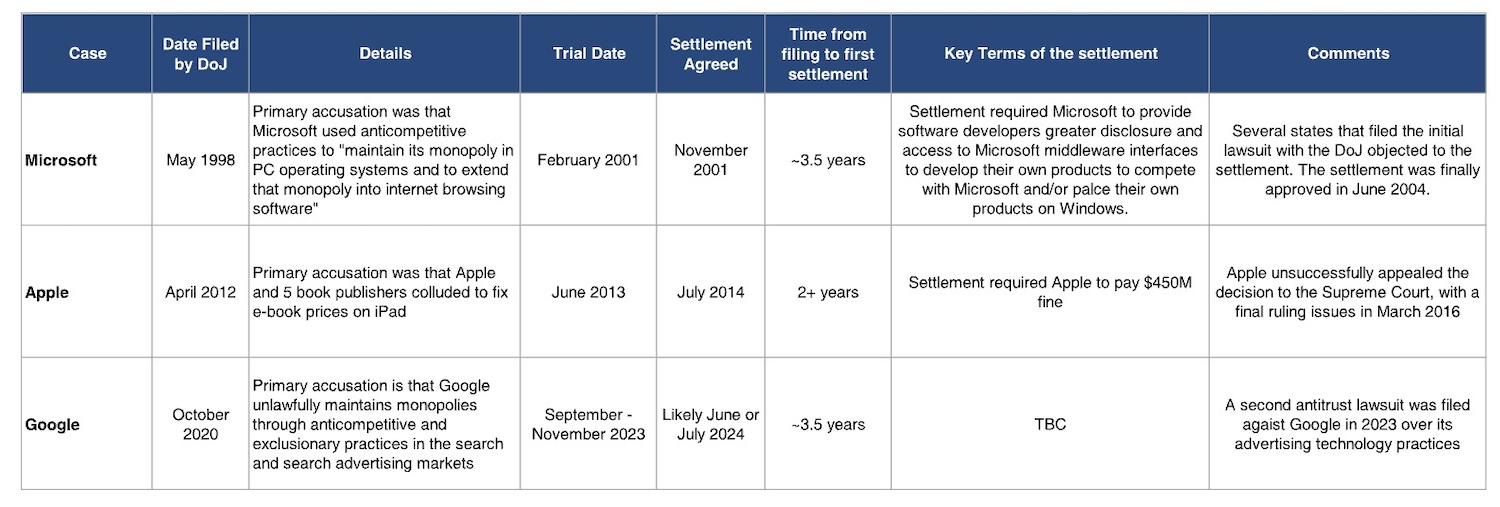

Nevertheless, even when the DOJ proves any of the allegations, it’s extremely unlikely that Apple will face materials adjustments for years, as historical past reveals that such lawsuits typically take a big period of time to achieve the trial, not to mention a decision. The DOJ’s ongoing case in opposition to Google, filed in 2020, solely went to trial in 2023, with no cures or monetary implications anticipated for as much as two extra years.

This isn’t the primary time Apple has confronted authorized motion from the DOJ. In 2012, the company sued Apple for conspiring with publishers to extend e-book costs, a lawsuit that was not settled until 2016.

“Precedents suggest that resolution of the complaint will take three to five years, including appeals,” Bernstein analysts wrote in a be aware.

Morgan Stanley analysts mentioned Friday that the present lawsuit might additionally favor Apple, as many comparable allegations have already been dominated on by a decide within the Apple vs Epic case, with the ruling stating that Apple does not violate antitrust laws. The DOJ submitting additionally made little to no point out of Apple’s profitable search take care of Google and didn’t cite the App Retailer as one among its 5 principal examples of monopolistic habits.

Earlier main antitrust instances. (Picture: Bernstein)

Bernstein analysts added, “While the DoJ’s charges are focused on iPhone, we do not see likely remediation as materially impacting Apple financially or undermining the iPhone franchise: worst case, Apple pays a fine, and loosens restrictions for competition across the iOS platform, which we believe will have limited impact on iPhone user retention or on Services revenues.”

Which led Morgan Stanley analysts to conclude that the DOJ’s lawsuit creates “more of a headline risk than a near-term event risk” for Apple.

They added:

Stated in another way, sure, this lawsuit creates a inventory overhang, however the market has a brief time period reminiscence and in our view, fundamentals usually tend to drive Apple’s inventory value over the subsequent 12 months (and several other years), quite than this lawsuit. We will cite plenty of historic situations the place corporations within the thick of litigation threatening their core product/differentiating worth proposition have outperformed regardless of the authorized overhang: 1) Apple/Epic, the place the inventory outperformed by 15 factors within the 18 months following Epic’s first authorized submitting threatening App Retailer take charges in August 2020, and a couple of) USA vs. Google, the place the inventory has practically doubled for the reason that DOJ first introduced its investigation into Alphabet’s search practices. Our level being, regulation/litigation is a better longterm tail threat for Apple than it has been traditionally, however the underlying drivers of the inventory for the foreseeable future will nearly definitely be fundamentals-based, particularly given this lawsuit may not be resolved till at the very least 2028 (and even 2030) based mostly on previous instances.