Bitcoin has opened the year on a positive note, with positive price action after a negative end to 2025. Price action has stabilized, and a recent break above $93,000 has encouraged positive momentum among traders.

However, not everyone is convinced that this recovery is the return of a sustained bull trend. An interesting technical analysis argues that the entire Bitcoin structure still points to weakness, warning that recent upside moves may be misleading within a larger setup.

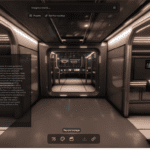

Analyst Says Bitcoin Is Bearish Below SuperGuppy

Technical analysis from a crypto analyst that goes by the name Alex Clay on the social media platform X has cautioned traders against getting carried away by Bitcoin’s recent bounce. In a post shared on the social media platform, Clay noted that despite the positive start to the year, Bitcoin will still continue to trend in a bearish trend as long as the price stays below the SuperGuppy indicator.

According to his analysis, the SuperGuppy, which combines multiple moving averages to define trend direction, should now be viewed as resistance rather than support. Clay noted that Bitcoin’s current structure looks like the previous market cycle in early 2022, where a similar relief rally occurred within a broader downtrend before the price rolled over again. Back then, the relief rally turned out to be a dead cat bounce and Bitcoin’s price action eventually reversed course.

Furthermore, the current setup shows Bitcoin’s market cap is trading close to the EMA 100 on the weekly candlestick timeframe. Since the latest weekly candle is about to close in positive territory, it would be normal to expect an extended upside reaction from this level. However, the analyst views any rebound from the EMA as corrective in nature, expecting it to be short-lived and reverse for another leg down.

Dead Cat Bounce Then Drop

The broader outlook is bearish, but Clay does not rule out further upside in the short term. The projection is that Bitcoin’s price action could still push to the $100,000 level or slightly above. In this case, such a move would be a classic dead cat bounce.

After the dead cat bounce, the analyst projected a downward move where the Bitcoin market cap falls to as low as $1.35 trillion. This scenario translates to a Bitcoin price target just below $69,000 based on the current circulating supply.

From this technical standpoint, the important condition that would weaken the bearish thesis is a sustained uptrend above the EMA 100 and a break above the SuperGuppy indicator. Without that, the analysis suggests that the dominant trend is to the downside.

At the time of writing, Bitcoin is trading at $93, corresponding to gains of about 1% over the past 24 hours and 6.3% over the past seven days.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.