David McNew

Inventory & Trade Snapshot

A number of occasions whereas visiting the Texas Gulf Coast, I handed by a small, unassuming city known as Freeport, and proper earlier than the place the bay waters meet the open ocean and the place the fleets of shrimp boats exit to sea, lies one of many greatest chemical vegetation in America.

That plant is run by none apart from Dow Inc. (NYSE:DOW), and at the moment I will be overlaying its inventory.

In accordance with the company, vegetation like this one assist make attainable among the on a regular basis merchandise we could take as a right: mouthwash, rubbish baggage, cosmetics, paints, and extra.

A number of extra quick facts about Dow, which trades on the NYSE and truly has company headquarters in Michigan, are that it’s diversified throughout a number of enterprise segments similar to Dow Packaging, Dow Client Options, Dow Polyurethanes, and Dow Industrial Options.

For example, one in all their many options is producing industrial-grade cleaning agents for meals, dairy, and beverage processing environments, a needed answer to lowering threat of contamination in meals processing vegetation.

I last covered this stock in early October after I known as it a purchase, and since then the share value has risen practically 4%.

Dow – value since final score (In search of Alpha)

From key market data on In search of Alpha, nevertheless, we are able to see that the supplies sector has not carried out in addition to another sectors, going up simply +9.4% in 3 years, though industrials have gone up practically +25%.

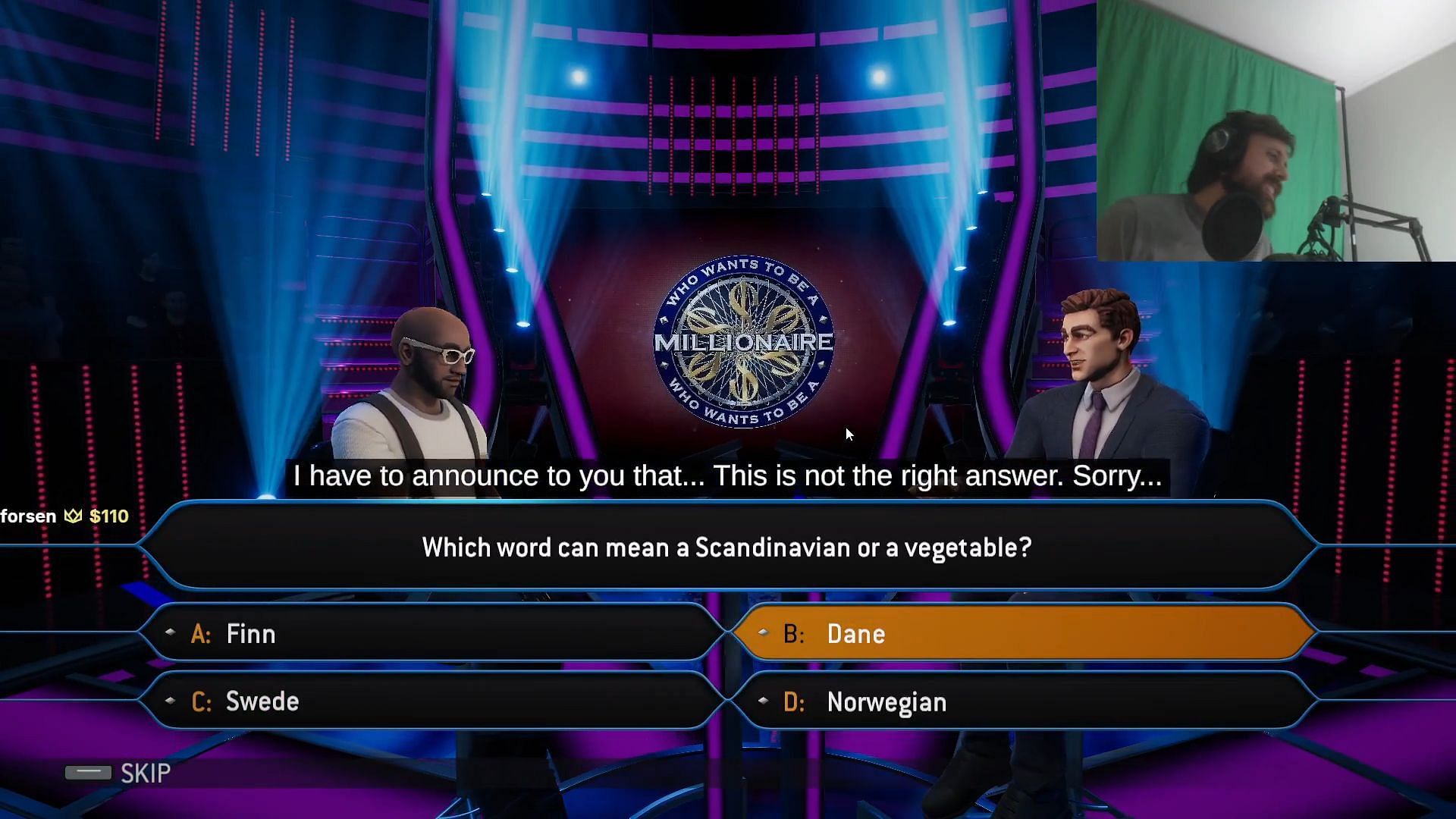

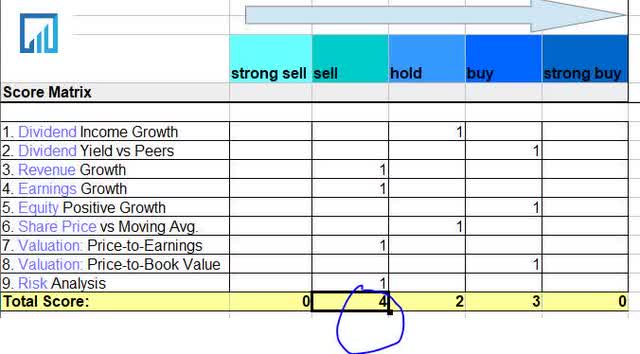

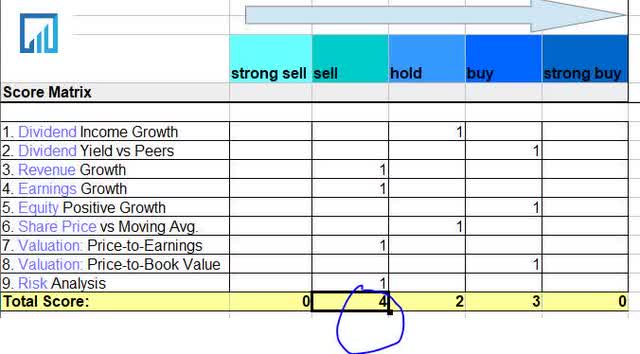

Scoring Matrix

We use a 9-point scoring technique that appears at this inventory holistically and assigns a complete score rating, utilizing a rating matrix. Our strategy focuses closely on accounting statements and follows a logical development to seek out relationships between earnings information, share value, and valuation.

Dow – rating matrix (creator evaluation)

Immediately’s Score

Based mostly on the rating whole within the rating matrix, this inventory is getting a score of promote.

This can be a downgrade from my prior purchase score.

In comparison with the consensus score on In search of Alpha at the moment, I’m extra bearish than the consensus:

Dow – rankings consensus (In search of Alpha)

Dividend Revenue Development

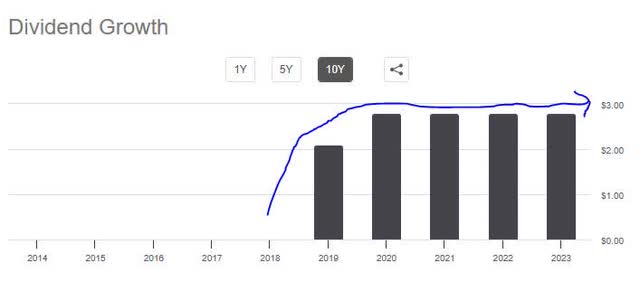

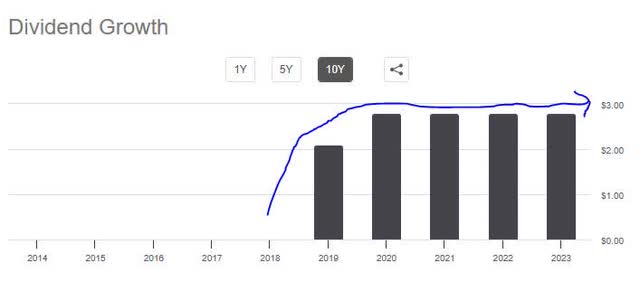

First, let’s discuss dividend income growth potential as an earnings technique with this inventory. We will see the expansion pattern within the following chart:

Dow – dividend progress (In search of Alpha)

The information begins in 2019 when the dividend was $2.10/share/yearly, after which it grew to $2.80 the following 12 months (a 33% progress) and stalled at that price. The truth is, the historical past tells us the quarterly dividend of $0.70/share has not gone up in years.

Trying forward I even have decrease confidence in a dividend hike quickly contemplating that earnings have seen a YoY decline, though the corporate has optimistic cash flow.

I believe the proof on dividend progress doesn’t current a purchase case nevertheless the dividend payout of $0.70/share has been regular with out interruption, so I’m inclined to say maintain.

Dividend Yield vs. Friends

My final protection of this inventory boasted of its engaging dividend yield, and I can achieve this once more as it’s previous the 5% mark.

Nevertheless, I need to examine towards 3 different friends on this sector and choose the very best one or two, utilizing the dividend yield comparison tool:

Dow – dividend yield vs friends (In search of Alpha)

Dow leads the pack with a trailing yield of +5.19%, tied with chemical compounds maker LyondellBasell Industries (LYB), whereas Dupont de Nemours (DD) and Westlake Corp(WLK) are trailing behind with lower than 2% yield.

I’ll reiterate my prior view then and name it a purchase at this yield of over 5%, price snagging particularly now within the bigger setting of extra aggressive yields in non-stocks (CDs, fixed-income, and many others.) and due to this fact of us trying to get the very best return on capital invested.

Income Development

On this half, we are going to have a look at YoY income progress but additionally anticipate what it is going to do going ahead. Because the saying from a well-liked Wall Avenue film goes, I’m right here to guess what the music will do in a month or 12 months from now.

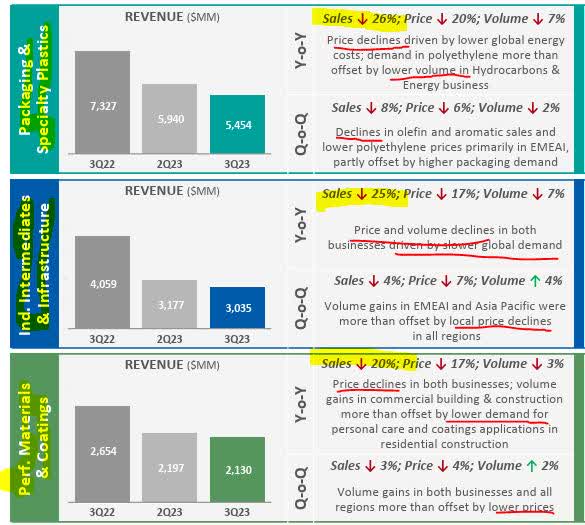

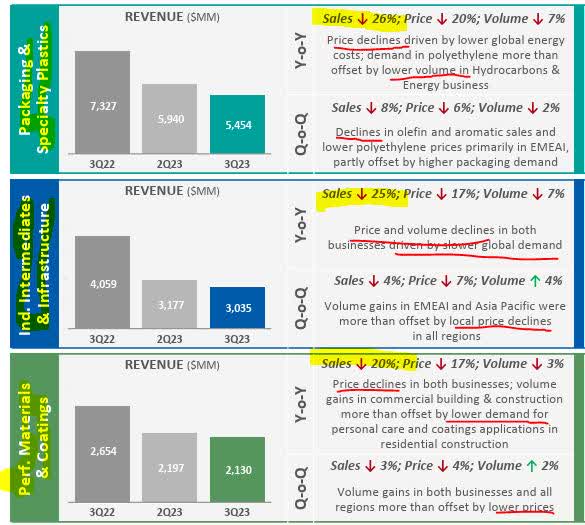

From the income statement, we all know that whole revenues dropped to $10.73B within the quarter ending September, vs $14.11B in Sept 2022, a 24% YoY decline.

That is what the corporate stated in its Q3 remarks as a driver of this:

Declines in all working segments as a result of slower world macroeconomic exercise. Gross sales have been down 6% sequentially, as quantity good points have been greater than offset by decrease native costs.

We will see within the following graphic a working theme of drops in demand and or drops in value, resulting in decrease income tendencies:

Dow – enterprise phase gross sales decline (firm Q3 presentation)

Though the FY23 Q4 results are usually not due out for an additional few weeks, on Jan. twenty fifth, we are able to type an informed guess on the place issues might be stepping into 2024 with this agency.

Simply from the Q3 earnings launch and presentation, I might collect that macroeconomic elements have an effect on this agency, pushed by shopper warning, decrease industrial exercise, weak spot within the EU market, and reduce in world manufacturing indexes.

It’s comprehensible that this may trigger a headwind to an organization that produces supplies that each business and customers buy.

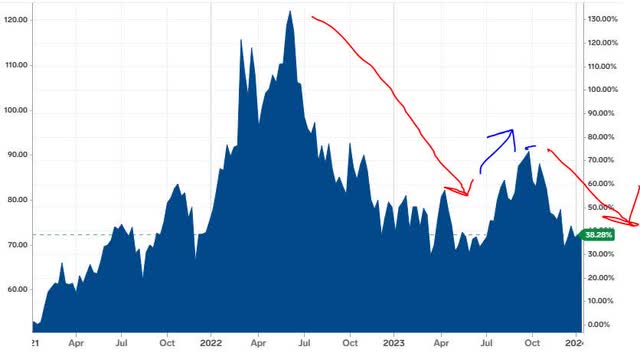

I need to level out that, in line with Statista, the purchasing managers’ index (PMI) has been on a gradual decline within the US since 2021:

Though there was a slight uptick in December within the PMI, it doesn’t essentially level to sturdy progress anticipated for 2024. Here’s what a Jan. 5th article by S&P Global needed to say on that matter:

Some encouragement relating to the near-term world progress pattern may be derived from the slight acceleration in progress throughout December, having been pushed by an elevated in new order inflows, which confirmed the most important rise since final June. Equally, enterprise expectations in regards to the 12 months forward lifted increased in December, additionally putting essentially the most optimistic tone since final June.

Nevertheless, each of those forward-looking gauges stay weak by historic requirements, hinting at sustained sub-par progress.

Subsequently, I’m satisfied the case right here is for a promote, not solely as a result of double-digit YoY income declines but additionally macro elements inflicting headwinds to this firm.

Earnings Development

Now that we mentioned the highest line at nice size, we are going to briefly contact on the underside line.

Based mostly on the income statement, it too noticed a drop to $302MM in earnings (web earnings) in Q3 vs $739MM in Sept 2022, a 59% YoY decline.

It seems whole working bills weren’t big drivers to the decline, as they solely grew modestly on a YoY foundation, 3%. Nevertheless, web curiosity expense grew by 23%. This, together with the drop in top-line income seems to be among the key drivers of bottom-line declines.

I’m satisfied it’s a promote case right here too, as a result of double-digit earnings declines together with a continuation of the excessive interest-rate setting for now and the way that might affect debt prices, in addition to the macro headwinds to income that additionally affect earnings trying forward.

Fairness Optimistic Development

On the fairness entrance, the image is rosier.

We will see from the balance sheet that whole fairness grew to $20.08B in Q3, vs $18.62B in Sept 2022, a YoY progress of seven.8%.

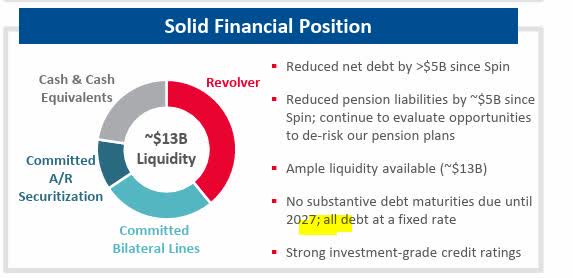

As well as, the corporate boasts of +$13B of obtainable liquidity, no debt maturities till 2027, and robust credit score rankings:

Dow – monetary power (Dow q3 presentation)

On the similar time, I might be aware that long-term debt had gone as much as $14.02B in Q3, vs $12.2B in Sept 2022, for a 16% YoY improve.

Nevertheless, we’re speaking about Dow, an organization with +$58B in belongings, so in relation to that the debt stage is barely 25% of the quantity of belongings this agency has. As well as, the debt stage is significantly down from the $15.8B in March 2021, so on a longer-term foundation it’s on the decline.

The proof, I believe, factors to a purchase on this class.

Share Worth vs. Transferring Common

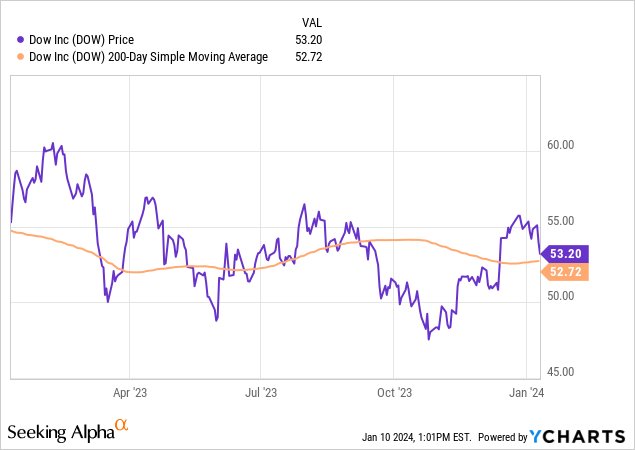

The next is at the moment’s YCharts I pulled, exhibiting a share value of $53.20 (as of this text writing) and its relation to the 200-day SMA of $52.72:

The share value is virtually flat vs the long-term shifting common proper now, having dipped from its current value spike. Nevertheless, additionally it is round $6/share up from its autumn lows, or a +13% value progress since then.

So, it appears what I’ve here’s a firm with double-digit income and earnings declines, a weak macro forecast, and single-digit fairness progress, that’s buying and selling close to its shifting common however double-digits above its autumn lows.

The bigger sectors of supplies and industrials have additionally not carried out strongly as I discussed earlier, and we are able to see from market momentum data that Dow has severely underperformed the S&P500 index within the final 12 months.

I do not assume it makes an important purchase case right here but additionally remains to be too low-cost to simply dump. I say maintain, however with the belief, that it might be a longer-term maintain till the macro impact improves and is mirrored in earnings since there have all the time been macro recoveries ultimately and the financial system goes in varied cycles.

Valuation: Worth-to-Earnings

Right here, we need to contact upon the ahead P/E ratio, from valuation data on In search of Alpha.

We see that the P/E is now 37.32, whereas the sector is simply averaging round 18.

What I believe is driving this elevated a number of is the steep hole between the double-digit earnings decline and the share value that’s double-digit percentages above its autumn lows.

I can’t see why a 37x value a number of could be justified, with that kind of earnings efficiency and a weak ahead macro outlook.

On this peer group, I might choose Westlake Corp. which has a significantly better valuation at 15.8x ahead P/E, though it too has a rift between rising share value and declining earnings.

I’ll name Dow a promote at this valuation.

Valuation: Worth-to-Ebook Worth

Additionally from valuation data, we are able to see the ahead P/B ratio is now at 1.96, just about according to the sector common.

Tying again to the sooner dialogue on share value and fairness, what we all know is there was a big share value progress since autumn however it’s nonetheless close to its shifting common for now, whereas fairness has additionally grown by single digits.

This mixture of share value at or beneath common, together with rising fairness(e-book worth) is what I’m searching for, so I might name this metric a very good purchase case.

Threat Evaluation

We already highlighted the decline within the PMI index and touched upon on a weak macro outlook on this case for 2024, so what’s one other draw back threat this firm can face going ahead?

In an October article in Reuters, it was talked about that a few of Dow’s enterprise segments are affected by the value of oil:

The corporate added it expects to see advantages from rising oil costs within the subsequent few quarters.

Costs of Dow merchandise similar to polyethylene, poly vinyl chloride and different base metals improve on the again of rising crude oil.

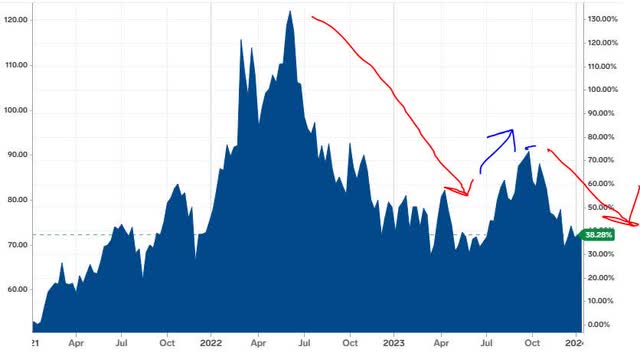

I believe the draw back threat due to this fact is an additional decline in oil costs. On the time of the corporate’s remarks, oil was on a rebound in October. Nevertheless, should you have a look at the chart beneath from Business Insider, oil has dropped since then and going into 2024:

Dow – oil costs (Enterprise Insider)

As well as, a Jan. 9th article by CBC indicated we’re in an setting of oversupply, and expectations of sluggish oil costs trying forward:

Deloitte forecasts the common WTI (West Texas Intermediate) value will stay low by 2026 earlier than rebounding barely within the years main as much as 2030 – nevertheless, costs nonetheless aren’t anticipated to climb over $80 a barrel.

So, along with the opposite macro elements I discussed earlier, the difficulty of oil value I believe will trigger headwinds to this firm’s segments affected by that. Therefore, the case right here factors to a promote, as there may be an excessive amount of not working in favor.

Fast Abstract

To briefly summarize, I’m downgrading this inventory to a promote, from my purchase score final 12 months. On a holistic foundation, the thesis factors to a promote moderately than a purchase or maintain proper now.

It has seen double-digit proportion value progress vs this autumn, though earnings and income have seen double-digit declines, and several other macro elements together with oil costs is not going to be on this firm’s favor going into 2024.

The agency has ample liquidity, optimistic money circulate, and has seen fairness progress too. It additionally nonetheless has a +5% dividend yield.

My portfolio technique on this one could be to reap the benefits of the 4% value achieve since my prior purchase score, take the capital achieve and redeploy elsewhere.

If I have been to have a maintain technique, for dividend earnings functions, I believe I must maintain on to this one far longer than I wish to, as I believe the proof reveals there will probably be extra probability of draw back than upside this 12 months.

For an investor trying to maintain for a few years, it’s nonetheless a stable and well-established firm that I believe might get better when macro elements are in its favor once more, however personally moderately than enjoying that ready sport I see higher choices proper now.