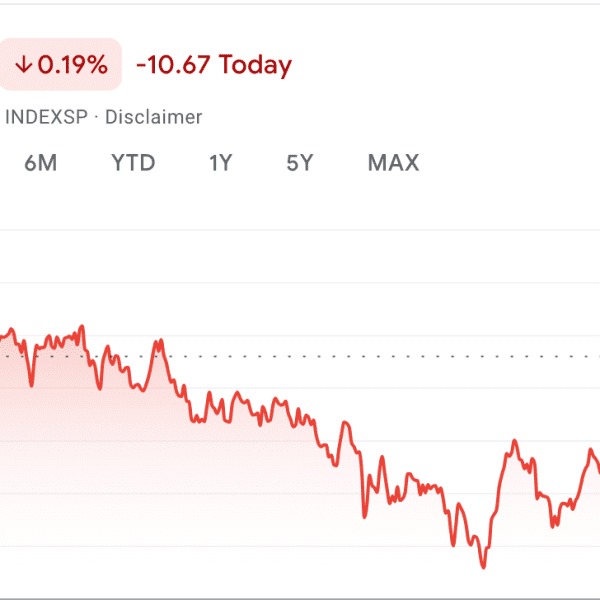

Yesterday,

the Dow Jones opened decrease and completed the day unfavourable following one other sizzling US CPI report.

This has pushed fee cuts expectations additional out with the market now pricing

in much less fee cuts than the Fed’s dot plot. The Treasury yields skyrocketed

throughout the board placing some strain on the inventory market. Now the market

would possibly even assume that the economic system continues to be doing nice, and the Fed shouldn’t be

going to hike anyway, however there at the moment are good causes to see a much bigger correction

to the draw back, so the bulls needs to be further cautious.

Dow Jones Technical

Evaluation – Day by day Timeframe

Dow Jones Day by day

On the each day chart, we are able to see that the Dow Jones has

been buying and selling inside a rising channel and continued to diverge with the

MACD for a

very long time. That is usually an indication of weakening momentum usually adopted by

pullbacks or reversals. Lately, we bought a breakout which opened the door for a

greater correction into the 37128 stage. The value bounced on the primary support stage at

38464 following the goldilocks NFP, however fell again to it following one other sizzling

CPI report.

Dow Jones Technical

Evaluation – 4 hour Timeframe

Dow Jones 4 hour

On the 4 hour chart, we are able to see that

the value bounced on the primary assist stage however bought rejected by the downward trendline and

the blue 8 moving average earlier than

breaking beneath the assist following the CPI launch. The sellers will now have

much more conviction to promote the rallies and we are able to count on a drop into the

second stage at 38043 subsequent. The consumers, alternatively, will need to see the

worth breaking above the trendline to invalidate the bearish setup and place

for a rally again into the highs.

Dow Jones Technical

Evaluation – 1 hour Timeframe

Dow Jones 1 hour

On the 1 hour chart, we are able to see extra

carefully the downward trendline the place we are able to additionally discover the confluence of the

crimson 21 transferring common and the 38.2% Fibonacci

retracement stage. That is the place we are able to count on the

sellers to step in with an outlined danger above the trendline to place for a continuation

of the downtrend with a greater danger to reward ratio. The consumers, on the opposite

hand, will need to see the value breaking greater to begin concentrating on new highs.

Upcoming Occasions

Today we get the US PPI report and the newest US

Jobless Claims figures. Tomorrow, we conclude the week with the College of

Michigan Client Sentiment survey.