E.l.f. Beauty, Inc., the 20-year-old cosmetics and skincare company, has reported continual growth for 23 consecutive quarters—an astonishing growth story. But one prominent short seller thinks the story to be true. According to Carson Block, founder of Muddy Waters, the make-up brand that won over a generation of young women has been inflating its revenue.

In a new report, Block said that over the past three quarters, e.l.f. has “materially overstated revenue” by about $135 million to approximately $190 million.

“We believe that in Q2 FY24, e.l.f. management realized its growth narrative was in trouble as its inventory built; it appears that e.l.f. then began reporting inflated revenue and profits,” according to the report. The company’s inventory also appears materially inflated as a result, the report adds, “to account for cash that has not really come in.”

E.l.f. reported in Q2 FY24 that its inventory was growing, and announced that a recent change to its sourcing practices was responsible for the “sudden appearance” of an additional $36.9 million of inventory, according to Block. E.l.f. said part of the inventory change came from taking ownership of its product on the China side, instead of its previous practice of taking possession only upon delivery to its Ontario, Calif., warehouse.

He and his team at Muddy Waters had a conversation with three of e.l.f.’s global largest suppliers and a former China-side manager. As a result, the firm said that e.l.f.’s claim it changed sourcing practices is categorically false.

“We understand that e.l.f. ‘s longstanding general practice was to take title to goods on the China side,” Block states in the report. “Therefore, e.l.f.’s reported inventory build was seemingly due to insufficient sales—not a change in buying practices.”

Led by Tarang Amin, the CEO and chairman, e.l.f. is a favorite brand among Gen Z, and gaining popularity with millennials and Gen X. At e.l.f. (which stands for eyes, lips, face), most of its products retail for about $6, a fraction of what other brands charge.

E.l.f. ranked No. 3 on the 2024 Fortune 100 Fastest-Growing Companies list released last month. The company reported that in fiscal 2024, it brought in more than $1 billion in total revenue, around 77% higher than the previous year.

The company released its Q2 FY 2025 earnings report on Nov. 6. “This was our 23rd consecutive quarter of both net sales growth and market share gains,” Amin said in the press release.

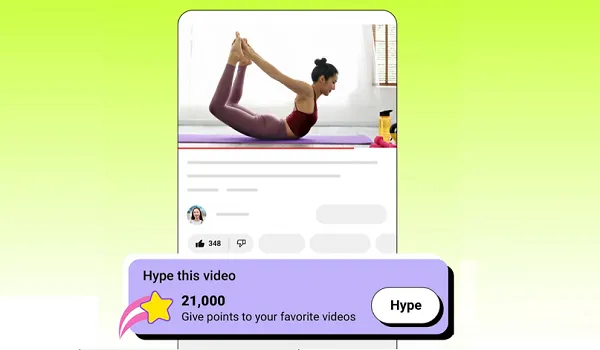

E.l.f. leans heavily on advertising, including Super Bowl ads, and has a big social media presence, and has also worked with beauty influencers. The company has also been leaning into A.I. with a generative-AI-powered social media bot. The CFO, Mandy Fields, said during Fortune’s Most Powerful Women event last month that AI is a collaborative effort, and added that the C-suite reflects upon a question of “how do we become more efficient and make sure that it’s human-led?”

Fortune reached out to e.l.f. for a comment regarding Muddy Waters’ report but didn’t receive a response as of press time.