Stewart Sutton

Investment action

I recommended a buy rating for E2open Parent Holdings (NYSE:ETWO) when I wrote about it in May, as I expected growth to turn positive and robust given the strong execution and signs that the revised strategy was working. Based on my current outlook and analysis, I recommend a buy rating for ETWO. The growth slowdown in 1Q25 was disappointing, but thankfully, it was not due to any structural weakness. It was more of a timing issue that seemed to be well addressed, as ETWO has already closed half of those pushed-out deals. Leading indicators of growth also suggest that a growth turnaround is near the corner. Therefore, I remain confident about my bullish view.

Review

ETWO reported earnings two days ago. Total GAAP revenue came in at $151.2 million, driven by subscription revenue of $131.4 million and professional services revenue of $19.8 million. Revenue growth was disappointing at the headline level, as it missed consensus expectations of $155.1 million. Adj gross profit also missed expectations, coming in at $102.6 million vs. consensus of $107.9 million. This led to poor adj. EBITDA performance as well, down 5.8% vs. 1Q25 to $50.7 million. As a result, adj. net income also fared poorly, declining from $15.9 million to $13 million.

I cannot say that I am satisfied with ETWO results as growth remained negative (in fact, y/y growth decelerated vs. 2H24). 1Q25 also flipped the narrative that ETWO is executing well against expectations given that it missed consensus expectations (vs. beating over the past 2 quarters). However, I am not ready to downgrade my rating as the weak headline growth figure seemed to stem from one-off reasons. The main reason for the poor growth performance was due to some deals being pushed out and longer customer approval processes (due to the weak macro environment). This basically caused a delay in the timing of revenue recognition (now pushed to 2Q25). The encouraging news is that ETWO has closed nearly half of the deals that got pushed out in June, and it is on track to meet internal targets. In other words, given that the deceleration was just 90 bps, there is a good chance that growth would’ve accelerated if not for these slippages. Importantly, given that ETWO has finished analyzing more than 400 major client accounts, I would assume that churn has troughed. In my opinion, this is a very encouraging development, as this aspect of growth headwind has ended, which means growth ahead should benefit from an easy comparable base vs. FY23.

Regarding the slowdown in professional services revenue (growth deteriorated from -18% in 4Q24 to -22% in 1Q25), this was self-inflicted damage that I am actually positive about. What really transpired was that management decided to speed up the implementation of unbilled deals in 1Q25. Because of this step-up, ETWO was able to allocate more resources that were dealing with the current backlog to enhancing the implementations of clients in the year 1 and 2 cohorts that were still not fully benefiting from ETWO solutions. Despite the short-term dip in professional services revenue, I think this is the right decision as it is more important to improve the customer experience, which helps improve retention rates. This is especially true for those new customers that have not fully implemented ETWO solutions (since it is less painful for them to switch now than later).

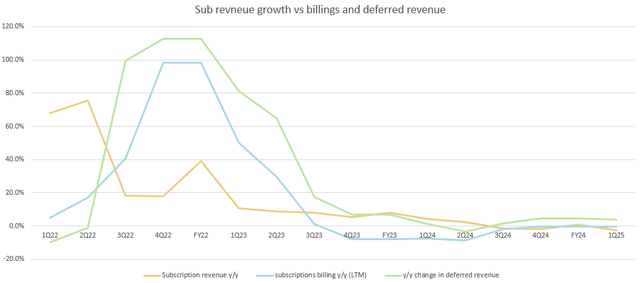

A few other data points also suggest that ETWO’s growth profile has not deteriorated at all. For instance, in the in the last twelve months, subscription billings (subscription revenue plus the change in total deferred revenue) have remained stable compared to 1Q24 (at around $540 million). ETWO current deferred revenue also grew 390 bps in 1Q25, an acceleration vs. 1Q24. As can be seen from the chart above, subscription revenue growth tends to lag these two metrics by a few quarters, and since billings and deferred revenue have inched upwards into the positive region, I believe ETWO growth inflection to the positive region is around the corner.

Valuation

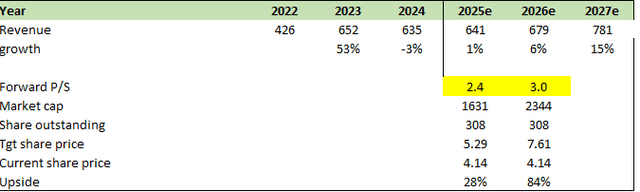

Contrary to how the market seems to digest the 1Q25 results, I remained bullish on ETWO as there are no major changes to the growth outlook. The slowdown in 1Q25 was not due to structural weakness, but was due to timing. Importantly, I now feel more confident about ETWO’s growth outlook as it has redirected more resources to step up implementation for existing customers (this should allow for faster revenue recognition). Hence, I have upgraded my growth outlook by 100bps across the forecast period, making the near-term assumption that ETWO will achieve the higher end of its FY25 revenue guidance.

Based on my assessment, I am not seeing any strong reason why ETWO should trade down from May’s level, as the growth outlook remains positive and leading indicators are pointing to a turnaround in growth soon. As such, I continue to believe that ETWO multiples can inflect upwards. In the near term, I think it is very likely that ETWO will see an inflection back to 2.4x (where it traded in May 2024) when growth turns positive, followed by a recovery back to 3x (the midpoint of 2.4x and 3.6x – ETWO historical average) as growth further accelerates.

Risk

I gave ETWO the benefit of the doubt that the slowdown in growth was due to timing rather than a structural weakness. However, if this continues to repeat for the next two quarters, it could be a sign that underlying demand has weakened. This could be a disaster for the stock as the market starts to price, causing further delays in growth recovery. Additionally, given that management has redirected resources to step up implementation for existing customers, if this is not balanced well against winning new logos, it could result in poor new customer growth, which the market may see as signs of weakness again.

Final thoughts

My recommendation is still a buy rating for ETWO. Despite the slowdown in growth on a headline basis, my review shows that it was due to deal delays. These challenges appear to be addressed, with half of the delayed deals already closed. Leading indicators like stable subscription billings and growing deferred revenue suggest a potential growth inflection point is near. While the market may have reacted negatively to the short-term results, I maintain a bullish outlook on ETWO.