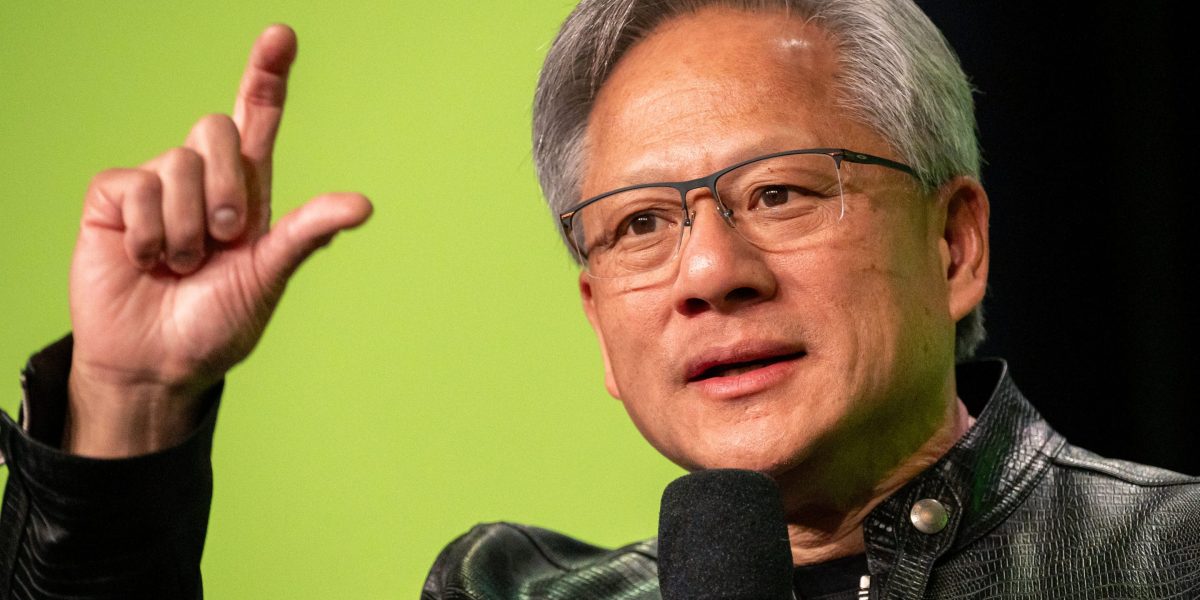

Nvidia’s rise has been astronomical—it’s grown its market capitalization from $1.1 trillion to $3.1 trillion in the past 12 months—and a tech investor who predicted the early success of Amazon and Tesla said this is just the beginning.

“The potential scale of Nvidia in the most optimistic outcome is both way higher than I’ve ever seen before and could lead to a market cap of double-digit trillions,” James Anderson, former partner at investment giant Baillie Gifford, told the Financial Times. “This isn’t a prediction but a possibility if artificial intelligence works for customers and Nvidia’s lead is intact.”

The chipmaker behind OpenAI’s ChatGPT has soared thanks to the AI boom, which has minted half a million new millionaires who invested in the tech that has begun to revolutionize the workplace and media consumption. Nvidia, along with tech giants Amazon, Google, Microsoft, and Apple, are worth $14.5 trillion and make up about 32% of the S&P 500. With the AI darling’s data center revenue growing at about 60%, Anderson calculated, should the pattern continue over the next decade, the company would have a market capitalization of about $49 trillion. That’s more than the entire value of every company in the S&P 500, which is roughly $45.84 trillion. Anderson estimated a 10%-15% probability of this outcome.

Anderson’s projection is a lofty one, but his hunches have proved correct before. With a go-big-or-go-home mentality, he was one of Amazon’s and Tesla’s biggest champions (for the EV giant, Anderson’s investments were second only to CEO Elon Musk). From 2005 to 2021, Scottish Mortgage Investment Trust, managed by Baillie Gifford, saw returns of 2,240%. It invested in Nvidia in 2016. Lingotto Investment Management, where Anderson is now an investor, has a $650 million fund with Nvidia as its largest position.

Nvidia didn’t have a clear path to success when Anderson first began investing in the company, he said. It remained to be seen if it would be a gaming, crypto, or AI company. But it did have the advantage of early success, unlike Amazon and Tesla, which “didn’t start from highly profitable and dominant positions but had to get there.” In some ways, Anderson still sees Nvidia as a nimble company.

“It is the long duration of the development of [graphic processing units] usage in AI—and not just AI—from excitement, through potential pauses, to transformation of industries that is most important to us,” Anderson said.

Not so fast

Other finance experts don’t share Anderson’s bullish take on Nvidia. Aswath Damodaran, professor of finance at New York University’s Stern School of Business, argues Nvidia is riding a wave of early AI optimism.

“The momentum is clearly with Nvidia,” Damodaran told CNBC in May. “They can do nothing wrong. Everything they touch turns to gold.”

Damodaran said Tesla experienced a similar rally in 2020, when its market cap soared, peaking in 2021 at 1.2 trillion, only for shares to plummet about 30% this year alone. Meta and Google also grappled with increased competition that have loosened their grip on the tech world. While Nvidia has the earnings to back up its sky-high value, the expectations for the future of the company may be too steep, he argued. Damodaran said the AI chip market is not worth $1 trillion alone, and the AI market more broadly is worth about $2 or $3 trillion, meaning Nvidia would have to tap into several big AI markets to maintain and grow its value.

“It’s clearly a possibility,” Damodaran said. “But is it plausible? I don’t think so.”

It’s too early to say if Nvidia has the juice to lead Big Tech into the AI frontier in the long term, Deepwater Asset Management managing partner Doug Clinton said. Nvidia’s colossal growth may appear scary, but it’s sustainable, particularly as the demand for AI is expected to increase.

“Despite all of us worrying that eventually this demand for chips will slow down, we haven’t really seen that slowdown happen yet,” Clinton told Yahoo Finance last month. “And it may take longer to slow down than we think.”

With Nvidia making up over 80% of the global GPU semiconductor market, the company will likely continue to ride high in the foreseeable future, Clinton said.

“Can Nvidia maintain its dominant position providing the brains to these artificial intelligence models?” he said. “I think they can for the next three to five years.”