guvendemir

Earnings season is right here for the inventory market, and the fourth quarter will not be anticipated to be as sturdy because the third quarter, based mostly on analysts’ consensus estimates. This may occasionally shock some, on condition that the fairness market has rallied aggressively because the third-quarter reporting season led to October.

Fourth-quarter earnings for the S&P 500 are anticipated to fall to $54.47 per share as of January 12, down from $57.77 per share within the third quarter. That may be a quarter-over-quarter decline in earnings of about 6%. In the meantime, fourth-quarter earnings are anticipated to rise by roughly 2% versus final yr’s outcomes of $53.36 per share.

Margin Growth Is The Key

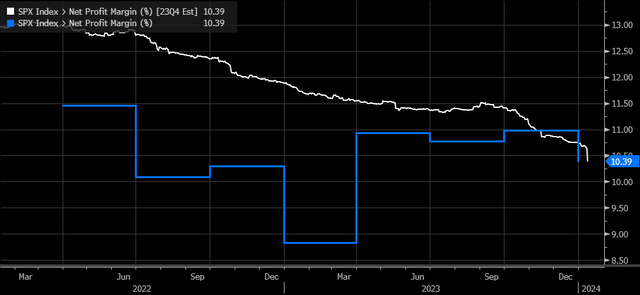

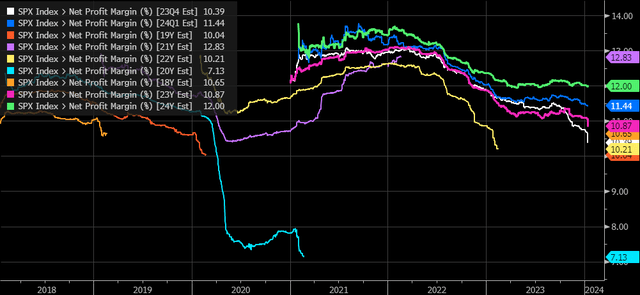

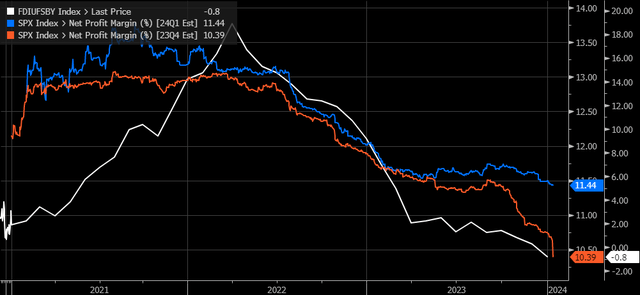

Earnings estimates have been falling within the fourth as margin estimates have declined dramatically to simply 10.4%, as noted in October, down from estimates of 11.5% in September and a peak effectively over 12%. That is much like what occurred within the fourth quarter of 2022, the place margin estimates began to return down heading into outcomes after which had been sharply revised decrease as earnings started to roll in.

Fourth-quarter 2023 margins may even be down from third-quarter margin ranges, which expanded to round 11% from 10.7% within the second quarter and had been flat with first-quarter margin ranges.

Decrease Inflation Charges And Rising Prices

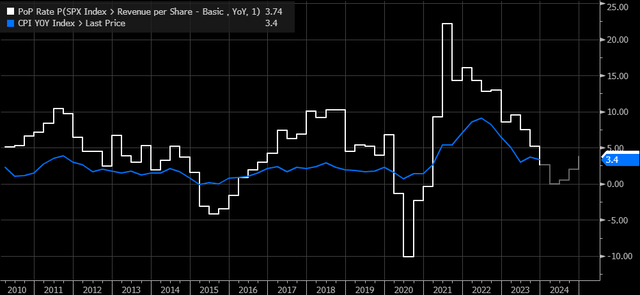

The most recent inflation information does not communicate too effectively to the route of margins in 2024 both, and that might start to point out up within the first quarter and full-year steerage as we transfer by way of earnings season. Due to decrease inflation, gross sales development will possible be decrease in 2024, whereas rising prices push margin expectations decrease in 2024.

Gross sales are anticipated to develop by 2.6% within the fourth quarter versus a yr in the past after which fall to simply flat within the first quarter versus a yr in the past. This might replicate the falling inflation price.

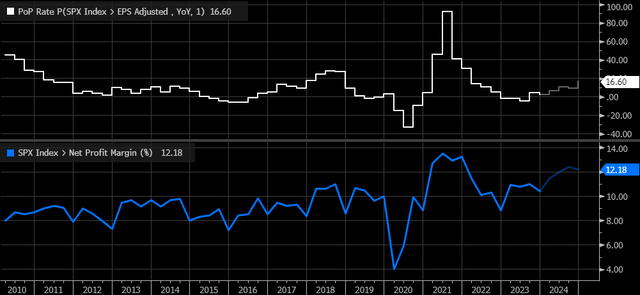

Regardless of forecasts for no gross sales development within the first quarter, earnings development is predicted to speed up to round 6% y/y, which signifies that a few of that development can come by way of inventory buybacks and, extra importantly, from margin enlargement. Margins are forecast to increase within the first quarter to 11.4% from 10.4% within the fourth quarter and from 10.9% within the first quarter of 2023.

Nevertheless, estimates like margins have a tendency to start out excessive after which come down over time, and that’s what we’ve got already began to see for the present fourth-quarter and first-quarter estimates. 2021 was one of many solely years since 2018 that has seen margin estimates rise all year long, and that was as a result of dynamics of the pandemic. Traditionally, margins vary from 10% to 11% over time, with 2021 margins rising to nearly 13%. Even 2022 reverted to the historic pattern of margins beginning excessive and falling under 11%. Whereas 2023 is not over but, it appears extra possible that these margins might be nearer to their historic norms between 10 and 11%, with present estimates at 10.9%, however 2024 is predicted to rise to 12%.

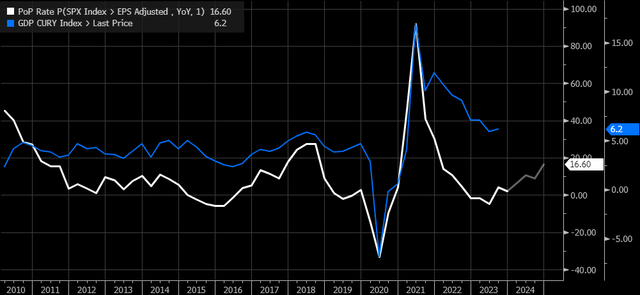

The producer worth index commerce companies y/y, which measures the margins that wholesalers and retailers obtain for the companies they supply, calls into query the margin expectations from analysts. That index has tended to trace margins fairly effectively over historical past, suggesting that margins aren’t prone to increase. They even recommend that margins will nonetheless be underneath additional strain within the first quarter.

It could possibly be why estimates for the fourth quarter margins plunged following the PPI report and why first-quarter estimates ticked decrease.

Slower Nominal Development

The massive leap in earnings development within the first quarter might not be fairly there but, and that might imply that total estimates for 2024 are too excessive and should still have to be adjusted decrease. Ultimately, incomes development charges are only a reflection of nominal GDP development, and what appears to be clear is that if inflation, which is an enormous a part of nominal development, is coming down, then nominal development charges ought to proceed to fall all through 2024, and return to one thing extra regular, and one thing nearer to 4%, assuming a 2% inflation price and a couple of% output development.

Ultimately, the inventory market trades on earnings expectations, and proper now, earnings replicate the concept of increasing margins and buybacks driving earnings development in 2024. The proof so far does not appear to recommend that margins and earnings development are prone to be as sturdy as presently being priced in until gross sales development accelerates meaningfully, however we should wait till the tip of earnings season to seek out out.