silvermanmediaservices/iStock by way of Getty Pictures

I got here throughout Easterly Authorities Properties, Inc. (NYSE:DEA) whereas screening for high-yielding investments.

DEA has many optimistic funding attributes comparable to secure, long-term tenants from the U.S. authorities and engaging valuations at simply 10.0x Fwd P/FFO.

Nevertheless, my major concern is that previously few years, prices have been rising quicker than revenues at DEA, resulting in a shortfall within the REIT’s money out there for distribution in comparison with its dividend price. This example makes DEA’s dividend susceptible to a lower.

Firm Overview

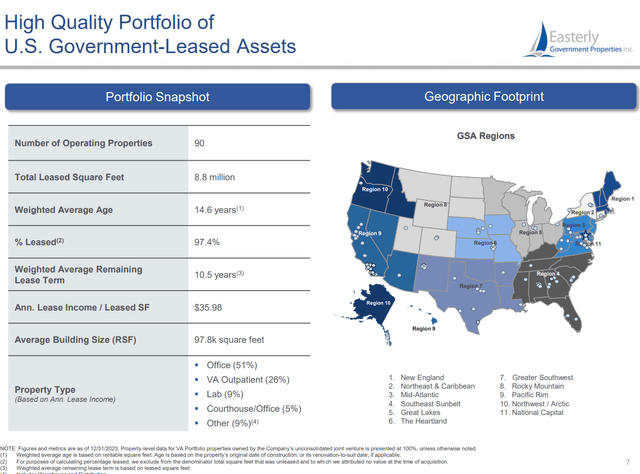

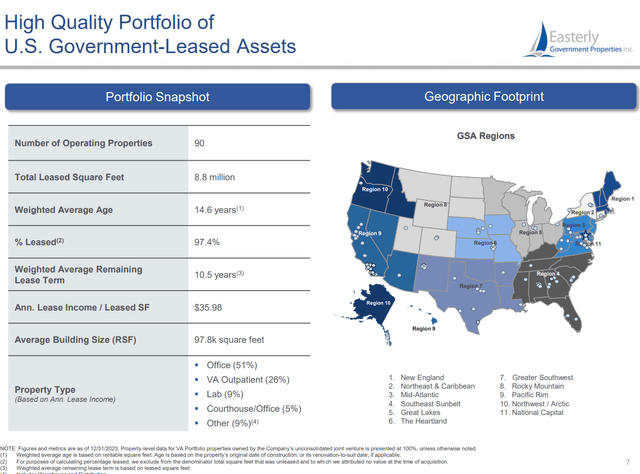

Easterly Authorities Properties is an actual property funding belief (“REIT”) targeted on buying, creating, and managing properties which can be leased to U.S. authorities businesses (Determine 1).

Determine 1 – DEA overview (DEA investor presentation)

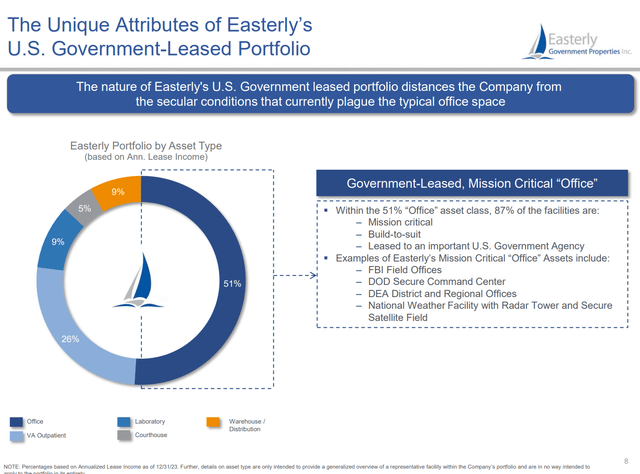

The corporate has 90 working properties with 8.8 million sq. ft. of leased actual property all through the US. DEA’s properties are primarily leased to authorities businesses just like the FBI, DOD, and the Division of Veterans Affairs.

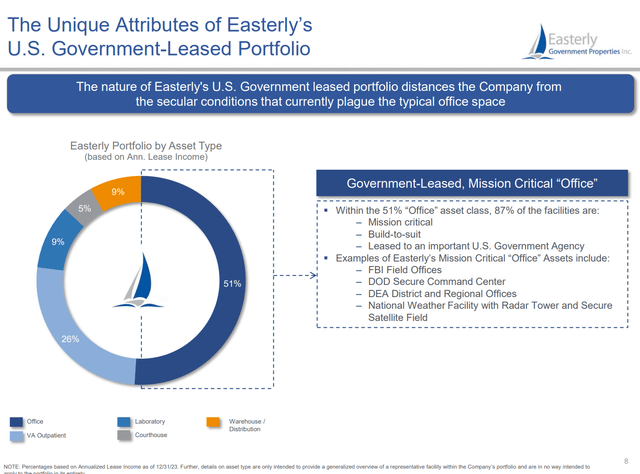

By asset class, 51% of DEA’s properties are workplace house, 26% are VA outpatient clinics, 9% are laboratories, 5% are courthouses, and 9% are warehouses and distribution facilities (Determine 2).

Determine 2 – DEA portfolio overview (DEA investor presentation)

Why Lease To The Authorities?

Leasing to the U.S. authorities has many benefits. First, lease funds are backed by the complete religion of the U.S. authorities. Though there have been current issues concerning the federal deficit and rising debt ranges resulting in a debt downgrade by the ranking businesses, there isn’t any doubt that the U.S. authorities has limitless capability to pay obligations in U.S. {dollars}.

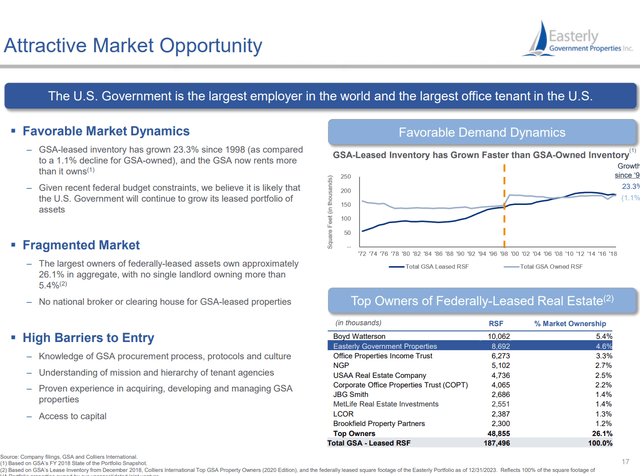

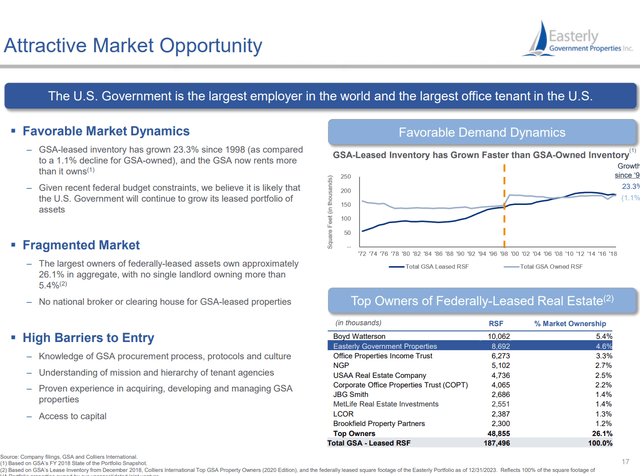

Second, the U.S. authorities is the most important employer on the planet and is the most important workplace tenant within the U.S. with excessive boundaries to entry (Determine 3). Because of budgetary constraints, the U.S. authorities has been favouring renting workplace somewhat than proudly owning them outright, resulting in long-term development tailwinds for DEA’s enterprise.

Determine 3 – Authorities leased actual property has long-term tailwinds (DEA investor presentation)

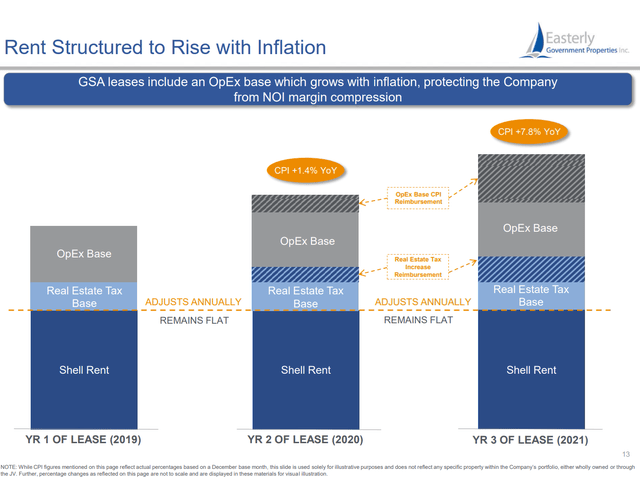

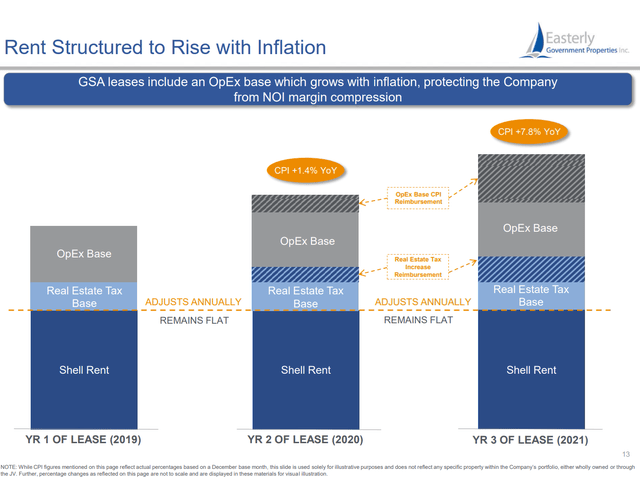

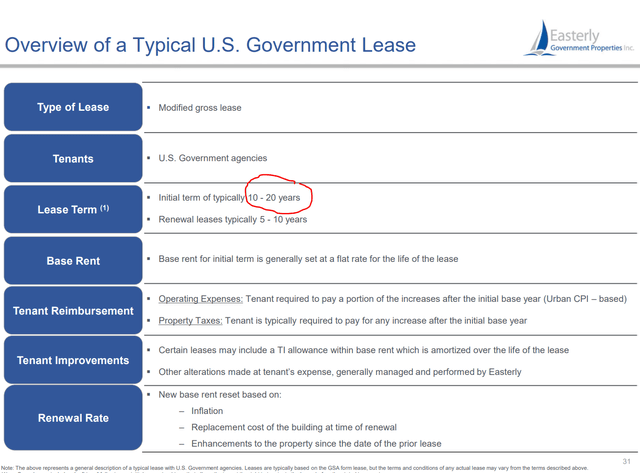

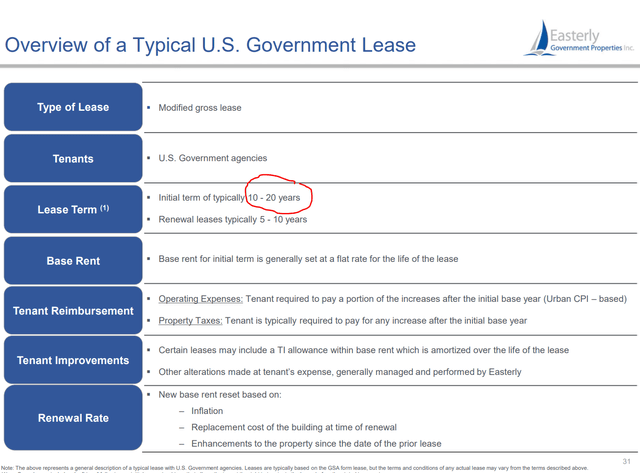

Moreover, DEA sometimes constructions its lease agreements with changes for inflation (Determine 4). This protects the corporate from NOI margin compression throughout inflationary intervals.

Determine 4 – Typical DEA hire construction (DEA investor presentation)

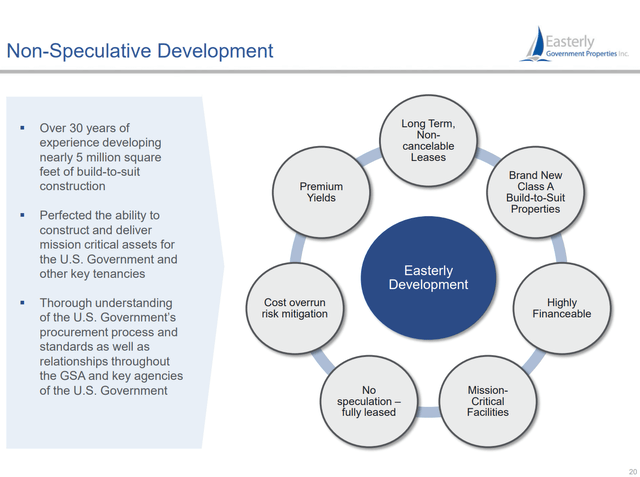

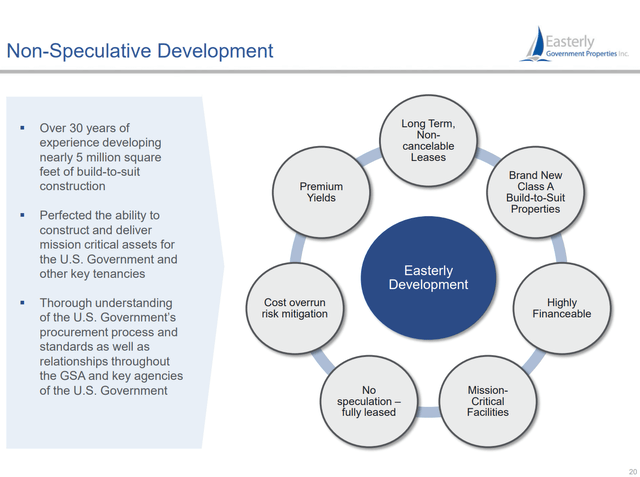

Nevertheless, there are additionally essential downsides to think about with respect to DEA’s enterprise. Since DEA usually acquires or develops properties to go well with particular authorities wants (“build-to-suit”), these properties is probably not appropriate for different companies and thus Easterly Growth could have a bargaining drawback in relation to lease renewals (Determine 5).

Determine 5 – DEA build-to-suit authorities wants (DEA investor presentation)

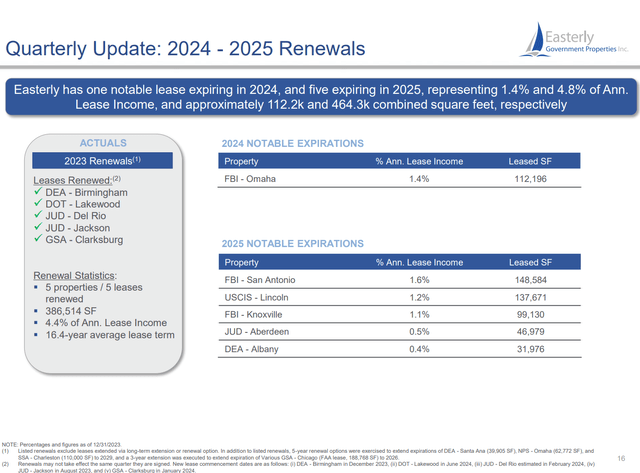

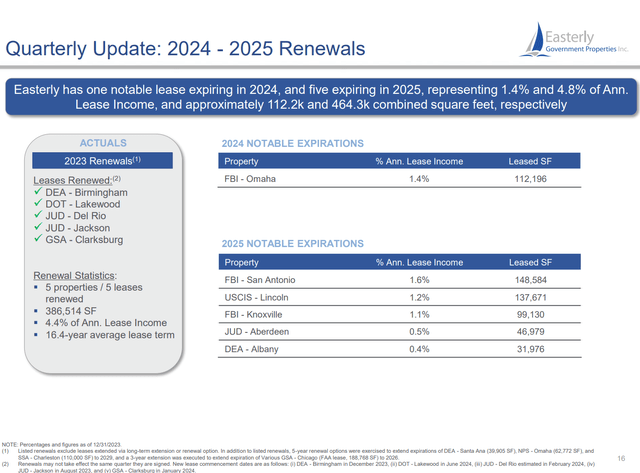

Fortuitously, the U.S. authorities seems to barter in good religion and up to now, DEA has not had any main points renewing its properties at prevailing market charges (Determine 6).

Determine 6 – DEA has been capable of renew its leases with no points (DEA investor presentation)

DEA Has Confirmed Capacity To Develop

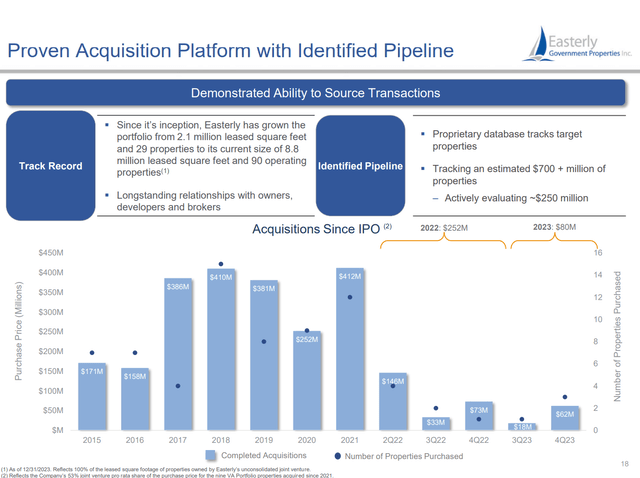

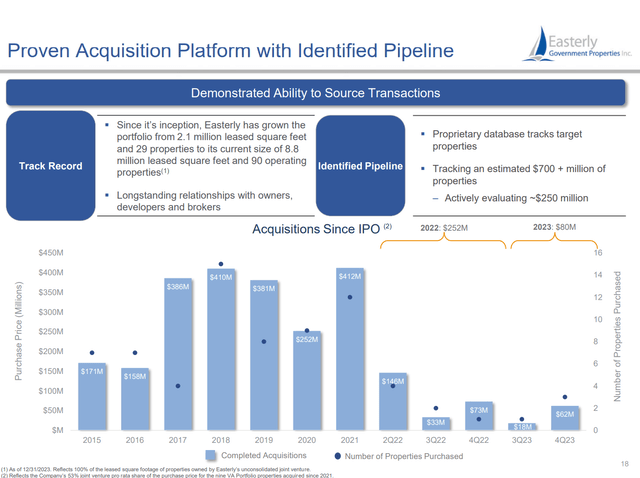

Since coming public in 2015, DEA has grown by way of a two-pronged method of buying present actual property or creating buildings to go well with particular company wants as talked about above. So far, DEA has acquired $3.3 billion in government-leased actual property (Determine 7).

Determine 7 – DEA has grown by means of acquisitions (DEA investor presentation)

DEA’s confirmed potential to amass or construct has allowed the corporate to scale up from 29 properties and a couple of.1 million leased sq. toes at IPO to 90 properties and eight.8 million sq. ft. in lower than a decade.

Monetary Overview

Whereas different workplace REITs have suffered within the face of adjusting employee tendencies in the direction of working from residence (“WFH”), DEA’s enterprise seems comparatively unscathed as a result of long-term nature of its authorities leases and the federal government’s creditworthiness (Determine 8).

Determine 8 – Typical authorities lease is for 10-20 years (DEA investor presentation)

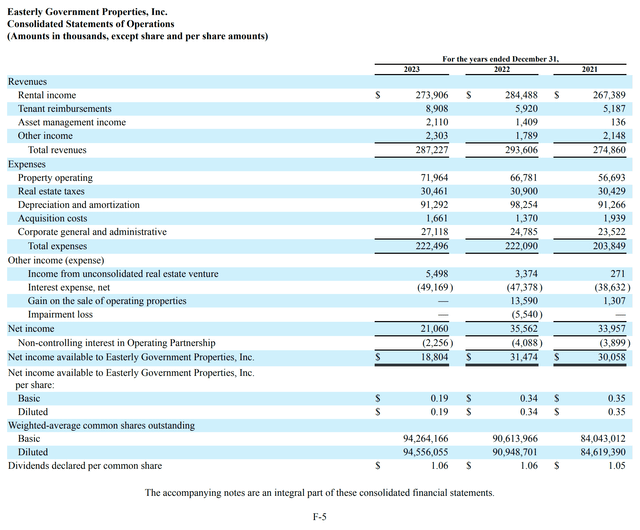

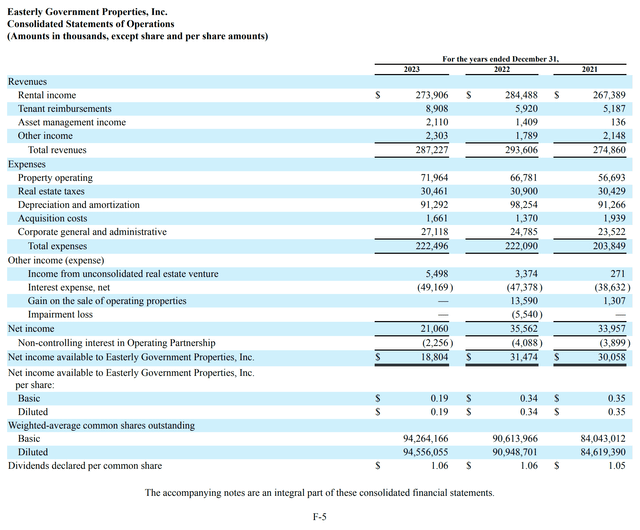

For instance, revenues for DEA had been $287.2 million in 2023, down a nominal 2% YoY because of some disposals, however nonetheless 4% larger than 2021 ranges (Determine 9).

Determine 9 – DEA monetary overview (DEA 10-Okay report)

Nevertheless, considerably larger working and curiosity bills have led to a deterioration in DEA’s internet revenue and money flows in 2023. Internet revenue for 2023 was solely $18.8 million, down 40% YoY because of $6.4 million decrease in revenues, and the absence of a big one-time acquire.

In comparison with 2021, 2023 working bills had been $18.7 million larger, greater than offsetting the $12.3 million enhance in revenues. Curiosity bills had been additionally $10.6 million larger, resulting in internet revenue being $11.3 million decrease than 2021.

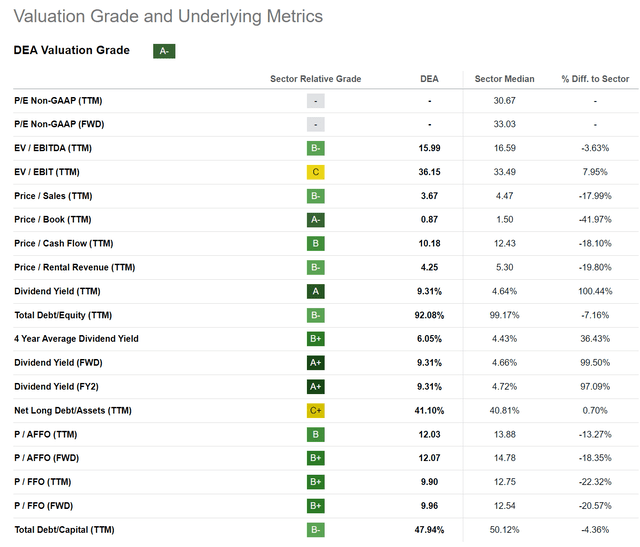

Valuation Seems Engaging

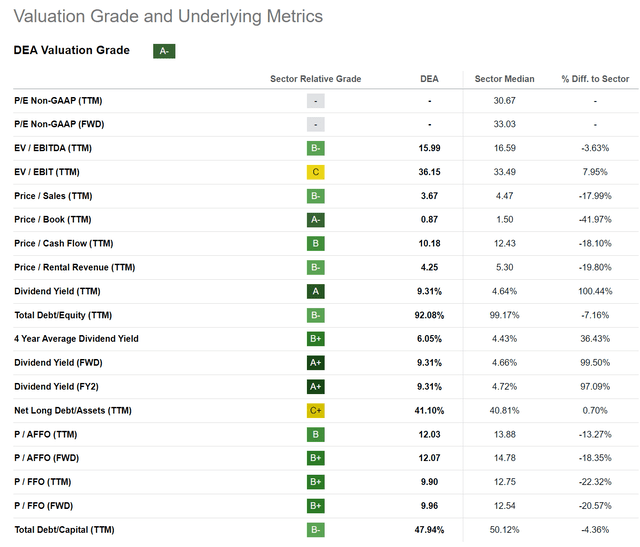

Valuation-wise, DEA does look engaging, as it’s buying and selling at 10.0x Fwd P/FFO in comparison with actual property friends at 12.5x (Determine 10).

Determine 10 – DEA valuation seems to be engaging (In search of Alpha)

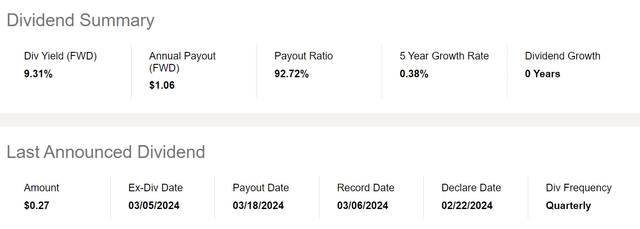

Moreover, DEA is presently paying a $1.06/share dividend, which works out to a 9.3% dividend yield, virtually double that of friends.

However Is The Distribution Sustainable?

To be trustworthy, the merchandise that first caught my consideration was Easterly Authorities’s dividend yield (Determine 11).

Determine 11 – DEA pays a 9.3% dividend (In search of Alpha)

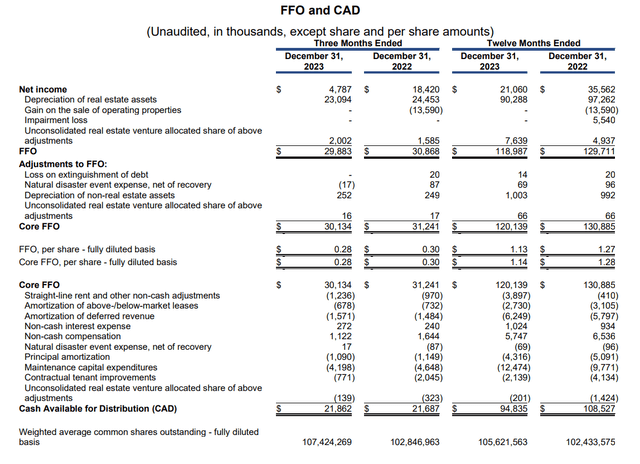

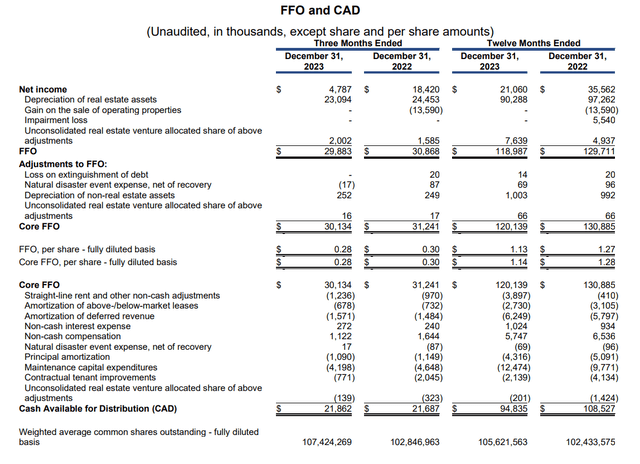

Nevertheless, digging into the small print, I’ve issues as as to if DEA’s dividend price is sustainable. For instance, if we take a look at the corporate’s funds from operations (“FFO”), we will see that DEA generated $120.1 million in Core FFO in 2023, or $1.14/share (Determine 12).

Determine 12 – DEA FFO vs. CAD (DEA This autumn earnings press launch)

Nevertheless, FFO excludes essential money outlays like upkeep capex and tenant enhancements. Money Out there For Distribution (“CAD”), we will see DEA solely generated $94.8 million in CAD or $0.897/share. That is considerably lower than the corporate’s dividend of $1.06/share, so DEA is paying greater than it generates in money. For comparability, in 2022, DEA generated $108.5 million in CAD or $1.06/share, which was simply capable of cowl its 2022 dividend of $1.06.

Within the brief run, corporations can normally afford to pay extra in dividends than it generates in money, as they will borrow from the bond markets or financial institution loans to make up the distinction. Nevertheless, if the overpayment is persistent and widens, then buyers must be cautious, as that would portend to a dividend lower.

Conclusion

Easterly Authorities is a REIT targeted on buying and creating actual property that’s leased to the U.S. authorities. The REIT has seen robust asset development since its IPO in 2015, greater than quadrupling leased sq. footage to eight.8 million sq. ft.

Relative to friends, DEA seems attractively valued, buying and selling at 10.0x Fwd P/FFO with a 9.3% dividend yield. Nevertheless, I’m involved that this dividend is probably not sustainable, as DEA has been paying greater than it generates in distributable money.

Whereas I like DEA’s high-quality tenants and engaging valuation, I’m involved the REIT could also be too aggressive in its distribution insurance policies, so I price it a maintain.