Governor of the Financial institution of Italy and therefore European Central Financial institution Governing Council member Fabio Panetta spoke on Saturday, saying that “the time for a reversal of the monetary policy stance is fast approaching.”

The ECB have already stopped elevating charges, the final was in September when the Financial institution raised its rate of interest on the principle refinancing operations and the rates of interest on the marginal lending facility and the deposit facility to 4.50%, 4.75% and 4.00% respectively.

Extra:

- “What should be discussed now are the conditions to start monetary easing, while avoiding risks to price stability and unnecessary damage to the real economy”

- says the coverage board will “need to consider the pros and cons of cutting interest rates quickly and gradually, as opposed to later and more aggressively, which could increase volatility in financial markets and economic activity”

- “Any speculation on the exact timing of monetary easing would be a sterile exercise”

- inflation is falling as shortly because it rose

- robust progress in nominal wages are being offset by declines in different prices to corporations

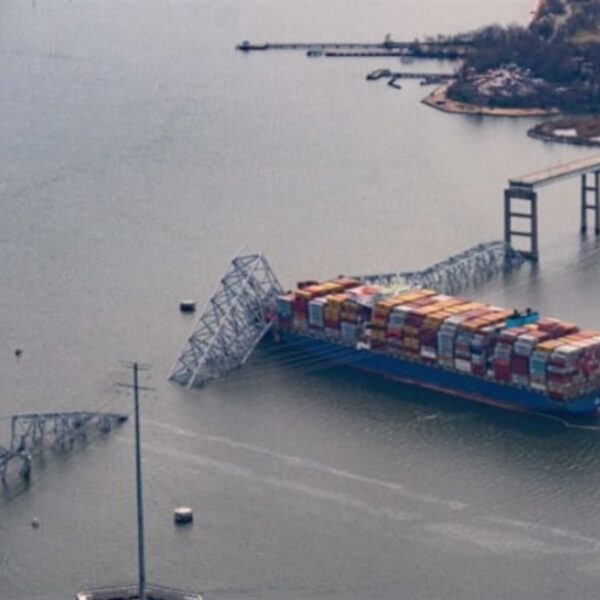

- does not see a excessive danger of inflation impacts from Purple Sea points, however acknowledged the chance of additional escalation within the area

ECB’s Panetta