On the agenda today we have Federal Reserve Bank of San Francisco President Mary Daly participating in a ‘fireside chat’ at a conference co-sponsored by the Federal Reserve Bank of Dallas and Federal Reserve Bank of Atlanta. Federal Reserve Board Governor Michelle Bowman will speak at the same event later, on “Accountability and Reform”.

Also on the session is June inflation data from Japan. All three of the measures (screenshot below) are expected to remain above the Bank of Japan’s 2% target. However, the BoJ is dissatisfied with the nature of the inflation in Japan. Higher inflation, says the BoJ, is mainly due to ‘cost-push’ inflation pressure from rising input prices and the weak yen. The BoJ want ‘demand-pull’ inflation from consumers increasing spending after wage rises. They are still waiting for that as the wage boosts seen in spring feed through. The Bank is under pressure to normalize policy further so they may have to become less fussy on the nature of the inflation they are seeing. The BoJ next meet on July 30 and 31 and a plan on further trimming JGB buys is expected.

ps. More on cost-push and demand-pull below under the calendar.

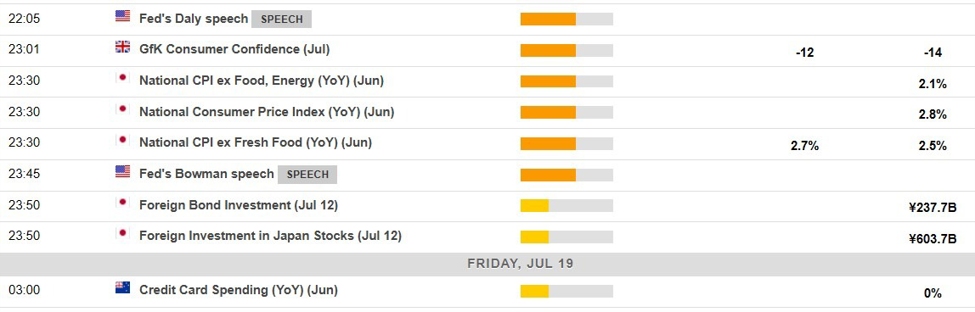

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

***

Cost-push inflation and demand-pull inflation are two types of inflation that arise from different economic factors. Here’s a comparison between the two:

Causes:

- Cost-Push Inflation: Cost-push inflation occurs when there is an increase in production costs, such as wages, raw materials, or energy prices. These cost increases lead to a decrease in the supply of goods and services, causing prices to rise.

- Demand-Pull Inflation: Demand-pull inflation occurs when there is an increase in aggregate demand for goods and services. This increase in demand outpaces the economy’s ability to supply goods and services, resulting in upward pressure on prices.

Key Drivers:

- Cost-Push Inflation: The main drivers of cost-push inflation are factors like rising labor costs, increased production costs due to higher commodity prices, or government regulations leading to increased costs for businesses.

- Demand-Pull Inflation: Demand-pull inflation is driven by factors such as increased consumer spending, government spending, investment, or expansionary monetary policies that stimulate aggregate demand beyond the economy’s productive capacity.