Marko Hannula/iStock via Getty Images

More than a year passed since previously covering Enel (OTCPK:ENLAY), when the statement was made the growth plan was too ambitious. Secondly, it was highlighted the Italian Treasury department pushed for a change in the board to exert more influence over the decision-making. Fast-forward and both the growth plan has been reduced and investments have been shifted towards Italy and Iberia. This did not withhold the company from posting impressive results in the first half of 2024, however. Yet, I remain cautious and will await weakness in the stock price before considering an expansion of my position.

Performance

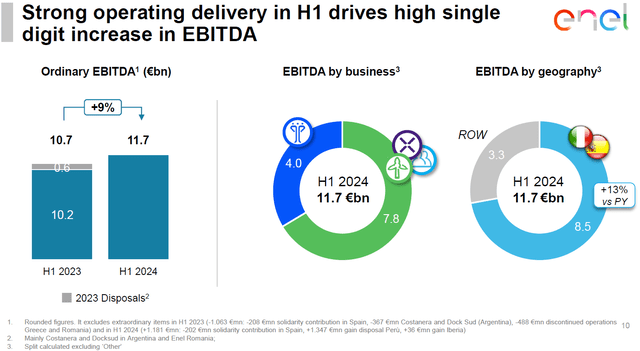

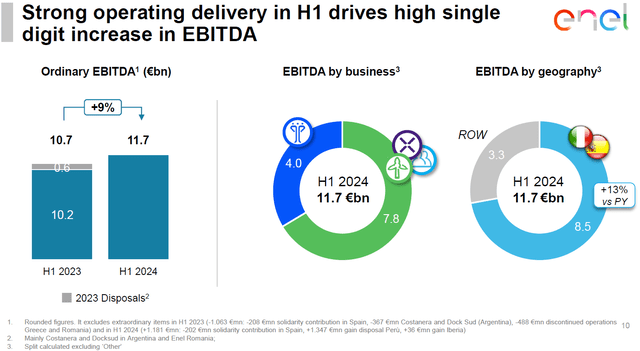

On the 25th of July, Enel presented a strong set of numbers for the first half of 2024. In spite of disposals, the company managed to grow earnings by 9 percent, see figure 1.

Figure 1 – 1H24 EBITDA, 1H24 results presentation (enel.com)

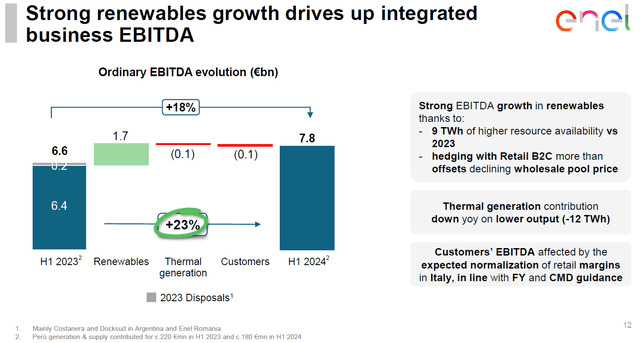

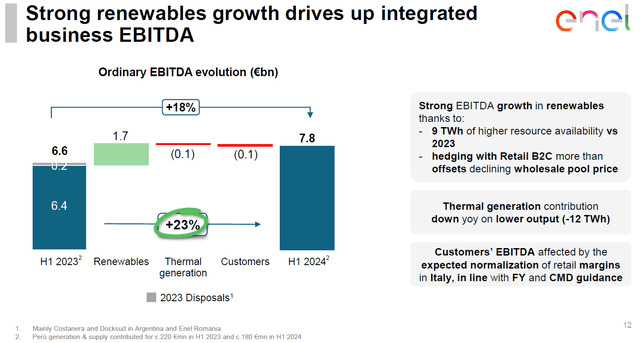

This strong performance was mainly driven by the Renewables segment, where EBITDA rose by €1.7Bn, see figure 2. It is worthwhile to note the contribution to earnings from the Grids business line remained flat year-over-year.

Figure 2 – Renewables single-handedly boosted EBITDA, 1H24 results presentation (enel.com)

To put EBITDA increase in perspective, it is worthwhile to note this number was only €2.2Bn in 1H21. For 1H24 the total contribution to EBITDA of Renewables was €3.7Bn, meaning this contribution rose by 68% over three years’ time. Clearly, the massive capacity expansion in Renewables now starts to bear fruit. So far, the company is proving me wrong on my thesis the EBITDA target for 2024 was too ambitious.

Regulation over Renewables

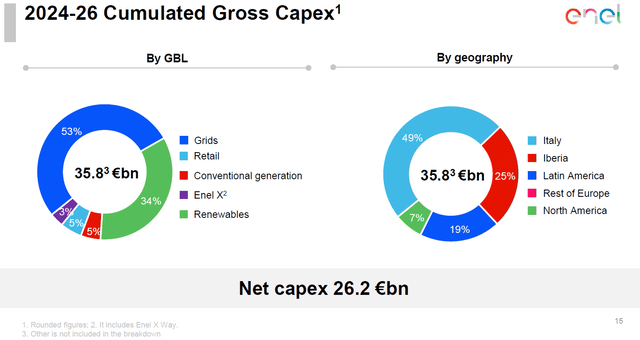

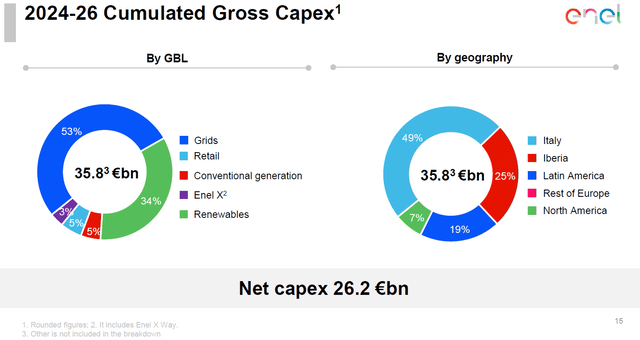

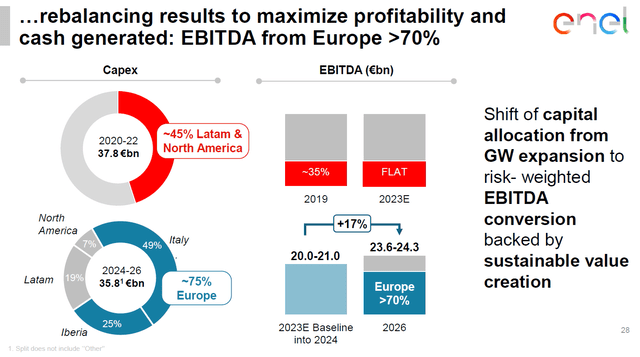

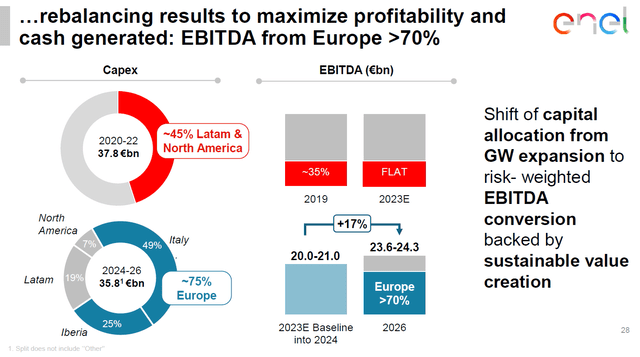

The current strategy of Enel is to reduce annual capex from a previous level of €12.5Bn per year to about €11.9Bn (or €35.8Bn over three years), see figure 3.

Figure 3 – Envisioned capex spending, CMD23 (enel.com)

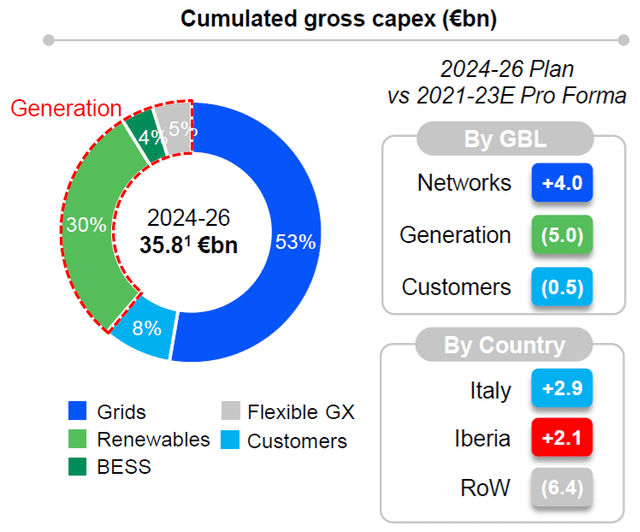

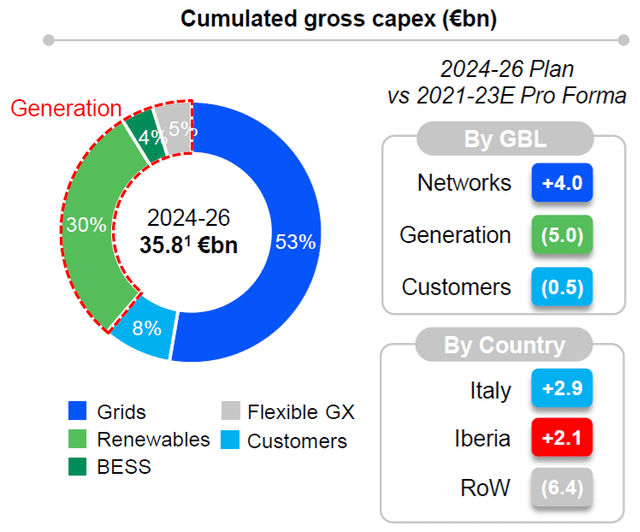

Tying this back to the previous strategy, the main changes are the reduced investments, increased focus on the traditional core markets Italy and Iberia and a preference to invest in grids rather than renewables, also see figure 4.

Figure 4 – Expected capex spending versus previous pro forma plan, CMD 23 (enel.com)

The investments done in Generation, or Renewables, is reduced by €5Bn and almost completely diverted to the Business Line Networks (Grids). This course of action is not in line with the impressive contribution of the Renewables segment to EBITDA as noted before. Moreover, the combined investment in Italy and Iberia (Spain and Portugal) is increased by €5Bn, at the expense of investments outside Europe.

The management team under the guidance of CEO Flavio Cattaneo clearly decided to opt for growth of the Regulated Asset Base with a clear focus on Italy and Iberia.

Where to put your money

Still it remains surprising the investments in Renewables are reduced in favor of Regulated Assets as the returns of the former are superior, see figure 5.

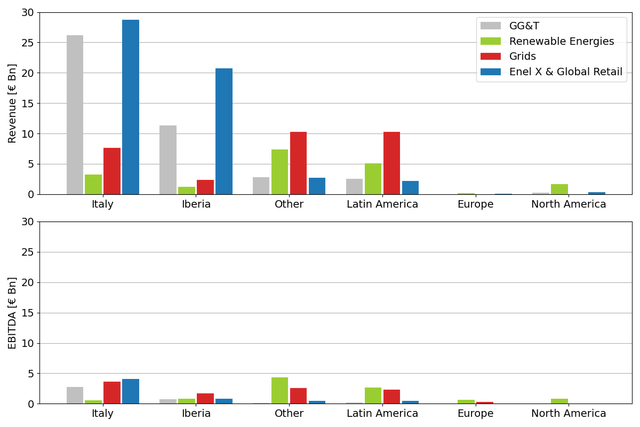

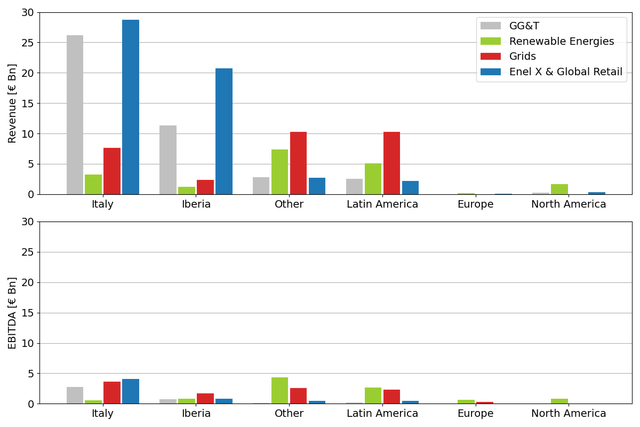

Figure 5 – 2023 Revenue and earnings per Business line, AR23 (data from enel.com, chart by author)

From the figure it follows, the Business Line ‘Global Generation & Trading’ captures a small amount of revenue as earnings. The same holds for the Retail business. Company-wide, the earnings drivers are the Grids and Renewable segments. In 2023, 34% of revenue from the Grids business was converted into (gross) profit, whereas this number was even higher at 52% for the Renewables business. In this respect, the previous strategy to focus on this business made sense.

The yield

The current course of action taken by management, favoring Regulated Assets over Renewables, can be explained if the potential yield of investments for both business lines is assessed. A ballpark comparison will be given next.

Renewables

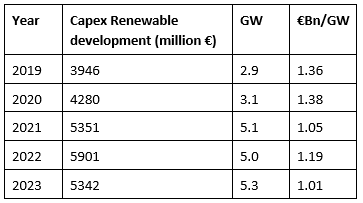

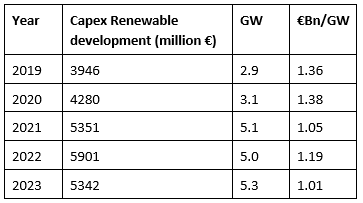

Everyone knows past results are no guarantee for future returns. This becomes clear when the potential yield on investments in Renewables is assessed.

Based on FY2023 production figures, 55.5 GW gigawatt (GW) of net renewable capacity generated 127,000 gigawatt hours (GWh) of renewable electricity. This means on average 1GW of installed capacity was running for 2288 hours per year, or an overall efficiency of about 26%.

Alternatively, one could state every installed gigawatt of capacity will generate, 2288 GWh of energy. Based on the supplemental information to the FY23 earnings presentation, the average spot price in Italy and Iberia was 100 €/MWh, nearly double the pre-pandemic number. Working under the assumption the electricity market will further normalize, a number of 50 €/MWh (50k €/GWh) will be used.

Now, the installation of an additional gigawatt of renewable capacity will generate annual income of €114 million. This translates into a return on investment of 10% based on the average construction cost of 1.1Bn/GW of the last three years, see figure 6.

Figure 6 – Renewable development costs (data from enel.com, table by author)

The assumption of prices reverting to pre-pandemic levels is potentially too conservative given the transition challenges and the subsequent demand for energy Europe is facing. If electricity prices of 100 €/MWh are the new normal, the annual income actually increases to €228 million, which would imply a return of about 20%. Obviously, the same holds for changes in efficiency or ‘resource availability’ as it was called in figure 2.

Grids

A similar exercise can be done for the Grids business line, where future returns are estimated based on the past performance of the Grids segment.

With regards to the Regulated Asset Base (RAB) the European business was valued at €32.6Bn in 2023 (2022: €31.4Bn). In the same year, the Grids segment accounted for €5.5Bn in EBITDA (2022: €5.3Bn). For both years, the yield of the Grids segment, only accounting for the European assets, was 16.8%.

While merely ballpark figures, these example highlight the dilemma management is facing; investing in more volatile Renewable Generation with the potential for higher returns or opt for expansion of the Regulated Assets for which returns are more certain? The decision made is clear, see figure 7.

Figure 7 – Capex to focus on Italy and Iberia, CMD 2023 (enel.com)

More regulation

ARERA is the Italian Regulatory Authority for Energy Networks and Environment. Needless to say, Enel falls under the supervision of this authority, which has the goal to promote ‘competition and efficiency in public utility services and protect the interests of users and consumers’.

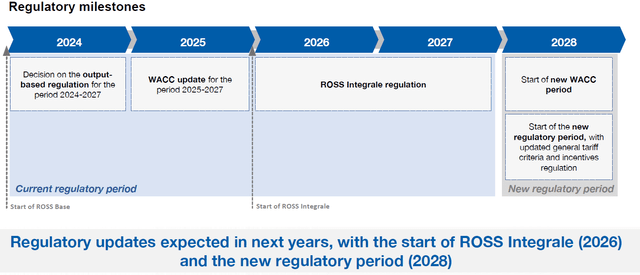

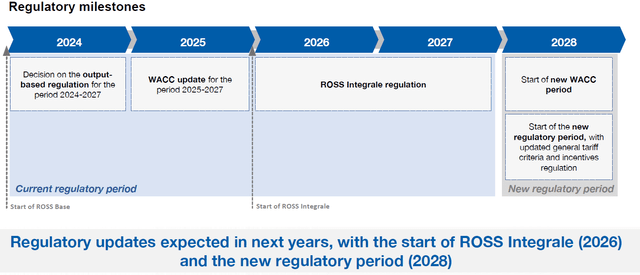

In 2021, this regulatory body started investigating a new regulatory process to set cost and quality targets:

…the regulatory process for the introduction of a new approach in setting allowed revenues of the electricity and gas infrastructure services regulated by (…) ARERA. Overall, the new approach is part of a broader regulatory reform based on setting expenditure and output targets (so called ‘regolazione per obiettivi di spesa e di servizio’, ROSS).

The rationale for this intervention is the so-called ‘capex bias’ introduced by current regulation:

ARERA adopts a ‘hybrid’ approach, with a price-cap applied to OPEX, and cost-of service regulation applied to CAPEX. Under cost-of-service regulation, allowed revenues are linked directly to the underlying costs: actual costs are passed through into the allowed revenues without a long delay.

Under the reign of former CEO Francesco Starace, investments in Renewables were favored, capacity expansion was preferred and rising debt levels taken for granted, a prime example of ‘capex bias’. It is this bias that ARERA wants to address by tying allowed revenues to total expenditures:

In recognition of the potential that regulatory incentives provide a bias towards excessive CAPEX, some national regulatory authorities introduced TOTEX-based regulation. (…) An approach based on total expenditure aims to treat both OPEX and CAPEX symmetrically, thereby reducing the risk of any CAPEX bias. (…) TOTEX-based approach and ‘ROSS-base’ are used interchangeably—that is, they refer to an approach of setting allowed revenues based on total expenditure.

While the reach of the regulatory body ARERA may be confined to Italy, the current strategy of Enel favors investments in Italy and already aligns with impending (national) regulation. As becomes clear from figure 8 the TOTEX-based (ROSS) approach is currently being initiated with a start of the new regulatory period in 2028 only.

Figure 8 – ARERA regulatory milestones, CMD24 Terna (terna.it)

As an aside, figure 8 is taken from the slide deck of the Capital Markets Day presentation from Terna. Terna is the transmission system operator of Italy that was divested from Enel in 2004 as part of deregulation in the energy sector and led by current Enel CEO Flavio Cattaneo until 2014.

Shareholder returns

Against the backdrop of new regulation being enacted and a reduction in capex, of which the majority is invested in regulated assets, investors need not be forgotten. To this end, a floor of €0.43 dividend per share has been set for the period until 2026. This number may be increased if cash flow neutrality is achieved, i.e. when cash flow will cover capex spending. At the 1H24 presentation, it was indicated the dividend would be above the floor, but further guidance was not given.

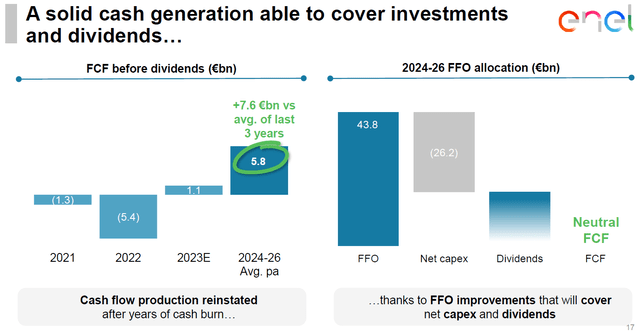

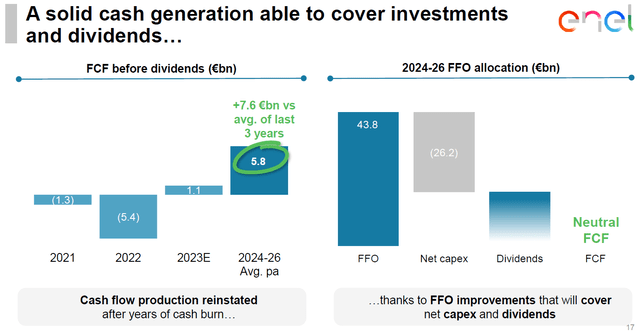

The current annual dividend payments amount to €5.1Bn. Based on information shared in the latest Capital Markets Day, management indicated there is room to grow this value to €5.8Bn on average, see figure 9.

Figure 9 – Cash flow and dividend, CMD23 (enel.com)

Under the assumption the total dividend payment can be increased by 13 percent towards, the dividend per share would increase to €0.49. At the time of writing, this generates a 7.6 percent forward dividend yield.

As for the capital gains, Enel is a company owned for the dividend. This becomes even more true now the strategy of rapid expansion has been ditched for a more modest approach. Moreover, I would argue that the ‘pull back’ to the roots in Southern Europe will make shareholders more cautious. Continued improved performance may offset this effect, but this will require time.

Risks

Italian politicians holding sway over Enel have been highlighted as a potential risk before. While the appointment of Flavio Cattaneo is an example of this, this does not necessarily need to be a negative when the financial position of the company can be propped up and shareholder distributions increased.

However, while the company does a tremendous job driving renewable development costs down, spending capex on regulated assets is preferred over renewables. On top of this, investments are diverted to Southern Europe to achieve more predictable returns, which has the side effect of a reduction in geographic spread. In other words, the concentration risk is building up even further.

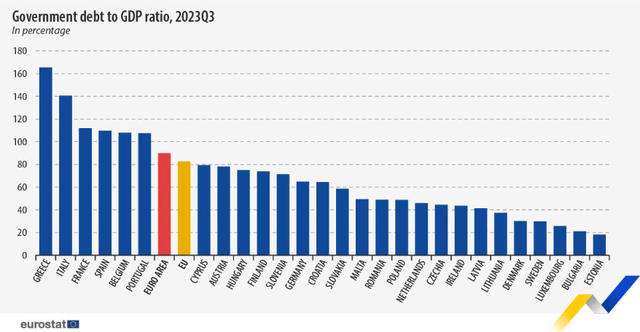

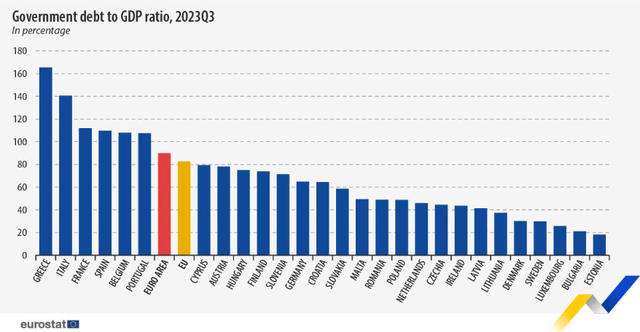

Investors around long enough to vividly remember the European debt crisis will remember the derogatory acronym PIGS (Portugal, Italy, Greece and Spain). While the governments in these countries have been working hard to improve finances, the current state of affairs per 3Q23 is shown in figure 10.

Figure 10 – Debt to GDP ratio per 3Q23 (Eurostat)

Against this backdrop, one should realize Enel is spending 75 percent of its capex in Italy, Spain and Portugal over the coming three years. So far, major recessions have been avoided in recent years, but the increased focus on Southern Europe may impose additional hardship on the stock price if macroeconomic conditions deteriorate.

Conclusion

Enel has been presenting strong numbers lately, which underline the earning capacity of the company. While this is definitely an advantage, investors should be more interested in future earnings. The current management team of Enel has taken the decision to reduce investments in Renewables and favor the less volatile business of the Grids segment. As the company is now operated in a more cautious manner, upside potential in the stock price will only materialize as a result of consistent execution and growing dividends.

The downside potential, however, is not to be ignored as increasing regulation, political interference and concentration risk in Southern Europe may increase volatility in earnings when macroeconomic conditions deteriorate.

In spite of impressive year-to-date results, I remain cautious and will await weakness in stock price before considering an expansion of my position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.