I wrote earlier this month about why a perfect storm is about to hit world energy grids.

Buyers and firms spend little or no time fascinated about electrical energy. For many corporations and customers — no less than exterior of South Africa — merely hook as much as the grid and switch o the lights.

The identical was true of the information centre enterprise for a lot of its existence however that is altering shortly. The Xbox community in California alone already makes use of extra electrical energy than complete African international locations and issues like generative AI will crunch grids additional.

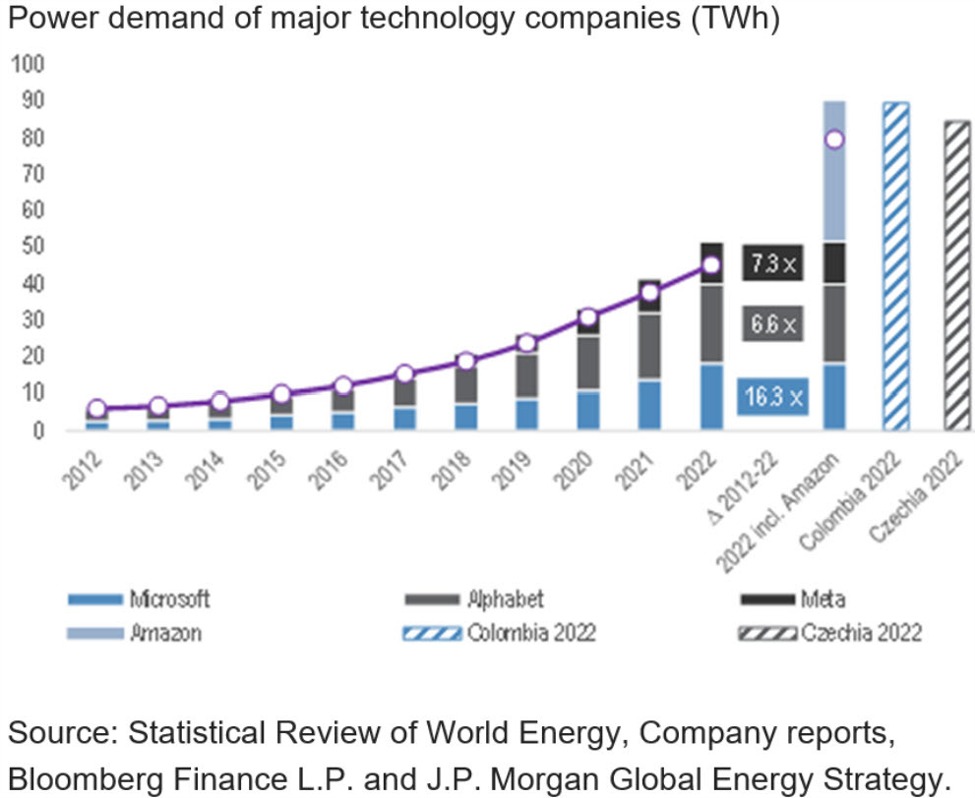

Here’s a (barely dated) chart displaying the acceleration in energy demand from tech corporations.

Right here was Sam Altman final month:

“We nonetheless don’t recognize the power wants of this know-how. There’s no strategy to get there and not using a breakthrough. We’d like fusion, or we want like radically cheaper photo voltaic plus storage or one thing at large scale.”

On Friday, Mark Zuckerberg gave an interview the place he made the identical level.

One of the things he highlights is the slow pace of energy permitting, including generation and transmission lines. Add into that the difficulties of getting green metals like copper and lithium out of the ground and you have a problem. Then factor in the need to limit carbon dioxide emissions and it’s compounded.

Right now, the market is turning to natural gas and coal to feed into new demand but that’s not going to work in the long term.

Zuckerberg argues that it’s a good idea to invest $10 billion or $100 billion into securing power supply but he also talks about the uncertainty around how much is needed and why it’s a tough decision to commit that capital. That hesitancy and the long lead times will lead to an inevitable crunch.

Investing around that theme is tricky. If we’re power-limited then perhaps there’s a case for the utilities themselves but they’re heavily regulated and that means that the payoff is moderate at best. There are companies building out transformers and the like but some have already moved and that’s still a relatively small industry.

Natural gas is cheap right now and that may ultimately be the beneficiary even though many people would rather the demand go to green energy instead. What’s happening is that places like Texas with abundant natural gas are courting data centres.

I am certain there are different avenues I have never thought-about however I feel many roads result in copper as a result of there merely is not sufficient provide and lead instances for brand new mines are extraordinary. The danger is that China’s demand for copper drops on a delicate economic system, creating some respiratory room. Nevertheless the dangers run each methods as demand for energy, EVs and robotics might supercharge the provision deficit.