Antagain

I’m a fan of international diversification, and thankfully with ETFs there are a lot of ways to get it. There are a number of country-specific funds out there, but one that stands out to me is the iShares MSCI Poland ETF (NYSEARCA:EPOL). This fund, you guessed it, is focused on Poland’s equities. The fund tracks the MSCI Poland IMI 25/50 Index and includes several dozen companies that are domiciled in Eastern Europe’s leading economy. EPOL has a unique sector breakdown, and targets an economy with promising prospects.

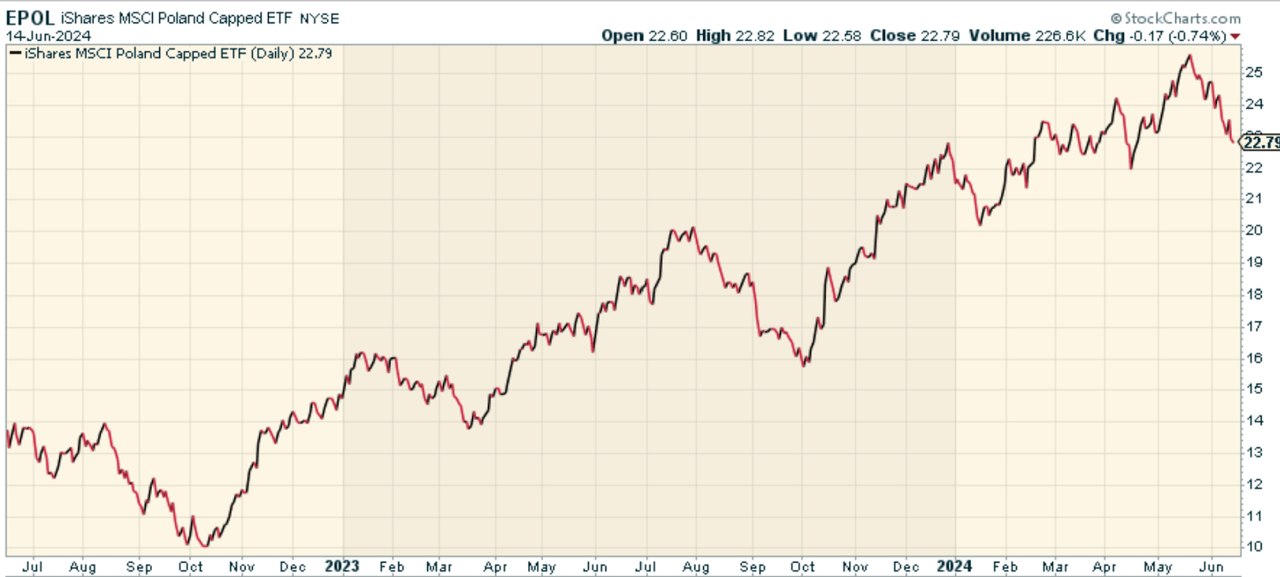

The investment case for Poland in general is strong. Labor costs in Poland are competitive compared with those of Western Europe. In addition, Poland’s infrastructure and geographical proximity to the core of the European market works synergistically in making the country attractive for logistics and manufacturing operations. And all that is clearly reflected in the chart of EPOL, which did particularly well over the past year.

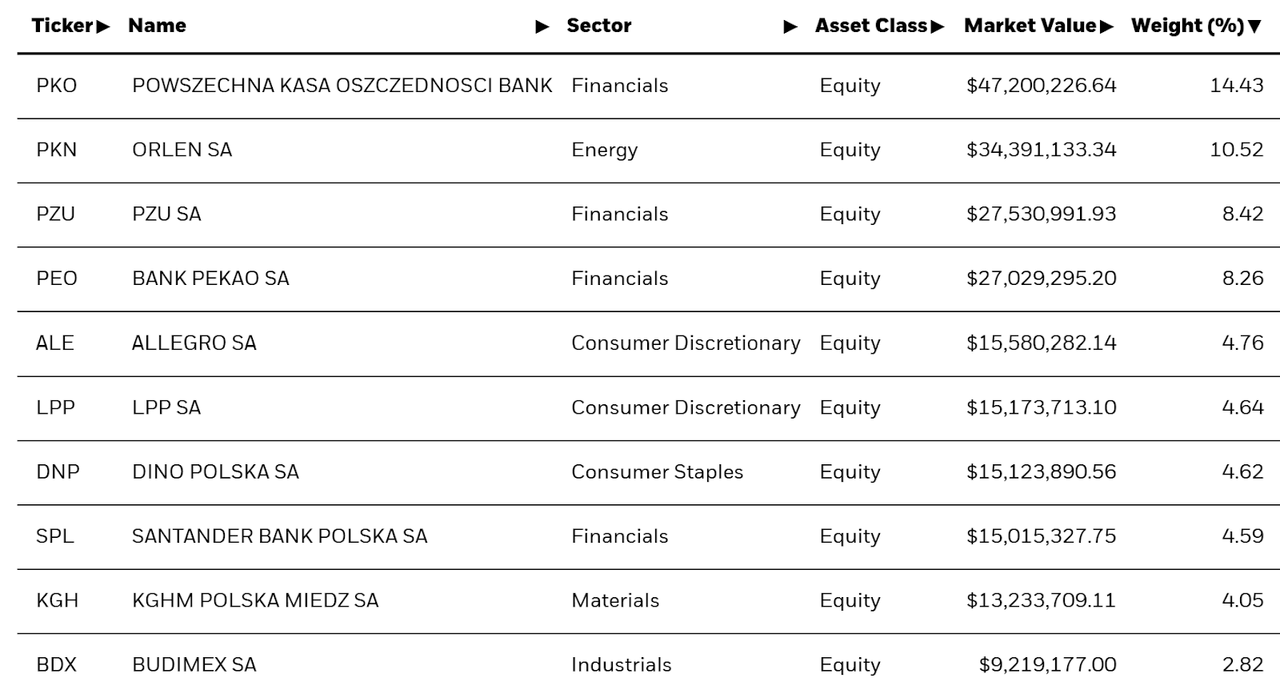

A Look At The Holdings

This is a fairly top-heavy fund, with the largest position making up 14.43% of the fund.

So what are these companies? Powszechna Kasa Oszczednosci Bank is Poland’s largest commercial bank, with a sizable retail network and a strong balance-sheet. Orlen SA is an international corporation that is one of the leading producers of crude oil, petroleum and petroleum products worldwide. PZU SA is a big financial services company. Bank Pekao SA is the leading commercial bank in Poland, providing a broad range of financial services to retail and corporate clients. Financials make up 3 of the top 4 biggest positions, as you can see here.

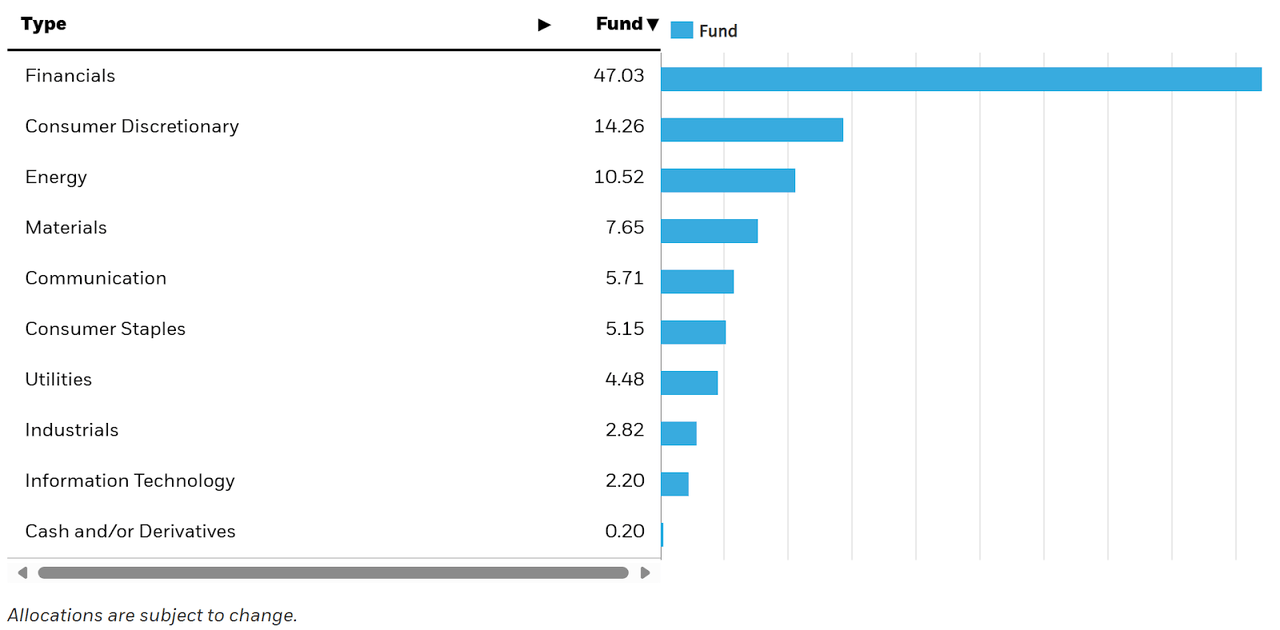

Sector Breakdown

Speaking of Financials, their importance in the fund goes beyond the top 4 holdings. In fact, Financials make up nearly 50% of EPOL.

The second-largest sector is Consumer Discretionary at 14.26%, followed by Energy and Materials. The large weighting to Financials is important to consider. While it clearly has worked, it does result in the fund having large sector-specific exposure, which could hurt meaningfully in any kind of downturn in Poland’s economy.

Peer Comparison

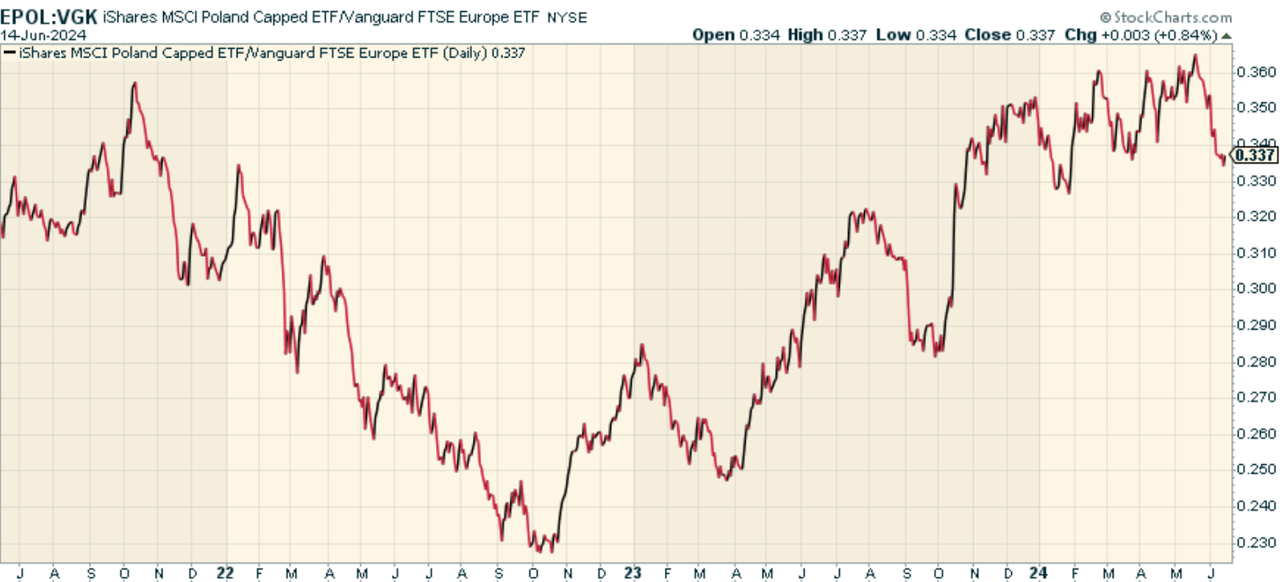

There aren’t any other funds that track Poland in this manner, so perhaps the best comparison here is against broader Europe. After all, the appeal here is around international diversification more broadly. When we look at the price ratio of EPOL to the Vanguard FTSE Europe ETF (VGK), we find that it has outperformed since October of 2022, but the ratio is back to where it was in September 2021. The only conclusion here is that the two funds over that time period have performed the same.

Pros and Cons

On the positive side, this is a strong way to play Poland’s potential, and get in on the upside of its financial services sector. Given the fund’s relatively low valuation multiples (a P/E of 9.18 and P/B of 1.17), Polish equities seem to be trading at a discount to their growth potential.

At the same time, that exposure to financial services may be a bit too much for some. The portfolio’s lack of exposure to the Technology and Healthcare sectors also might be seen as a negative. This could have consequences if adverse developments in the financial services industry disrupt the country’s economy. Let’s not also forget there is always geopolitical risk given Poland’s proximity to Ukraine and Russia more generally.

Finally, remember it’s not currency hedged, which means returns will also be impacted by the forex market. This may actually be a positive, though. If the Dollar were to weaken broadly (particularly in a falling rate environment), then the currency conversion would actually be a net positive for returns on the fund separate from the underlying holdings.

Conclusion

For those wanting targeted exposure to the Polish equity market, EPOL is your (only) way to play it as an ETF. I think it’s relatively well constructed despite the large Financials exposure. You may want to consider the broader VGK Europe ETF though if you want more balance. Overall good nonetheless.

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.