Trygve Finkelsen/iStock Editorial via Getty Images

Dear readers/followers,

At this point, it’s been over 3 years since I updated my thesis on Essity (OTC:ESAKF) (OTCPK:ETTYF) – so to say that the time is ripe for an update on my thesis Is a bit of an understatement. First of all, let me make it clear that I no longer own a stake in this company – at least not right now.

I view Essity as an interesting business with a potentially superb upside – but only at the right valöuration. I make no secret of my desire to own appealing, fundamental companies. Companies that manufacture or deliver products and/or services that are non-optional for daily living. Essity is one such business – because it manufactures, researches, and develops exactly these products.

It’s an attractive mix of tissue paper, diapers, feminine care, incontinence, compression therapy, orthopedics, and wound care. When I say attractive, you have to realize I know that these are typically low-margin businesses – and the only way to make them work is to work with “scale”, which is what this company does.

The reason I sold my stake was very simple. It went above 300 SEK/share in 2023, and I was clear with myself that this company is not something you own at such a sales or revenue multiple – and I was right to do so.

Despite the company dropping significantly since that time, only to go up slightly again, I did not yet buy it back.

So in writing this, know that I come in “clean” – and I may be looking to get back in ,but only at a good price.

So what would be a good price?

Long-term Update on Essity and what has happened in the last 3 years.

A lot of things have happened over the last 3 years, not the least of which is the divestment of JVs such as Vinda. Essity is looking for growth – which is natural because this is a company that’s going to see some struggles to grow.

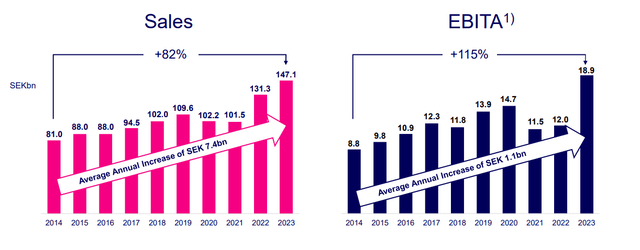

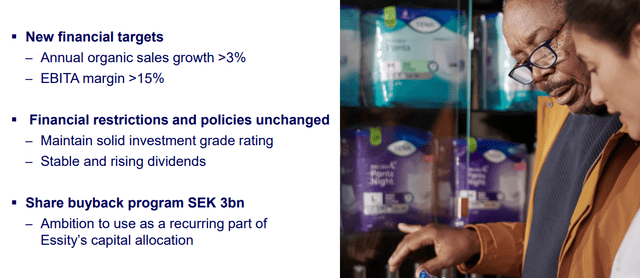

The company announced new financial targets less than 3 weeks ago. These targets include annual organic sales growth of 3% or above and EBITDA margins of 15% or above. The sales growth is a bit of a pickle in my opinion – it’s unclear to me how the company is managing this long-term organically, sans raising prices, which the company can only do so long.

The share price will be buffeted by the share buyback program – over 3B SEK targeted.

Fundamental stats for 2023 remain good. Almost 150B of annual net sales in 150 countries, with over 36,000 employees and producing in 72 facilities.

I like the mix, even if I personally would have preferred a higher exposure to professional and health/medical – these tend to be more stable and less prone to competition for an established player like Essity. It’s also fair to say that Essity has now been through an entire decade of change – and while the company presents this as something positive (which in some cases it is), it has also been a decade of decent with plenty of ups and downs that have left your portfolio development so-so, unless you’ve known exactly how to enter and exit.

Especially COVID-19 saw some struggles for this business.

Still, Essity has generated, despite the trends in the last decade, impressive amounts of EPS growth at a CAGR of 7.2% from 2017-2023 (less before), while strengthening the balance sheet in no small way with a current net debt/EBITDA of 1.3x exclusive of IAC.

The company is also in good shape in terms of margins and efficiency. Having improved this over the past few years, the company now has lower production inefficiencies, better pricing power, and lower volatility.

However, the company’s divestment and efficiency moves have a certain effect on these targets and performances. We have Vinda divestment affecting organic sales growth by at least 1%, but at the same time, the divestment enables a higher ROCE than before due to the comparative lower returns of that JV.

The company points to pretty much the same overall macro trends that most other consumer-oriented businesses do. These are not wrong. We have a growing middle class with higher living standards and disposable income. We have an aging population and demographics, with an increased global awareness of hygiene and health. All of this drives sales and trends for a company such as this – and this is a global company with significant global market exposure.

The company has a nr 1 or 2 position in 90% of its sales products, and it’s investing continually in A&P. The company is also in a position, due to scale and size, of really driving profit and can endure lower returns and pricing due to size for longer than many other competitors can.

The roadmap to the margin target includes – and this is what we want to look at when we look at what Essity is expected to generate in the next few quarters – further optimizing the portfolio, better cost savings, and better operating leverage. Anything that increases costs or lowers these KPIs would be clearly against the margin target of above 15% for EBITDA – and would mean that the company might not reach its targets or goals.

The company also targets “growing dividends”.

And while this is great, you need to remember that the company is yielding less than 2.85% in a market where above 3.8% is risk-free – I get around 4.15% on cash. So this yield isn’t, nor will it be in the near term, anything to write home about.

However, with BBB+, a market cap of almost 200B SEK, and a long-term debt/cap at only 30%, the company is one of the most conservatively leveraged and well-positioned hygiene companies in Europe. It’s expected to grow adjusted EPS at around 4-6% for 2024, with double digits in 2025ER due to improvements, and another high 5-8% in 2025E (Paywalled F.A.S.T Graphs link).

All in all – I like Essity as a business – I just want to make sure I’m investing at a good price. The reason is that this company really has potential, and a proven trend to do rather badly. The result of this has been volatility atypical of this sort of business area, with 8-year returns since 2018 of less than 5% per year. This is poor performance – and it’s possible that a repeat could happen unless the company really improves things.

Let’s look at the valuation assumptions and forecasts here.

Essity – Valuation and Forecasts imply that there is an upside, if earnings come in as expected

It really comes down to what you expect out of the company. At the valuation levels we’re seeing today, the company does have an upside of a positive nature to the next few years, if the company manages growth.

The main argument against such a development or an upside in Essity is the company’s tendency to miss estimates by 33-40% on a 1-2 year basis with a 10-20% margin of error. This is neither small nor unrealistic, and if the company were to miss these estimates, it’s more than likely in my mind that the company would continue to underperform as it has now.

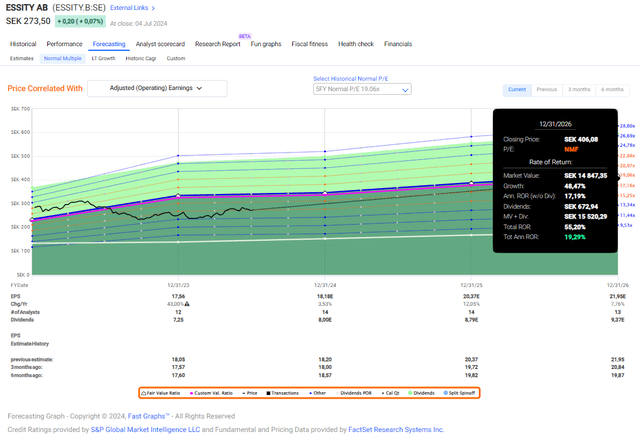

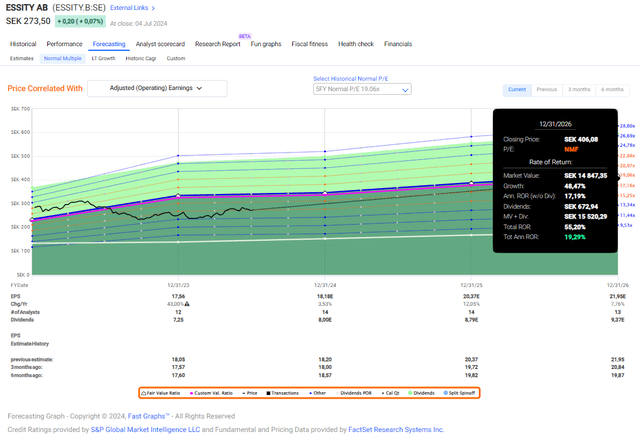

Here is the upside to the 5-year premium – which I by the way view as somewhat too positive in this context and circumstance.

F.A.S.T graphs Essity Upside (F.A.S.T graphs Essity Upside)

But it is, if the company manages these estimates, entirely possible. Even on a 15-16x P/E, the company manages 10-15% annualized return in terms of upside – and this is good enough for me to consider the company a “BUY” here.

My valuation target for Essity has always been “Below 19X NTM earnings.” This alone isn’t to make me buy, but when reading the 1Q21 report and expectations, coupled with the quick depression in valuation, I decided that it wasn’t yet the time for me, in context, to establish a fresh position in Essity – at least not yet. Any investment in Essity won’t turn $10k into $100k in a matter of 1-2 years. This is a low-growth, low-yield company – the main potential for good returns here is market-beating valuation upside.

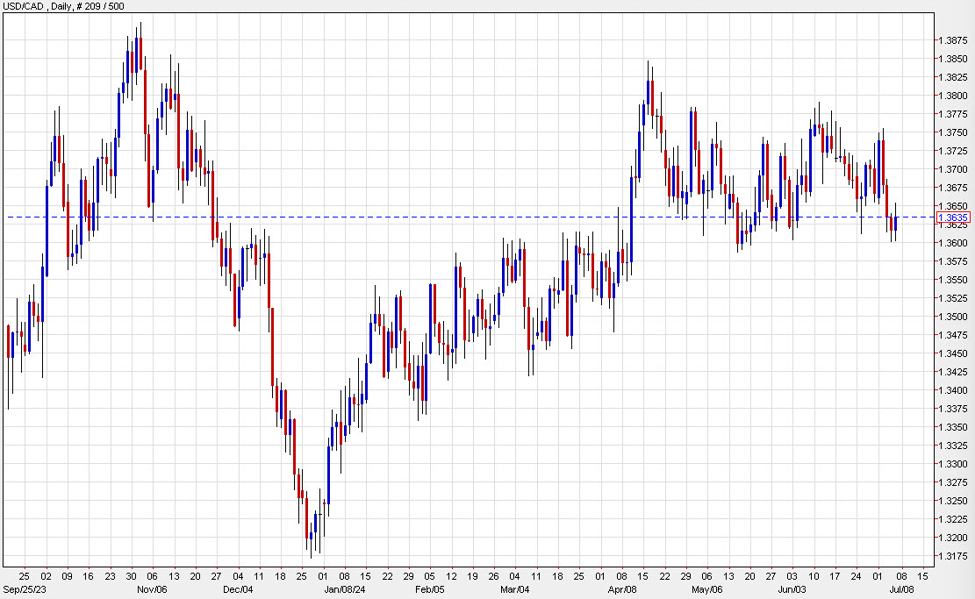

While we have some of that today, I would still be much more comfortable investing at around 250 or slightly below. But we may not get that price in the near term. I’ve also played around a lot with options for Essity for the past 1-2 years.

As things stand now, I would categorize Essity as a “BUY” – not a big one – the upside here is decent, but there are better ones on the market today. At 273 SEK, the analysts following the company have a range of 251 to 330 SEK with an average of 292, meaning an upside of 6.7% (Source: Paywalled TIKR.com Article). Out of those 13 analysts following Essity, 7 of them have “BUY” or outperform which is a decent conviction here.

I say that it’s likely here that Essity can generate returns in excess of 10% per year, but no more than 15% per year, which makes this a low-priority investment target for me, with a “BUY” rating and a PT of 280 SEK/share.

Here is my fresh thesis for the company.

Thesis

- Essity remains at heart a fairly simple play – you either accept/find the company’s valuation to be valid both today and going forward, or you do not. I previously liked Essity trading at 15-16x P/E, but I’m no longer as certain about the upside as I once was. However, historically, if you invested in Essity based on this multiple, you would always have enjoyed impressive results, and there is a good argument to be made why this isn’t expected to change now.

- Given the company’s market-leading positions in 150 countries, international operations, and scale, it’s extremely debatable as to what could threaten this giant’s dominance in its field. It could happen, but given the company’s fundamentals and extremely low debt, Essity could buy out almost anyone in any one specific geography, except of course the very largest players on the market.

- I believe that if you accept the company’s forecasts, and if the transformation makes sense to you (as it does me), there is an argument to be made for a bullish stance for Essity here. Based on a conservative 15–16x P/E range on a forward basis given the relatively low yield at this time, I would estimate that Essity at 15x P/E with current estimates has the potential to return at least double digits annually. If you go up to 16-16.5x P/E, it doesn’t take much for this upside to turn into 15%. Given that the company typically trades at premium of around 19x, which would imply around 20% annually, an argument can be made why Essity Is a “BUY” here – and I would agree with this, though not the best buy on the market.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

As I have said years ago, Essity is never really “cheap”, but it does fulfill my other criteria, meaning I consider the company a “BUY” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.