Ether futures are trading near $1,960 after a volatile stretch that saw sharp downside pressure followed by responsive buying. The broader crypto space remains sensitive to macro headlines and equity sentiment, but ETH is currently attempting to stabilize rather than extend lower.

What underlying crypto activity suggests

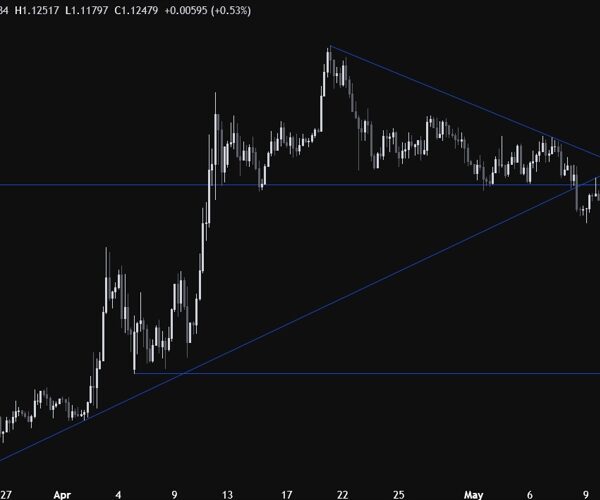

Bitcoin’s price action has been stuck in a tight range and technically biased lower, as noted in the Bitcoin Technicals piece from Feb 18 where price sits below the 100- and 200-hour moving averages and traders are watching support near ~$66,926 with a break below pointing toward ~$65,080. Resistance around the two moving averages and a key trendline near ~$70,000 must be convincingly overcome for the bias to shift bullish. That theme of compression and constrained range carried through from the prior day’s analysis in Bitcoin compresses below key resistance, which highlights repeated failure to clear the 38.2 % retracement near ~$71,551 and the flattening of moving averages as signaling a non-trending market that’s building energy for a directional breakout—likely down while beneath those key averages, but also capable of a sharp move up if momentum shifts.

Turning to altcoins, Ethereum chops at the bottom of the rangedescribed ETH stuck near the lower bounds around ~$2,000 with price action carving out a range that looks weak and leaves the next move open but leaning downward given the broader risk backdrop and lackluster bounce off recent lows. The author paints a somewhat grim picture for crypto risk assets in general, referencing longer-term selloff patterns and ongoing weak sentiment as factors that could influence how both ETH and BTC resolve their respective consolidation structures.

For Ether futures, in the recent sessions, sellers pushed aggressively lower, and participation expanded into the decline. However, despite that intensity, price did not continue cascading. Instead, lower levels began attracting demand.

That shift is important.

After the flush, buying activity began to respond more efficiently. Selling attempts started to produce less downside progress, while rebounds carried more follow-through. This suggests that supply is no longer moving price as easily as it did during the breakdown phase.

In simple terms:

Sellers were dominant earlier, but their control is no longer expanding.

Longer-term vs recent behavior for Ethereum

From a medium-term perspective, ETH is still working through prior damage. The broader structure is not yet fully repaired, and overhead supply likely remains.

However, in the most recent activity, there are early signs of stabilization:

-

Downside pressure is being absorbed rather than accelerating.

-

Rebounds are beginning to show more acceptance.

-

Price is no longer reacting to heavy activity with persistent lower lows.

This does not confirm a strong uptrend.

But it does suggest that immediate downside momentum is cooling.

Key areas to watch for ETH Futures

-

$1,943–$1,950 zone: This area represents recent demand. Holding above it keeps the stabilization thesis intact.

-

$1,985–$2,000 area: First meaningful overhead zone. Acceptance above this region would signal improving structure.

-

Below $1,930: Sustained trade under this level would suggest sellers are regaining initiative.

Scenarios

Bullish scenario for ETH futures

If ETH continues to hold above the recent demand zone and rebounds begin to show clean follow-through, the path of least resistance shifts toward rotation higher into the $1,985–$2,000 area.

A sustained move above that zone would suggest the market is accepting higher prices rather than simply short-covering.

Bearish scenario for ETH futures

If price begins to accept trade below $1,943 and selling pressure expands with follow-through, the stabilization narrative weakens. In that case, a retest of lower liquidity pockets becomes more likely.

Market bias score for Ethereum Today

Market bias score: +2 (slightly bullish).

This reflects improving buyer responsiveness after a heavy selling phase, but not a confirmed upside expansion. The bias is modest because overhead supply is still nearby, and broader crypto volatility remains elevated.

A clean acceptance above $2,000 would increase the score.

A sustained break below $1,930 would shift it back toward neutral or bearish.

What would change the view

-

Sustained acceptance below $1,943

-

Strong follow-through selling with expanding participation

-

Failure of rebounds to hold above prior intraday demand zones

Risk note for crypto traders and investors

This analysis is intended for educational and decision-support purposes only. It is not financial advice. Markets are inherently uncertain, and all trading and investing decisions carry risk.

For real-time trade ideas, follow-ups, and market insights across stocks, indices, commodities, and crypto, check out the investingLive Stocks Telegram channel. Trade ideas are shared for educational purposes only and at your own risk.