Key Notes

- Ethereum price breaks above $4,600 for the first time in two weeks despite insider sell-off by Ethereum Foundation.

- Derivatives market shows new speculative long positions building as open interest rises 1.7% amid flat weekend trading volume.

- Institutional inflows remain strong, with ETH ETF logging five consecutive days of net gains and Bitmine’s treasury holdings crossing 2.65 million ETH.

Ethereum price rose 1.4% on Sunday, October 5, breaking above $4,600 for the first time in two weeks. Derivatives market data shows ETH attracting fresh long bets, even after the Ethereum Foundation confirmed a 1,000 ETH sell-off on Friday.

According to CoinMarketCap, Ethereum traded as high as $4,619 intraday, defying lean spot trading volumes through the weekend. More so, the rally came in the wake of a Foundation announcement stating it would convert 1,000 ETH to stablecoins to fund research, grants, and donations.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap‘s TWAP feature, as part of our ongoing work to fund R&D, grants and donations, and to highlight the power of DeFi.

— Ethereum Foundation (@ethereumfndn) October 3, 2025

Historically, Ethereum Foundation sell-offs have imposed downward pressure on ETH price action. However, ETH derivative markets activity over the weekend may invalidate this trend.

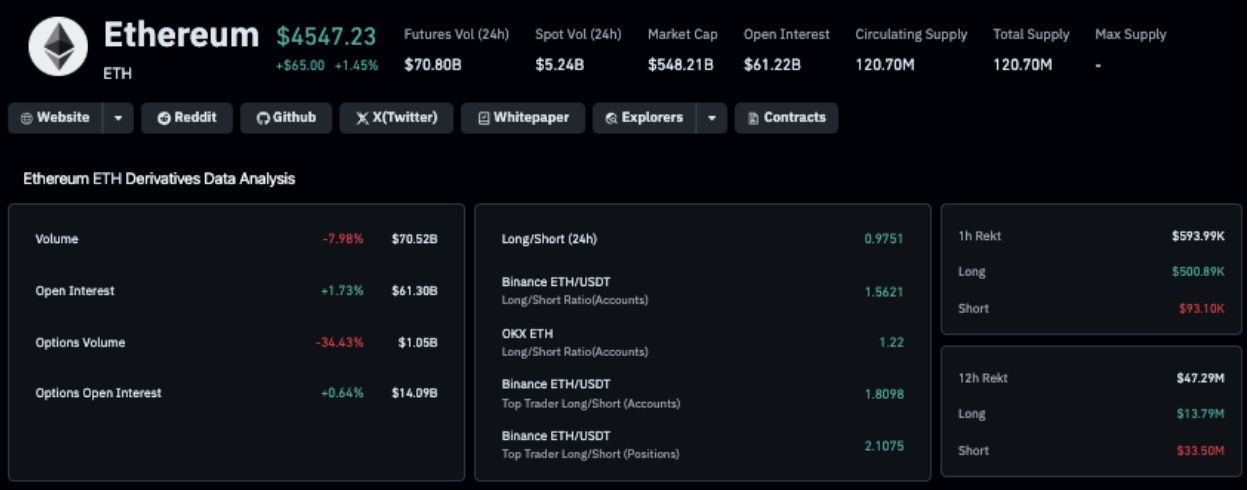

Ethereum Derivatives Market Analysis | Source: Coinglass

The latest data from Coinglass shows that ETH open interest climbed 1.7% in the past 24 hours, to hit $41.3 billion despite a 7.9% drop in trading volume. This divergence suggests that Ethereum Foundation’s sell-off has not nullified bullish conviction among ETH speculative traders.

Bulls Charge Forward Despite Ethereum Foundation Sell-Off

While insider transactions typically spark fear-driven sell-offs, Ethereum’s price has staged a breakout above the $4,600 level and attracted net inflows of $700 million in new futures contracts positions on Sunday.

Valued at approximately $4.6 million at current prices, markets appear unfazed by the Ethereum Foundation’s 1,000 ETH sell-off, with institutional demand and ETF inflows providing strong counterweights.

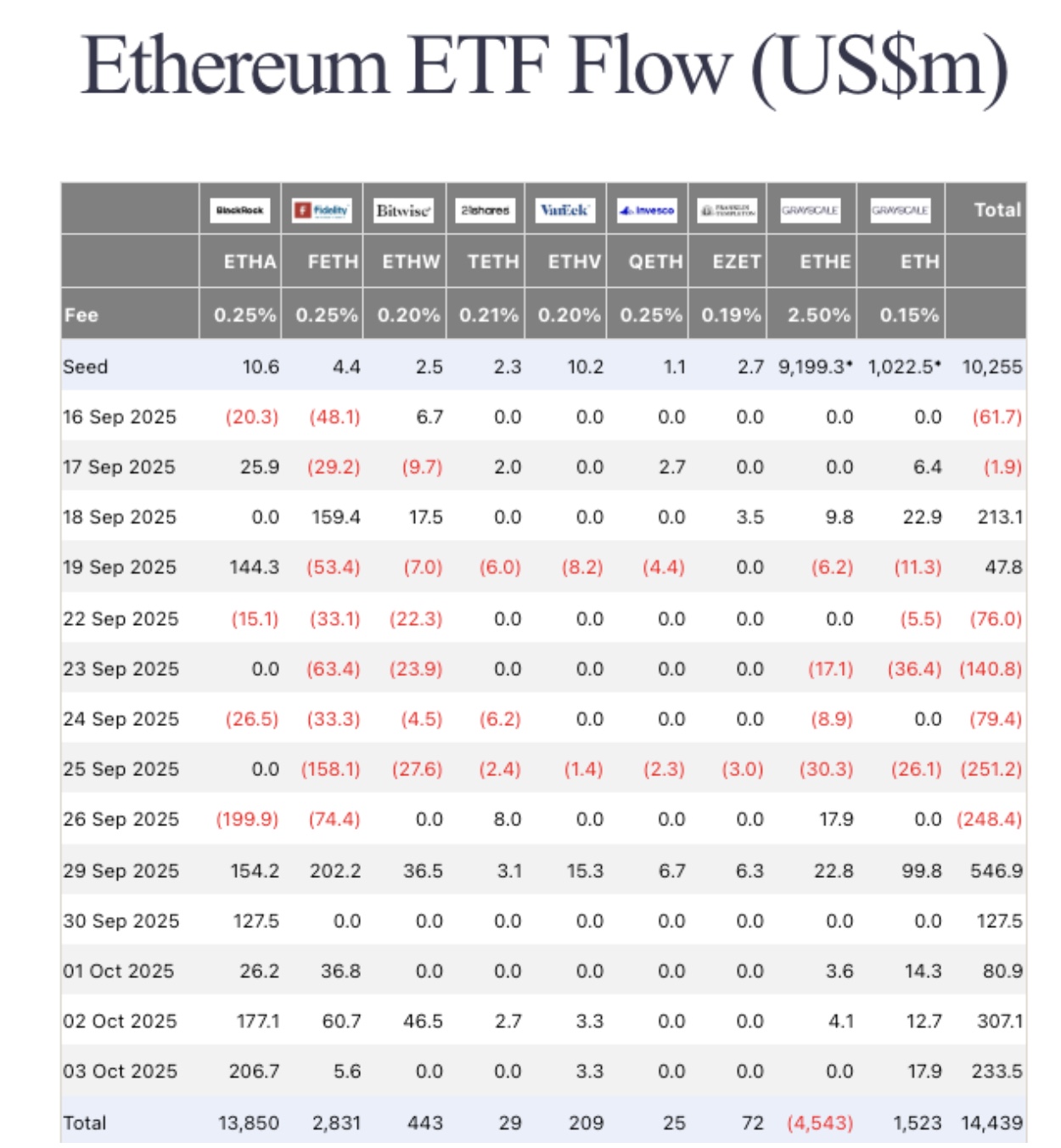

Ethereum ETFs record 1.3 billion net inflows between Sept 29 to Oct 3 | Source: FarsideInvestors

FarsideInvestors data shows the Ethereum ETF scooped $1.3 billion in five consecutive days of net inflows last week.

ETHtreasury reserve inflows also remain active, with market-leader Bitmine (BMNR) has increased its Ethereum holdings to 2.6 million ETH.

Combined, these inflows have provided ETH with the liquidity to defend the $4,600 resistance zone. Should open interest continue rising along with ETF inflows, ETH price could potentially test $4,750 in the week ahead.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.