Analysts’ optimism on the probability of Ethereum Spot Exchange-Traded Funds (ETFs) approval in Might is consistently waning, because the as soon as optimistic senior Bloomberg Intelligence analyst Eric Balchunas has lowered his prediction for the merchandise being authorized to a mere 25%.

Ethereum Spot ETFs Odds Continues To Drop

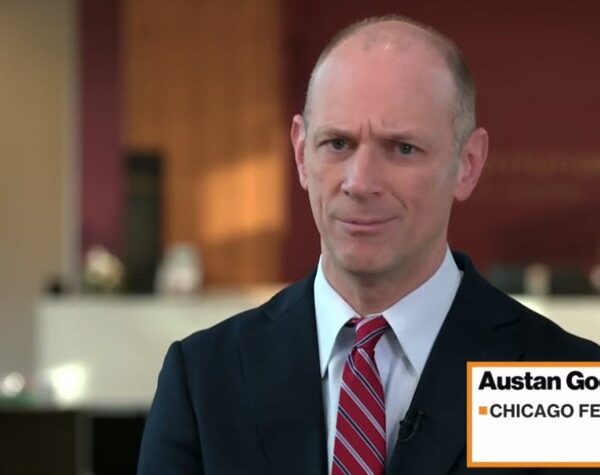

Eric Balchunas, who famous that his possibilities of having an Ethereum ETF authorized in Might by america Securities and Alternate Fee (SEC) are nonetheless a bleak 25%, expressed his pessimism in an X post. In accordance with Balchunas, he would in all probability go decrease if he may accomplish that, suggesting how unsure the analyst is in direction of the merchandise.

The Bloomberg skilled’s insights coincide together with his colleague James Seyffart’s put up concerning Bitwise Make investments’s newest Ethereum ETF filling. On Thursday, Bitwise Make investments registered shares of its ETH ETF with the SEC utilizing a Type S-1 registration assertion, which is its first stage of making use of for the change merchandise.

A 19b-4 kind, saying the agency’s intention to listing the ETF on a inventory change, was filed after this one. Bitwise plans to situation shares of the ETH funding car on NYSE Arca, in accordance with the 19b-4 modification submitting that was submitted to the SEC.

Each filings preceded amid rumors that the SEC was making an attempt to categorise ETH as a safety underneath its regulatory scope, elevating issues about future listings of the ETH ETFs. Bitwise Make investments is the most recent asset firm to hitch the ETH ETF race, indicating the agency’s confidence about an approval by the Might deadline.

Regardless that some within the cryptocurrency world welcomed this transfer as a touch that rules would quickly approve it, consultants like Eric Balchunas are nonetheless not satisfied, warning that the probability continues to be slim.

Balchunas acknowledged that he has been getting tagged in tweets about Bitwise’s newest submitting, the ETH Correlation research, and different ETH ETF hopium. Regardless of his excessive regard for the developments, he nonetheless believes that the chances for approval are very low.

Moreover, with seven weeks remaining till the Might deadline, Balchunas famous that the SEC’s radio silence continues to be miserable. “Again, personally I want them to approve but I also want to get the call right so we will be a perfect 4 for 4 in crypto ETF predictions,” he added.

New Correlation As Half Of Bitwise’s ETH ETF Submitting

It’s value noting that Bitwise’s latest spot Ethereum ETF submitting includes the discharge of a brand new correlation evaluation. This marks the primary ETH correlation evaluation to mimic the exact evaluation means of Bitcoin (BTC) by the SEC, offering a promising final result.

A number of research had been performed by Bitwise as a way to mirror the SEC’s analysis of Bitcoin particularly. These embrace the identical 2.5-year pattern interval, precise intraday correlation intervals, the identical correlation statistic, and others.

For hourly, one-minute, and five-minute correlations, the variations in correlation values throughout the entire pattern interval are restricted to 0.2%, 8%, and 5%, respectively.

Featured picture from iStock, chart from Tradingview.com