The introduction of a brand new draft bill geared toward regulating stablecoins in the US has ignited a firestorm of debate throughout the cryptocurrency sector. This legislative improvement, whereas nonetheless in its formative phases, is positioned to considerably alter the operational panorama for digital currencies, significantly Ethereum and its related stablecoins.

A Massive Win For Ethereum?

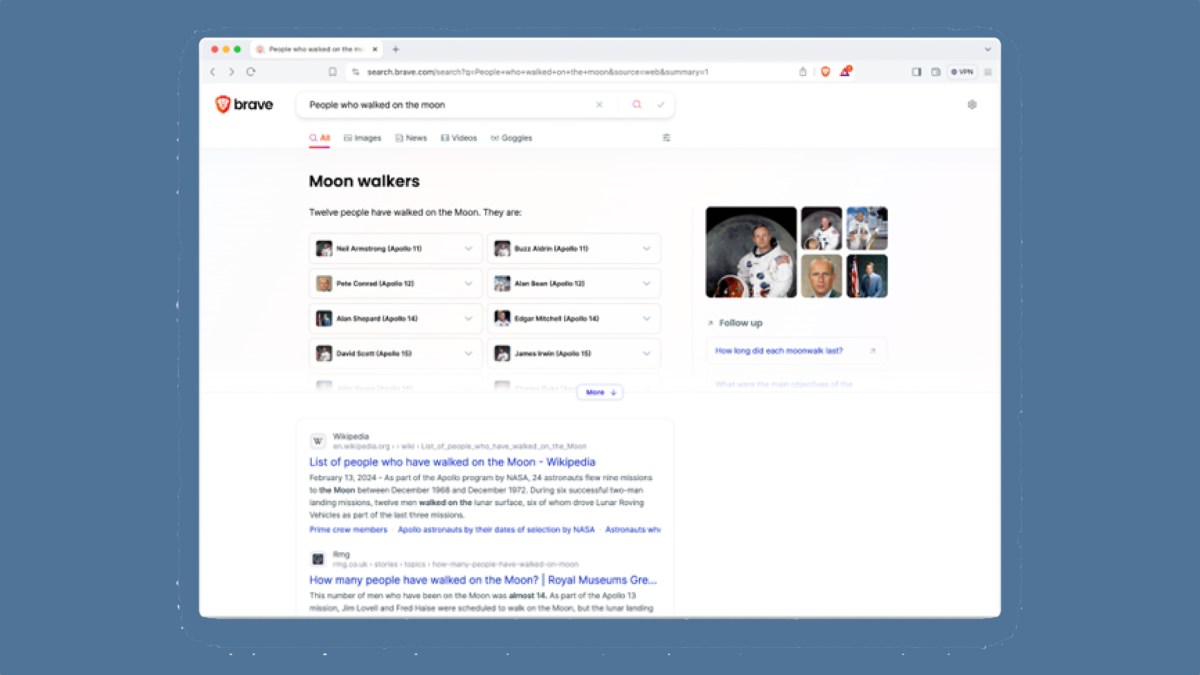

Ryan Berckmans, a outstanding member of the Ethereum group and an investor with intensive expertise, offered an enthusiastic evaluation of the draft invoice. He shared his ideas by way of X, a well-liked social media platform, the place he described the invoice as “extremely bullish” for Ethereum.

In keeping with Berckmans, the draft invoice’s most important characteristic is its broad legitimization of stablecoins on public chains, significantly Ethereum, the place a big majority of stablecoins are minted. “My initial read is that the bill is extremely bullish and legitimizes Ethereum like never before. The bill broadly legitimizes stablecoins on public chains in America, where 59% of all stablecoins are minted on Ethereum, rising to 93% when excluding centralized platforms like Tron,” he acknowledged.

He additional elaborated that the laws “opens floodgates for US banks to obtain stablecoin licenses and for certain private companies to issue up to $10 billion in stablecoins without a license.” This provision might doubtlessly rework the banking sector’s strategy to digital currencies, integrating them extra deeply into the monetary mainstream and broadening their use throughout a spread of financial actions.

Additional elaborating on the positives, Berckmans was happy with the invoice’s strategy to belongings not pegged to the USD, similar to on-chain euros and gold. The invoice, in accordance with his interpretation, doesn’t impose regulatory measures on these belongings, which might keep a free and globalized marketplace for them and improve their attraction as different reserve currencies or funding belongings.

Nonetheless, Berckmans additionally recognized a number of areas of concern throughout the draft invoice. Notably, the invoice imposes strict rules on unlicensed USD-pegged stablecoins, doubtlessly prohibiting their issuance to US individuals residing in the US. This might influence standard decentralized stablecoins like DAI. Moreover, he criticized the invoice’s definition of “algorithmic payment stablecoin” for being overly broad, which might embody a spread of decentralized stablecoins that use algorithms to take care of their peg to the greenback or different belongings.

🚨New stablecoin invoice draft🚨

My preliminary learn is that the invoice is extraordinarily bullish and legitimizes Ethereum.

Disclaimer: I am not a lawyer or regulatory skilled. I learn by way of chunks of the brand new invoice[1] and analyzed it with GPT4. Analyze it your self[2]

TL;DR

– Ethereum wins large…— Ryan Berckmans ryanb.eth (@ryanberckmans) April 17, 2024

Issues And Criticisms

Contrasting sharply with Berckmans’ optimistic perspective, Jake Chervinsky, Chief Authorized Officer at Variant Fund and a former CLO of the Blockchain Affiliation, offered a way more important viewpoint. Chervinsky expressed his issues by way of X, stating, “The bill published today is deeply flawed: it appears to ban nearly everything except a narrow band of centralized, custodial stablecoins.”

Stablecoin laws ought to be a prime precedence for everybody who cares about crypto coverage.

However the invoice revealed right this moment is deeply flawed: it seems to ban almost the whole lot besides a slim band of centralized, custodial stablecoins.

This is able to be far worse than establishment.

— Jake Chervinsky (@jchervinsky) April 17, 2024

Chervinsky additionally identified that the draft invoice appears to contravene a number of rules he advocated for in his testimony to Congress final 12 months. In keeping with him, a deal with custodial stablecoins ought to be paramount, however the invoice as an alternative seems to create anti-competitive regulatory moats that would hinder additional improvement within the house.

Regardless of these divergent views, Berckmans remained hopeful in regards to the broader implications of the invoice. He envisioned a situation the place the restrictions on USD-pegged stablecoins might inadvertently increase the marketplace for non-USD stablecoins, permitting them to flourish and diversify the stablecoin market considerably. He speculated that sooner or later, the dominance of USD-pegged stablecoins might lower, making approach for a extra balanced stablecoin ecosystem.

Because the cryptocurrency group continues to investigate and debate the draft invoice, it’s clear that the ultimate model of the laws will probably be important in shaping the way forward for stablecoins and blockchain know-how in the US and probably globally.

At press time, ETH traded at $2,984.

Featured picture created with DALL·E, chart from TradingView.com