EUR/USD every day chart

For the reason that retreat from 1.1000 on the finish of final month, the pair was caught in and across the 100-day (crimson line) and 200-day (blue line) transferring averages. However after the greenback slumped following the FOMC assembly yesterday, patrons took the decision to motion to interrupt above the latter and that’s seeing the bias within the pair shift to being extra bullish.

The greenback softness at this time is extending, with the pair buying and selling up 0.3% to 1.0910 at present. Nonetheless, the euro aspect of the equation can even come into play afterward with the ECB arising subsequent.

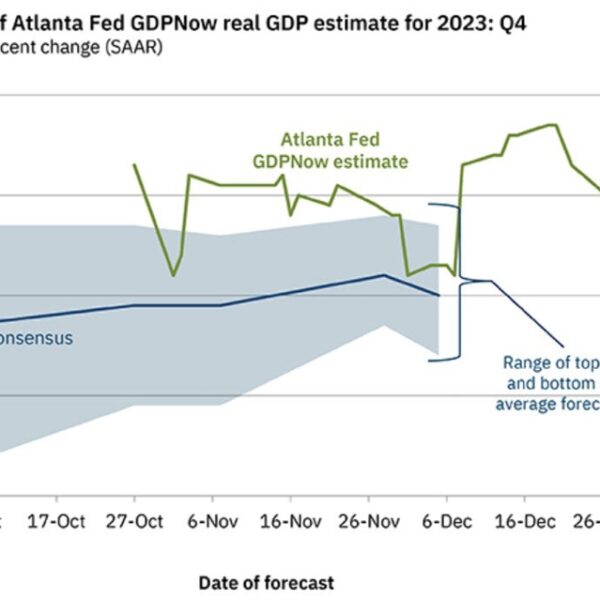

As issues stand, merchants are pricing in a whopping 154 bps price of price cuts by the ECB for subsequent yr. The percentages of a March price minimize have moved as much as ~77% with almost 50 bps priced in already for April. In different phrases, the Fed’s dovishness has arrange extra expectations of a faster transfer by different main central banks going into subsequent yr.

That being stated, it is very important keep in mind that not each economic system is similar. The so-called disinflation course of appears to be farther alongside within the US than the Eurozone, particularly when you think about the latest PMI knowledge takeaways here.

Nonetheless, there may be additionally the narrative that the euro space economic system is slowing down a lot quicker than the US. And so, if the ECB needs to, they’ll choose to spin the rhetoric accordingly and concentrate on that to tee up price cuts following the timeline priced in by markets for the time being.

EUR/USD could also be primed for a retest of the 1.1000 mark primarily based on the technicals. However the euro aspect of the equation may offset the greenback weak point that we’re seeing for the time being, protecting the stability of flows extra balanced in direction of the top of the week.