- Prior 53.2

- Manufacturing PMI 45.6 vs 47.9 expected

- Prior 47.3

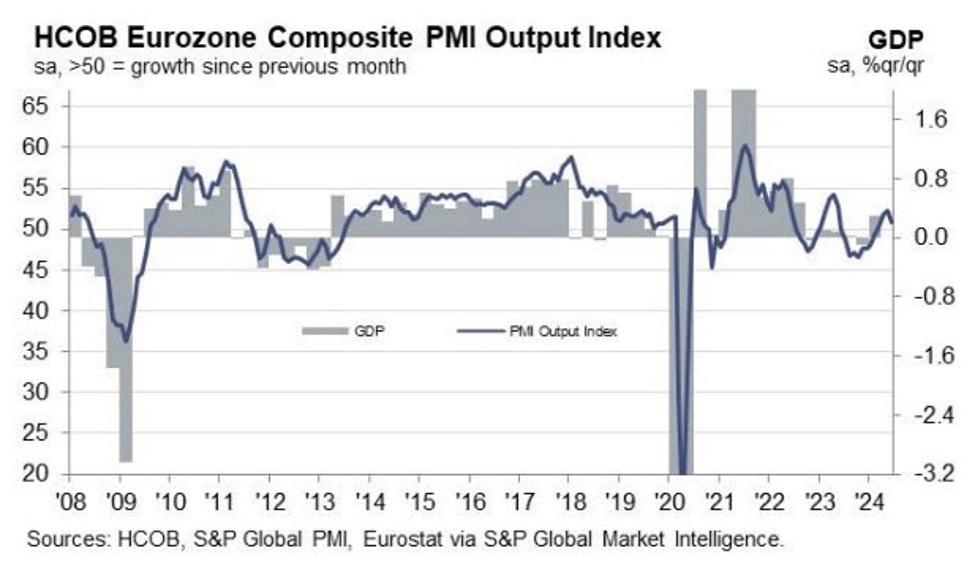

- Composite PMI 50.8 vs 52.5 expected

- Prior 52.2

Business activity in the euro area slows sharply towards the end of Q2, with manufacturing continuing to prove to be a drag. The output index there is seen slumping to a six-month low. Meanwhile, the services sector reading also eased but to a three-month low.

Looking at the details, new orders were seen contracting for the first time in four months while the pace of growth in employment conditions was the weakest since March. HCOB notes that:

“Is the recovery in the manufacturing sector ending before it began? Both we and the market consensus anticipated that the

increase in the index in May would be followed by another rise in June, potentially setting the stage for an upward trend.

However, rather than moving closer to expansionary territory, the HCOB Flash Eurozone Manufacturing PMI reading fell,

dashing hopes for a recovery. This setback was compounded by the fact that new orders, which typically serve as a good

indicator of near-term activity, fell at a much faster rate than in May. This rapid decline in new orders suggests that a

recovery may be further off than initially expected.

“The services sector continues to keep the Eurozone afloat. Even though activity didn’t pick up as much as last month and

fell short of what most analysts were expecting, the overall expansion was solid. Parallel to the softer activity figures, service

providers were a bit more reserved when it came to increasing their staffing levels. Using the preliminary HCOB Flash

Eurozone Composite Output Index in a simple regression analysis, the GDP estimate for the second quarter indicates a

slight downgrade but still points to positive growth of 0.2% compared to the first quarter.

“The ECB, which cut interest rates in June, may feel vindicated by prices data which signalled easing pressure in the

Eurozone’s service sector. However, the HCOB PMI do not provide ammunition for another rate cut in July by the ECB. This

is because, for the biggest Eurozone economy, Germany, service providers increased their selling prices at a sharper pace

than in May. In addition, in the Eurozone manufacturing sector, which experienced deflation in output charges over the last

14 months, we may see a return of selling price inflation again as input prices in the region increased in June for the first

time since February 2023.

“The worsening situation in both the services and manufacturing sectors in France might be tied to the results of the recent

European Parliament election and President Emmanuel Macron’s announcement of snap elections on June 30. This

unexpected turn of events has likely stirred up a lot of uncertainty about future economic policies, causing many companies

to hit the brakes on new investments and orders. In any case, it is evident that France’s poor economic performance has

significantly contributed to the deteriorating economic conditions in the Eurozone.”