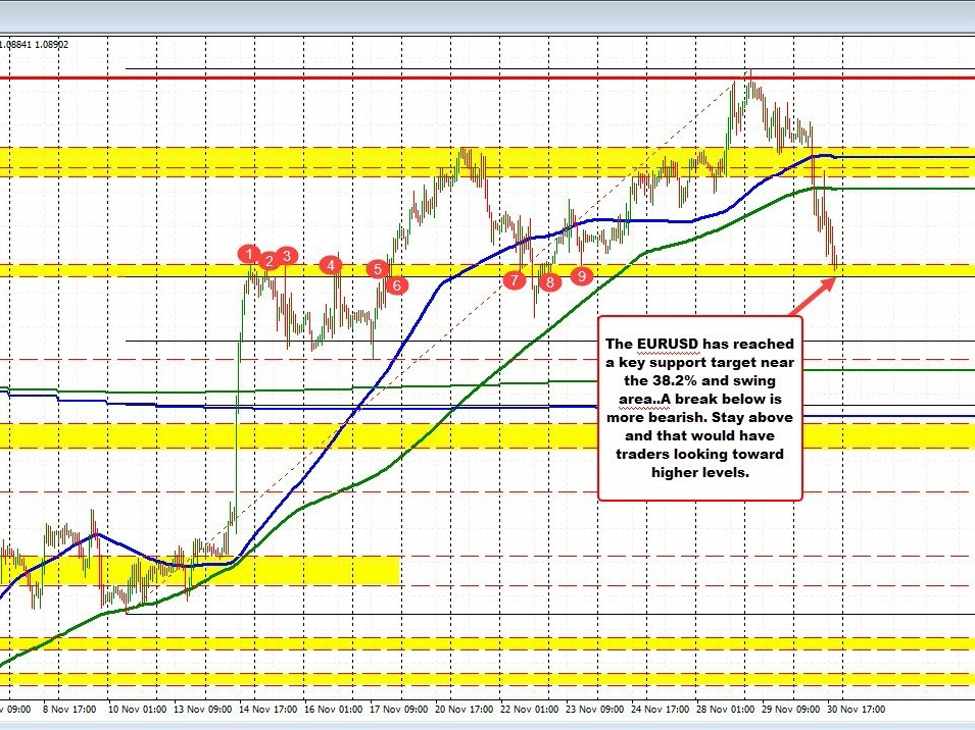

EURUSD falls to technical barometer close to 38.2% retracement

The EURUSD pair lately hit a brand new session low, testing a crucial swing space and the 38.2% Fibonacci retracement stage, ranging between 1.0878 and 1.0887. The pair’s low touched 1.08829, influenced partly by the Eurozone CPI coming in weaker than anticipated, which favored the draw back. Technically vital, the EURUSD fell beneath its 200-hour transferring common for the primary time since November 13. Publish the discharge of U.S. knowledge at 8:30, there was a short spike above the 200-hour transferring common, however this proved non permanent as promoting stress resumed.

For a stronger bearish bias, the 38.2% retracement of the upward motion from the November 10 low must be decisively damaged. Notably, an identical dip beneath this stage occurred on November 22, however the value remained above the 200-hour transferring common then, prompting a shift from promoting to purchasing. Nonetheless, the latest break beneath the 200-hour transferring common has tilted the steadiness in favor of the sellers. Regardless of this, the proximity to the 38.2% retracement stage and the swing space is inflicting some hesitation amongst merchants, because it presents a well-defined danger limitation level.

Wanting forward, tomorrow’s speech by Fed Chair Powell is extremely anticipated and can possible have a big affect on the EURUSD’s trajectory. His remarks might both bolster the EURUSD (weakening the U.S. greenback) or apply additional bearish stress (strengthening the U.S. greenback), relying on the tone and content material of his tackle.