PM Images

Investment Thesis

EUSA iShares MSCI USA Equal Weighted ETF (NYSEARCA:EUSA) owns a portfolio of about 600 U.S. stocks. The fund’s equal-weighted approach is a two-sided sword. While the approach has resulted in lower concentration risk, EUSA’s growth prospect is also limited relative to the S&P 500 index as this approach has resulted in lower exposure to fast-growing technology sector. Given EUSA’s lower earnings growth prospect than the S&P 500 index, we are unable to give EUSA a buy rating. Investors may want to seek other alternatives instead.

Fund Analysis

EUSA has lower concentration risk thanks to its equal-weighted strategy

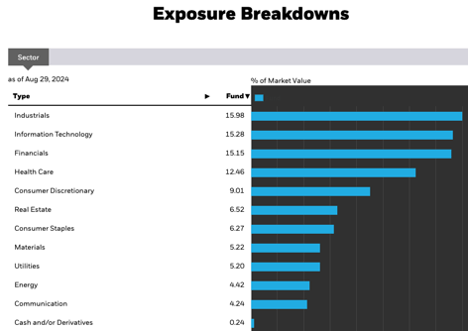

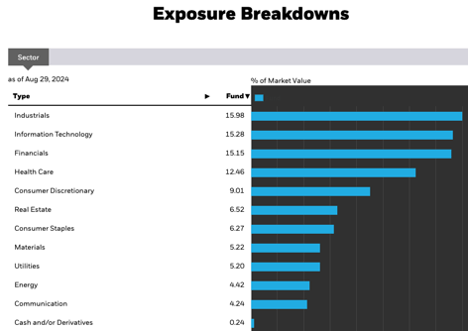

EUSA owns a portfolio of about 600 U.S. stocks. There is significant overlap between EUSA and the S&P 500 index as one can find many of these stocks in the S&P 500 index as well. The difference is that the S&P 500 index is market-cap-weighted while EUSA is equal-weighted. This means that after each rebalancing, all stocks in EUSA’s portfolio will have the same weighting. The fund rebalances four times per year. However, frequent rebalancing usually means higher trading costs. Surprisingly, it has a low expense ratio of only 0.09%. Other similar ETFs such as Invesco S&P 500 Equal Weight ETF (RSP) has a higher expense ratio of 0.20%. EUSA’s equal-weighted approach means that the fund is diversified as no stocks in its portfolio will represent over 0.167% of the total portfolio after each rebalancing. In terms of sector allocation, EUSA is also much more balanced relative to the S&P 500 index. As can be seen from the chart below, not a single sector represents over 16% of EUSA’s total portfolio.

iShares

Overweight in industrials but underweight in technology

However, a balanced and diversified portfolio in terms of sector allocation may not contribute to better returns. If we compare the sectors allocation of EUSA with the S&P 500 index, we noticed that EUSA is overweight in industrials sector but underweight in information technology sector. As can be seen from the table below, industrials sector represents nearly 16.0% of EUSA’s total portfolio but it only represents about 8.4% of the S&P 500 index. That is nearly twice of the representation in the S&P 500 index. On the other hand, EUSA’s exposure to information technology is less than half of that of the S&P 500 index. As can be seen from the table, information technology sector represents about 15.3% of EUSA’s total portfolio but nearly 31% of the S&P 500 index.

|

EUSA |

S&P 500 |

|

|

Industrials |

15.98% |

8.43% |

|

Information Technology |

15.25% |

30.95% |

|

Financials |

15.15% |

13.29% |

|

Healthcare |

12.46% |

12.19% |

Table: Exposure Breakdown between EUSA and S&P 500

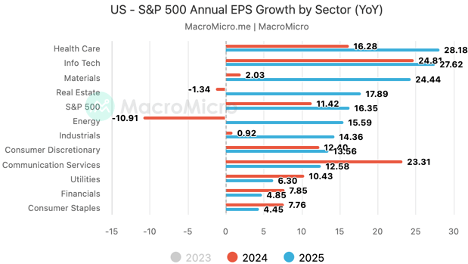

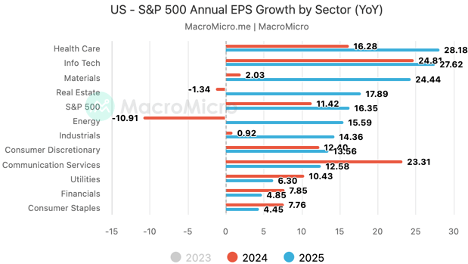

EUSA’s lower exposure to information technology sector and higher exposure to industrials sector relative to the S&P 500 index is not beneficial. Why do we make this conclusion? This is because technology sector is riding on several important mega-trends including artificial intelligence, cloud computing, Internet of Things (“IoT”), industrial automation, etc. These trends should result in strong earnings growth for many technology stocks at least in the next few years. As can be seen from the chart below, consensus annual earnings growth estimates for information technology sector in 2025 is expected to be 27.6%. This is much higher than the 16.4% consensus earnings estimate of the S&P 500. On the other hand, consensus earnings growth rate for industrials sector is only 14.4% in 2025. This is lower than the earnings growth rates of information technology sector and the S&P 500 index. Therefore, EUSA’s overweight to industrials sector and underweight to information technology sector means that it will likely have lower earnings growth potential than the S&P 500 index, at least in the near term.

MacroMicro

EUSA has underperformed the S&P 500 index in the past

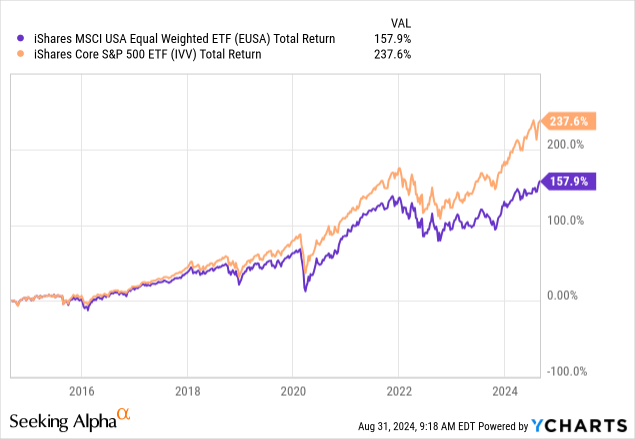

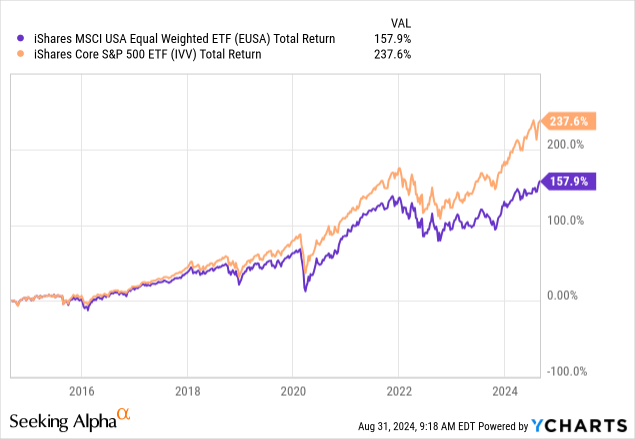

Let us now look at how EUSA has performed relative to the S&P 500 index in the past. As can be seen from the chart below, EUSA delivered a total return of 157.9% in the past 10 years. This return is good, but still not that good relative to the S&P 500 index. As can be seen from the chart, the S&P 500 index delivered a total return of 237.6% in the past 10 years, far more superior than EUSA.

YCharts

Let us now compare the average annual return in the past 10 year between EUSA and the S&P 500 index. As can be seen from the table below, the average annual return for the S&P 500 index in the past 10 years was 13.1%. This was nearly 3.6 percentage points higher than the 9.5% average annual return of EUSA.

|

As of July 31, 2024 |

EUSA |

S&P 500 |

|

1 year |

13.86% |

22.12% |

|

3 year |

3.09% |

9.57% |

|

5 year |

10.01% |

14.96% |

|

10 year |

9.54% |

13.11% |

Table: Average Annual Return

EUSA’s underperformance is not surprising. As we have discussed earlier in the article, EUSA’s equal-weighted approach means that it cannot reap the full benefit of the strong returns of many growth stocks. For example, Microsoft (MSFT) saw its share price increased by over 800% in the past 10 years. The S&P 500 index’s market-cap-weighted approach will be able to fully benefit the strong return of this stock. In contrast, the contribution of Microsoft to EUSA’s return is limited due to the fund’s frequent rebalancing.

Investor Takeaway

EUSA’s equal-weighted approach means that it has a lower earnings growth prospect than the S&P 500 index. Therefore, we do not think investors with a long-term earnings horizon need to own this fund.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.