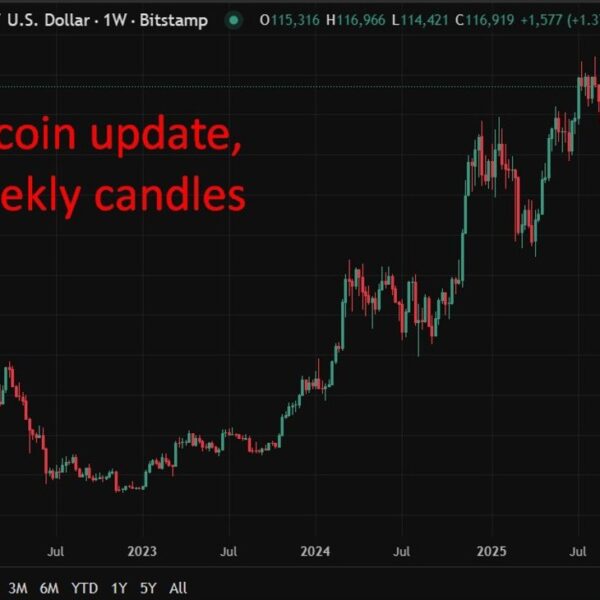

Two industries are getting smoked today that had previously been on the sidelines of the AI trade:

- Freight brokers/trucking

- Office real estate

Here is a look at CH Robinson, which is one of the largest third-party logistics companies in the world.

CHRW daily

They arrange transportation between shippers and carriers and take a margin in return. It’s a company that’s been highlighting its efforts to get leaner via AI but suddenly the share gains for the past two months have been wiped out.

In fact, the entire Dow Transports index is down 5% today in its worst drop since Liberation Day.

Another big loser today is office real estate and real estate brokers. Here is Cushman and Wakefield, which is down by a quarter in two days.

CWK stock

The thing is, it’s not just the brokers on either side. The trucking companies and the office companies are getting sucked down with it.

So part of the thinking is that AI agents will replace the agents but there is also some line of thinking that the disruption will be so brutal that it crushes trucking demand and demand for office workers.

Alternatively, there is this landscape that’s bordering on irrational, where even the hint of AI disruption causes a wholesale flight out of the sector, indiscriminate of the individual business model.

Microsoft AI CEO, Mustafa Suleyman, said this week that “most, if not all, professional tasks” undertaken by white collar workers will be fully automated by AI within the next 12 to 18 months.

We’ve been in this sweet spot where all the upsides from AI were being priced into everything but none of the downsides. It’s flipping now and everything is being tossed out as something to be potentially disrupted.

This is a very tough environment to trade in because almost anything can be disrupted by AI if we’re looking at it with a broader economic lens. So the question is how long this lasts. There have been some opportunities to flip it but I fear now that every new AI model release won’t be treated as a ‘wow’ moment but a ‘worry’ moment that will hurt the broader market.