On Monday, the US Securities and Exchange Commission (SEC) approved nine spot Ethereum Exchange Traded Funds (ETFs). Coinbase, the leading US cryptocurrency exchange, responded with enthusiasm on X. It noted its integral role as a custodian for the vast majority of these new financial products. According to their statement, Coinbase is “proud to be a trusted partner and custodian powering 10 of 11 spot BTC ETFs and 8 of the 9 newly approved ETH ETFs.”

Coinbase Is A Single-Point Of Failure

The statement from Coinbase also highlights the transformative potential of spot ETFs, claiming they will “help catalyze further growth and innovation” and “expand the size and breadth of crypto markets.” However, this significant consolidation of custodial responsibilities by Coinbase has sparked a critical response from some industry experts who are concerned about the implications of such concentration.

Gabor Gurbacs, founder of PointsVille and strategy advisor at Tether, expressed his criticism via X. He questioned the wisdom of the fund issuers’ decision-making processes: “Coinbase holds assets for 10 out of 11 spot Bitcoin ETFs and 8 out of 9 ETH ETFs. While I am sure they have a great security team, I fundamentally question the competency and judgment of boards and risk management committees at fund issuers who think this is acceptable risk.”

Gurbacs’s concerns stem from the potential risks associated with such a high concentration of assets under the management of a single entity. He elaborated, “It’s practically all assets for almost all US ETFs. What if something goes wrong? As we learned, that’s certainly a possibility in the exchange space. I lost the last bit of confidence that even traditional assets are remotely safe with most issuers. Boards are incompetent.” His comments reflect a broader anxiety about the vulnerability of the crypto ecosystem to single points of failure, a concern that has been underscored by numerous high-profile exchange hacks and technical failures in recent years.

To further clarify his position, Gurbacs noted that his criticism was not a reflection of his opinion of Coinbase’s operational capabilities. It is rather a critique of the systemic risks posed by such concentration. He stated, “Single entity counterparty for the whole space is still an unacceptable risk,” emphasizing the need for diversification in custodial services to mitigate potential systemic threats.

In response to an X user’s query about the uniqueness of Fidelity‘s custody solution, Gurbacs confirmed, “Yes,” indicating that Fidelity is the only major player that has established its own custodial services for cryptocurrencies.

Echoing Gurbacs’s sentiments, Steven Dickens, Chief Technology Advisor at The Futurum Group, added his perspective on the need for regulatory scrutiny: “Agree. Regulators need to assess the systemic risks. Not saying anything bad about Coinbase but last week should be a cautionary tale about the IT concentration risks alone.”

At press time, ETH traded at $3,499.

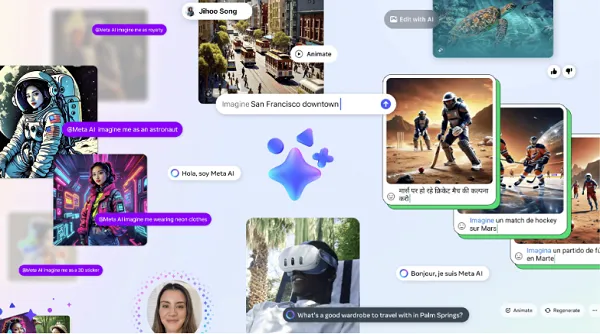

Featured image created with DALL·E, chart from TradingView.com