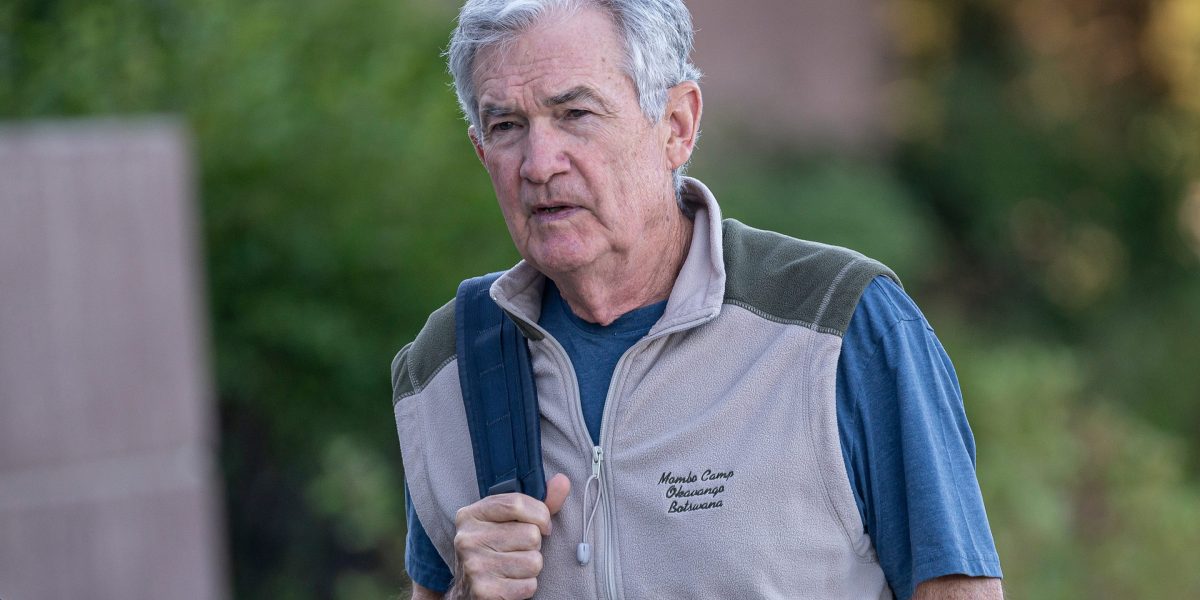

All eyes will turn to Federal Reserve Chairman Jerome Powell on Friday, when he is scheduled to deliver a highly anticipated speech at a central bank conference in Jackson Hole, Wyo.

The annual event previously has served as an opportunity for policymakers to tease forthcoming rate moves. Last year, Powell signaled a pivot to cuts, saying “the time has come for policy to adjust” and that “my confidence has grown that inflation is on a sustainable path back to 2%.”

Wall Street overwhelmingly expects the Fed to resume rate cuts in September, after holding off for months as President Donald Trump’s tariffs ripple through the economy. That’s as Trump and the White House have put immense pressure on the Fed to ease while a more dovish governor was named to the board of governors.

But Powell may not drop big hints this year.

For one thing, some analysts don’t think a September rate cut is in the bag because inflation remains above the Fed’s 2% target and is ticking higher as tariffs put upward pressure on prices.

Meanwhile, economists are debating whether deteriorating jobs data are due to weak demand for workers or weak supply. If the problem is supply, then rate cuts would worsen inflation.

“Tariffs are feeding through unevenly and will continue to push inflation higher in the coming months,” wrote Michael Pearce, deputy chief U.S. economist at Oxford Economics, in a note on Friday. “It will be difficult for policymakers to tease out one-off tariff effects from longer-lasting inflationary pressures.”

For now, he thinks the Fed will remain on hold until December, but a weak August jobs report would change his view.

Market veteran Ed Yardeni has maintained a “none-and-done” forecast for this year, saying the Fed will hold off on cuts due to still-elevated inflation and the continued resilience of the U.S. economy.

As for the Jackson Hole speech, a note from Yardeni Research on Sunday predicted Powell would keep his cards close to his vest.

“Odds are that he will be more of an owl—waiting and watching—than either a hawk or a dove,” it said. “In other words, he’ll say that a Fed rate cut is possible at the September meeting, but the Fed’s decisions are data-dependent.”

Bank of America has similarly been skeptical about rate cuts this year and pointed out that Powell suggested in July he would be comfortable with low job gains as long as the unemployment rate stays in a tight range.

That scenario now looks like it’s becoming reality, and BofA said Powell’s Jackson Hole speech will give him a chance to “walk the talk.”

“If Powell wants to lean against a September cut, he could say that the policy stance remains appropriate given the data at hand. We note that this phrasing would allow him to retain the optionality of cutting if the August jobs report is very weak,” the bank said in a note Wednesday. “Of course, he might also telegraph a cut by saying it is appropriate to move to a less restrictive policy stance.”

Wall Street has so thoroughly priced in a September cut that any sign investors may have to wait longer would not only be a severe letdown—it would feel like a rate hike.

Preston Caldwell, chief US economist at Morningstar, wrote Tuesday that given how long the market has been expecting a reduction, “postponing cuts much further would constitute an effective tightening of monetary policy at this stage.”

‘We don’t think Powell can firmly guide toward easing’

But even some economists who do think the Fed will cut next month are doubtful that Powell will tip his hand on Friday.

JPMorgan said the tension in the Fed’s dual mandate between fighting inflation and maximizing employment now favors the latter.

Despite recent inflation data indicating tariffs are filtering into prices more, the disappointing jobs report should tilt the Fed toward cutting rates next month.

“However, with several Fed speakers recently stating that the case for a cut has not been made, and with more employment data to come, we don’t think Powell can firmly guide toward easing at the next meeting,” JPMorgan said in a note Friday.

Citi Research chief US economist Andrew Hollenhorst thinks Powell will hint at a cut, but won’t go beyond that.

The hint could come in the form of a remark that risks to employment and inflation are coming into balance. In July, Powell said if they were in balance, then rates should be more neutral. Given that he called the current rate level “modestly restrictive,” that suggests balanced risks would merit a cut.

Since then, jobs data show the labor market has softened, allowing Powell to say that risks are more balanced and that rate cuts would be appropriate next month if that trend continues, Hollenhorst wrote in a note Friday.

“We expect Chair Powell to confirm market pricing for a return to rate cuts in September, but stop short of explicitly committing to cut at that meeting,” he said. “We do not expect he will comment on the size of the cut, but it is safe to assume the base case at the moment is for a 25bp cut.”