Federal Reserve Chairman Jerome Powell on Friday pushed again on market expectations for aggressive rate of interest cuts forward, calling it too early to declare victory over inflation.

Regardless of a string of constructive indicators not too long ago concerning costs, the central financial institution chief stated the Federal Open Market Committee plans on “keeping policy restrictive” till policymakers are satisfied that inflation is heading solidly again to 2%.

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease,” Powell stated in ready remarks for an viewers at Spelman School in Atlanta. “We are prepared to tighten policy further if it becomes appropriate to do so.”

Expectations that the Fed is done raising rates and can transfer to an easing posture in 2024 have helped underpin a powerful Wall Road rally that has despatched the Dow Jones Industrial Common up greater than 8% over the previous month to a brand new 2023 excessive.

A Commerce Division report Thursday confirmed that non-public consumption expenditures costs, the Fed’s most popular inflation gauge, have been up 3% from a 12 months in the past, but 3.5% at a core basis that excludes unstable meals and power costs. Current sharp declines in power have been answerable for a lot of the easing in inflation.

Powell stated the present ranges are nonetheless “well above” the central financial institution’s aim. Noting that core inflation has run at a 2.5% annual charge over the previous six months, Powell stated, “while the lower inflation readings of the past few months are welcome, that progress must continue if we are to reach our 2 percent objective.”

After inflation hit its highest degree for the reason that early Eighties, the Fed enacted a sequence of 11 rate of interest hikes, taking its coverage charge to the best in 22 years at a goal vary between 5.25%-5.5%. The FOMC at its previous two conferences stored charges degree, and a number of officers have indicated they suppose the federal funds charge might be at or close to the place it must be.

The Fed’s subsequent assembly is Dec. 12-13.

“The strong actions we have taken have moved our policy rate well into restrictive territory, meaning that tight monetary policy is putting downward pressure on economic activity and inflation,” Powell stated. “Monetary policy is thought to affect economic conditions with a lag, and the full effects of our tightening have likely not yet been felt.”

Merchants count on cuts

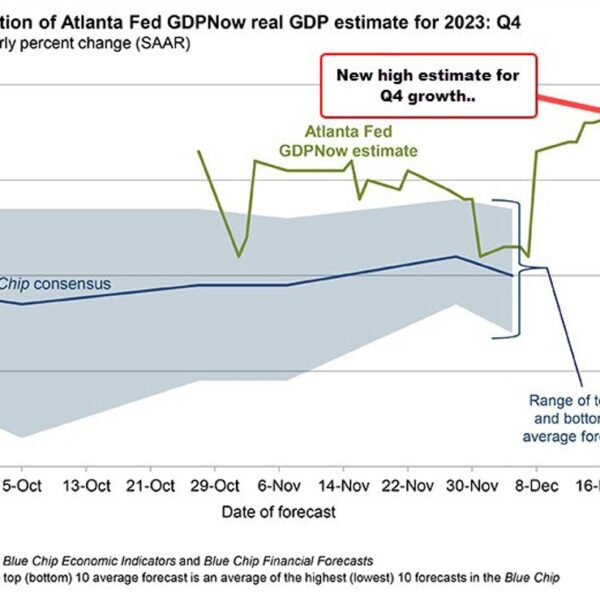

Market pricing Friday morning indicated that the Fed certainly is completed mountain climbing and will begin slicing as quickly as March 2024, according to the CME Group. Furthermore, futures are pointing to cuts totaling 1.25 proportion factors by the top of the 12 months, the equal of 5 quarter proportion level reductions.

Nevertheless, neither Powell nor any of his fellow officers have provided any indication that they are enthusiastic about cuts, with the chair adhering to information dependence for future selections fairly than any preset course.

“We are making decisions meeting by meeting, based on the totality of the incoming data and their implications for the outlook for economic activity and inflation, as well as the balance of risks,” Powell stated.

Addressing the financial information, Powell characterised the labor market as “very strong,” by way of he stated a diminished tempo of job creation helps deliver provide and demand again in line. He additionally famous that easing provide chain pressures have helped take the warmth off inflation and stated dangers of elevating charges an excessive amount of or too little are “becoming more balanced.” Because the Fed was mountain climbing charges, Powell had pressured the significance of being aggressive.