- The next couple of points of inflation will be pretty important.

- Even if get better data on inflation, should be cautious on rates

- if labor market stays stronger, better inflation data doesn’t necessarily mean Fed can cut.

- Also focused on geopolitical, policy changes.

- We are taking our time to see how these affect economy.

- There is a lot of optimism among Texas banks on loan demand, economic growth.

- Need tailoring of banking regulation, based on size as well as risk profile

- Critically important that every bank is set up to use the Fed’s discount window.

- Still are some banks that are not signed up to discount window, still some that have not tested it.

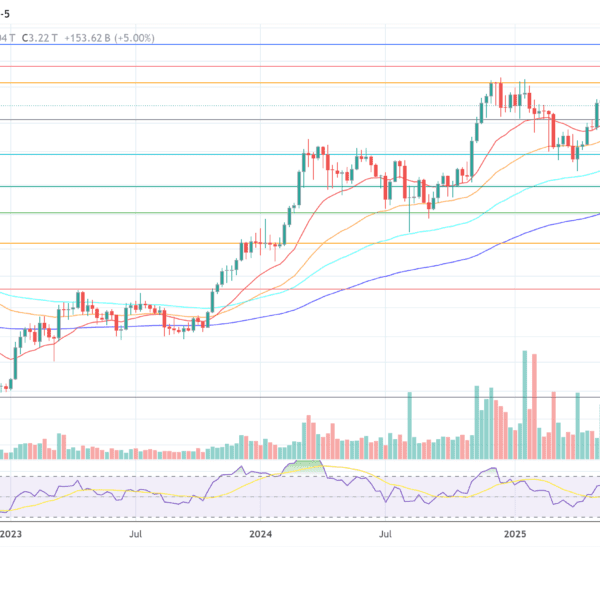

- Some of the increase in longer-term rates came from expectations from stronger economic growth, expectation Fed policy rate will stay high for longer.

- Level of long rate is a key factor in assessing financial conditions

- We will lower rates further if we need, that’s not where we are right now.

- Right now the focus is on restoring 2% inflation.

This article was written by Greg Michalowski at www.forexlive.com.