Fed Chair Jerome Powell stated that the FOMC will not be pondering of fee cuts in any respect amid their continued struggle in opposition to inflation. The FOMC members have hinted deceleration in financial development throughout he fourth quarter this yr.

Throughout their newest assembly, Federal Reserve (Fed) officers indicated a reluctance to cut back rates of interest within the close to future. That is very true contemplating the persistent inflationary pressures exceeding their goal, as revealed within the launched minutes on Tuesday, November 21.

The abstract of the assembly, carried out from October 31 to November 1, highlighted the continued issues amongst Federal Open Market Committee members relating to the potential of sustained or elevated inflation, signaling a possible necessity for additional actions.

They emphasised that coverage measures ought to stay “restrictive” till there may be compelling proof of inflation returning convincingly to the central financial institution’s 2% goal. Of their launched minutes, the FOMC members stated:

“In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time.”

The minutes additionally present that the FOMC members consider that they might “proceed carefully” and make selections “on the totality of incoming information and its implications for the economic outlook as well as the balance of risks”.

Fed Stays Tight-Lipped on Charge Cuts

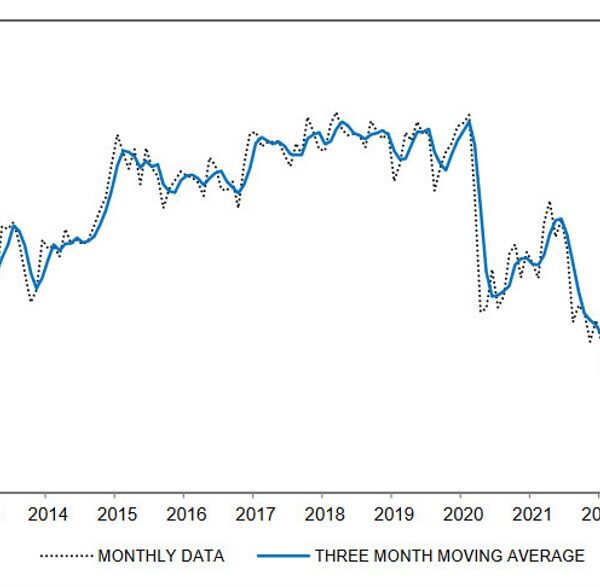

Analysts on Wall Road consider that the Federal Reserve has concluded its tightening cycle. Merchants within the fed funds futures market are expressing nearly no chance of additional fee hikes on this cycle. In actual fact, they’re anticipating fee cuts to start in Might. Total, the market envisions that the Federal Reserve will implement the equal of 4 quarter-point cuts earlier than the conclusion of 2024.

Nonetheless, the US central financial institution has given no such indications. “The fact is, the Committee is not thinking about rate cuts right now at all,” stated Fed Chair Jerome Powell. In a gathering in opposition to the backdrop of issues about surging Treasury yields, the Federal Reserve opted to keep up its benchmark funds fee inside the vary of 5.25% to five.5%, marking the best stage in 22 years.

The dialogue, which occurred on November 1, coincided with the Treasury Division’s announcement of its borrowing necessities for the approaching months, revealing figures barely beneath market expectations. Put up-meeting, yields have retreated from 16-year highs because the market grapples with the affect of considerable authorities borrowing and speculations in regards to the Fed’s future fee actions.

Officers assessed that the rise in yields was pushed by mounting “term premiums”, denoting the extra yield demanded by buyers for holding longer-term securities. The assembly minutes highlighted policymakers’ notion that the rising time period premium resulted from elevated provide because of the authorities addressing its substantial finances deficits. The discussions additionally delved into the Fed’s financial coverage stance, together with views on inflation and financial development.

Slowdown in Financial Progress

Throughout discussions, officers anticipated a notable deceleration in financial development within the fourth quarter following the sturdy 4.9% enhance in gross home product (GDP) recorded within the third quarter. Assessing the dangers, they famous that broader financial development faces a possible draw back, whereas dangers to inflation are tilted to the upside.

Relating to present coverage, members acknowledged its restrictive nature, exerting downward stress on financial exercise and inflation, in keeping with the assembly minutes. Public statements from Fed officers have mirrored a divergence of opinions, with some advocating for a pause to judge the affect of the 11 earlier fee hikes, totaling 5.25 share factors, on the financial system, whereas others advocate for added will increase.

Financial information has introduced a combined image, usually supporting inflation tendencies. The Fed’s key inflation indicator, the non-public consumption expenditures value index, revealed core inflation operating at a 3.7% 12-month tempo in September, exhibiting enchancment from Might however nonetheless exceeding the Fed’s goal. Some economists anticipate challenges in decreasing inflation, given robust wage will increase and protracted elevations in elements resembling lease and medical care.