A prime U.S. monetary regulator is warning banks about potential dangers in providing buy-now, pay-later merchandise which have surged in reputation with shoppers.

Conventional lenders are becoming a member of corporations like Affirm Holdings Inc., Klarna Financial institution AB and Afterpay Ltd. in giving clients shorter-term borrowing choices. Regardless of their surging reputation, the preparations can pose main challenges for large banks, in response to the Workplace of the Comptroller of the Forex.

The OCC, a part of the Treasury Division, mentioned Tuesday the merchandise current credit score, compliance and fame challenges for the banks. Lenders ought to be sure that advertising and marketing supplies are clear, the regulator mentioned.

The warnings comply with comparable assessments by the Client Monetary Safety Bureau and doable new authorities rules. In the meantime, buy-now, pay-later choices helped gas a record start to the vacation buying season within the US, in response to Adobe Inc.

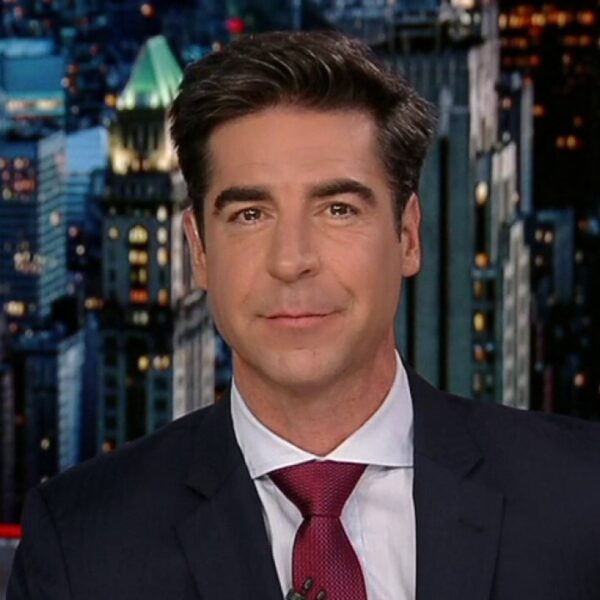

“We think this is well-timed to say, ‘Hey, banks, if you get into this, this is how to do it responsibly,’” Michael Hsu, the performing comptroller of the forex, mentioned in an interview.

Hsu added that if shoppers aren’t cautious with the merchandise they’ll get overextended and that may result in mortgage delinquencies. He mentioned that even when the loans don’t have any finance costs, they’ll spur costs like overdrafts or late charges once they’re linked to credit score or debit playing cards. “That’s where the risks are,” Hsu mentioned.

The regulator cautioned banks about:

- Shoppers not absolutely understanding reimbursement phrases

- Debtors who could not have credit score historical past making use of for buy-now, pay-later loans, making underwriting tougher

- Third-party relationships probably exposing banks to operational or compliance dangers outdoors of their management

- Restricted seize of buy-now, pay-later borrowing exercise by credit score reporting businesses

- Problems tied to returning gadgets or disputing purchases