Moussa81

Quality matters when it comes to picking stocks, and as Buffett once said, “it’s better to own a wonderful company at a fair price than a fair company at a wonderful price.”

This is especially true when it comes to REITs that have stood the test of time. This, in turn, saves time on part of the investor in that they can focus their time on more productive things, rather than fretting about what impact a recession may have on their holdings.

This brings me to Federal Realty Investment Trust (NYSE:FRT), which is a Dividend King that has increased its payout for investors through thick and thin for 50+ years. I last covered FRT in December of last year, highlighting strong fundamentals, development pipeline, and undervaluation.

The stock has done well for investors, giving a 20% total return since then, sitting just shy of the 23% rise in the S&P 500 (SPY) over the same timeframe. In this article, I revisit the stock including recent business performance and discuss whether if it’s currently a buy or hold, so let’s get started!

Federal Realty: Dividend King With Up To 6% Yield

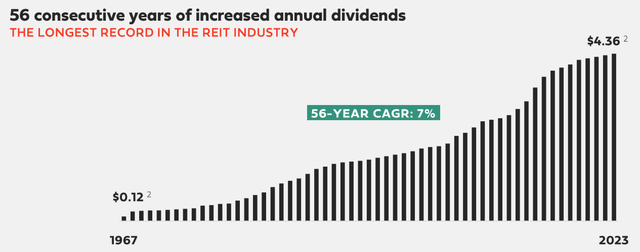

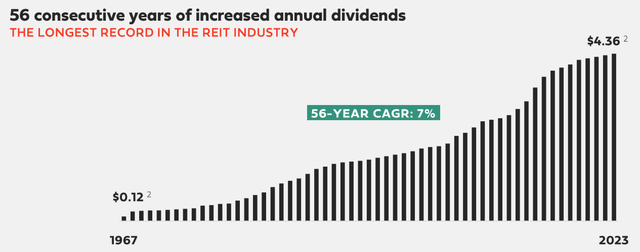

Federal Realty is a premier shopping center REIT that’s been in existence since before REITs became widely recognized as an asset class. As mentioned earlier, it has a 56-year track record of raising its dividend, as shown below.

Investor Presentation

Beyond its storied dividend track record, I like the company for its exposure to Tier 1 markets along both the East and West Coast as well as Chicago and Phoenix. These high barrier to entry markets where vacant land is hard to come by serves as a competitive moat around its existing properties which are frequented by locals.

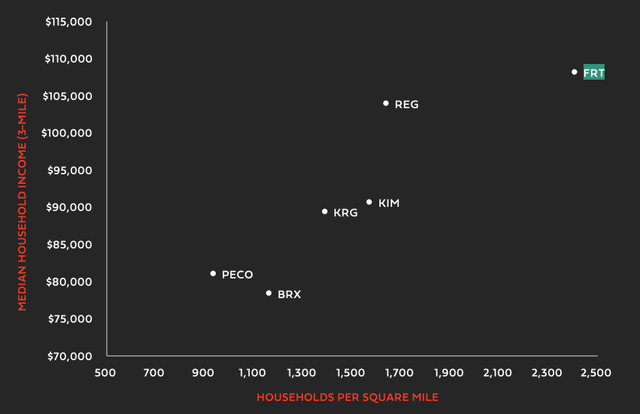

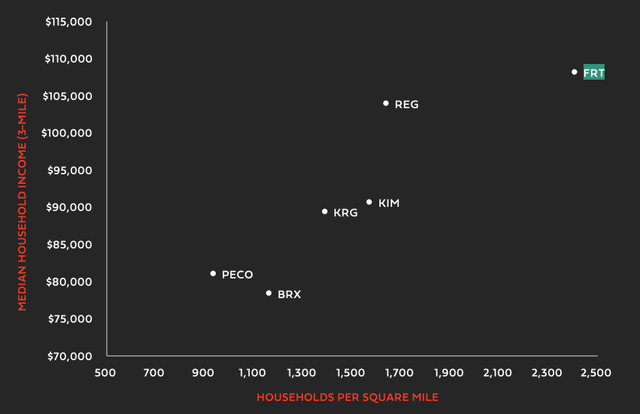

Its strategically located properties also cater to high-income households, which are better equipped to handle inflationary effects. In fact, FRT’s 3-mile radius carries an aggregate income of $10.4 billion, giving its tenants a stable consumer spending base. As shown below, FRT tops its peers including Regency Centers (REG) and Kimco Realty (KIM) in both population density and median household income.

Investor Presentation

FRT’s prime real estate enables it to raise rents more periodically than peers. This includes contractual rent bumps of 2.25% annually, which is one of the highest across the shopping center industry. Having rent bumps annually compares favorably to reliance on rental increases at lease rollover (usually every 5 years), as the former allows for faster compounded returns.

Meanwhile, FRT continues to turn in sound results, with comparable property income growth of 2.9% YoY, driven by respectable blended lease spread of 10% and 23% on a cash and GAAP basis, respectively.

Strong tenant demand is also reflected by a 100 basis point improvement in the leased rate over the prior year period to 95.3%. This was driven by a 230 bps increase in small-shop occupancy, which pays higher rent per square foot than anchor tenants, and are key revenue drivers for FRT and shopping center REITs alike.

Also encouraging, management raised its full year FFO/share guidance to $6.70 to $6.88, representing 3.7% growth over the prior year at the midpoint of range, and 5% growth at upper end of range, underscoring management’s confidence in its ability to drive bottom-line growth amidst macroeconomic uncertainty.

FRT’s strategic focus remains on enhancing its portfolio through selective acquisitions and high-value redevelopment projects. This includes the recent acquisitions of Virginia Gateway and Pinole Vista Crossing both of which are well-leased and carry starting yields of over 7%.

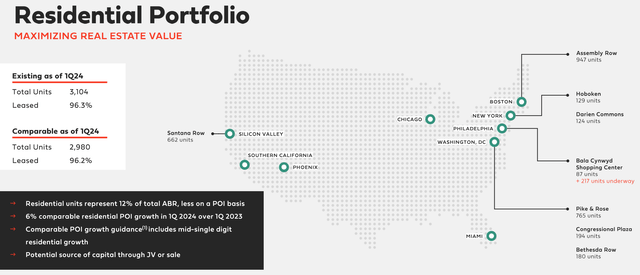

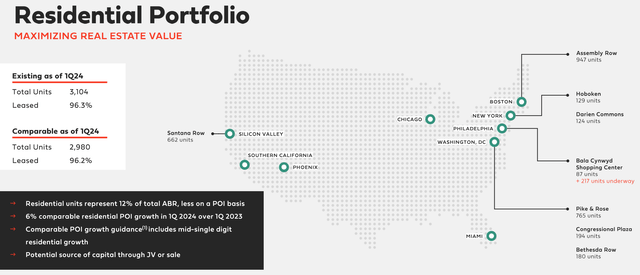

Additionally, FRT is maximizing the value of its real estate by adding residential units, which now comprise 12% of total ABR. This forms a virtuous cycle as it further enhances the appeal and value proposition of its real estate to its retail and office tenants. As shown below, this includes the Bala Cynwyd shopping center with 217 units underway.

Investor Presentation

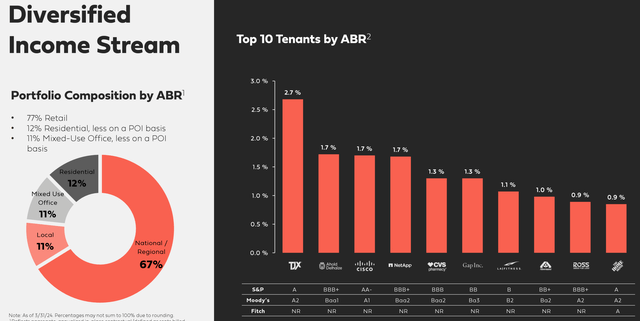

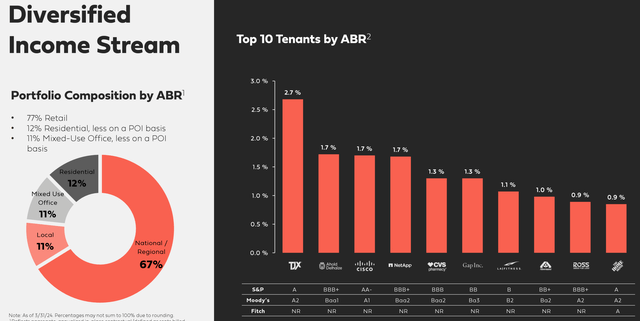

Bala Cynwyd is a $95 million mixed-use redevelopment project, which is expected to yield a 7% stabilized return. Mixed-use office now comprises 11% of total ABR. Unlike traditional offices, offices in mixed use properties provide retail tenants with a captive audience who may find it convenient to socialize and shop before, during, and after office hours.

As shown below, top 10 tenants include a mix of discount retailers, grocers, and office tenants like TJX (TJX), Ahold Delhaize (OTCQX:ADRNY), Cisco (CSCO), and NetApp (NTAP).

Investor Presentation

Importantly, FRT carries a strong balance sheet with BBB+/Baa1 credit ratings from S&P and Moody’s. This is supported by a net debt to EBITDA ratio of 5.8x, sitting below the 6.0x level generally considered safe for REITs by ratings agencies, and management expects to reach the mid-5x range by 2025. FRT also carries a healthy fixed charge coverage ratio of 3.6x.

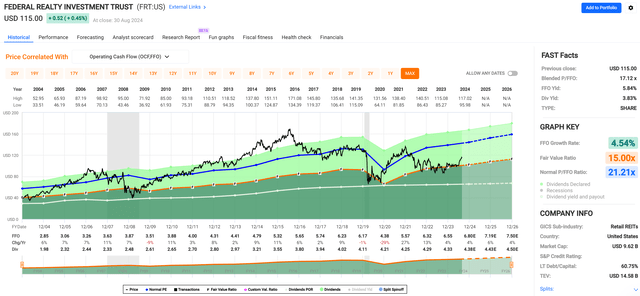

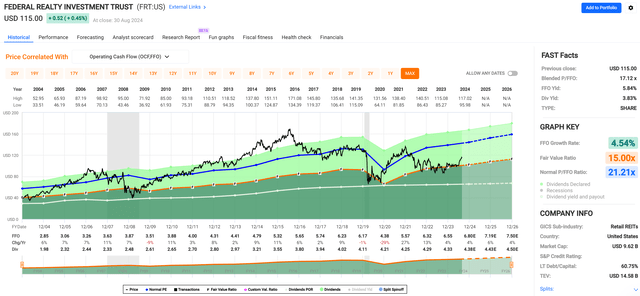

At the current price of $115, FRT carries a dividend yield of 3.8%. The dividend is well-covered by a 64% payout ratio and as noted earlier, comes with 56 years of consecutive growth. Despite the recent uptick in share price, FRT forward P/FFO of 16.9 remains well below its historical PFFO of 21.2, as shown below.

FAST Graphs

While FRT is not as cheap as it was earlier this year, it remains a solid value for long-term investors due to industry-leading contractual rent bumps, its development potential, and strong balance sheet. With a near 4% yield and analyst expectations for around mid-single digit annual FFO/share growth, and potential for a return to historical valuation, FRT could deliver market-beating returns.

More value-minded investors may want to opt for the Preferred Series C stock (NYSE:FRT.PR.C), which carries a current yield of 5.7% and is cumulative, which means that any missed dividends must be made up by the company unless if it goes insolvent.

At the current price of $21.94, this preferred series trades at a 9% discount to par value of $25.00. While FRT.PR.C is trading post its call date of 9/29/22, that’s likely a low possibility scenario for now given its low original coupon rate of 5.0% (at par value) while interest rates remain high. Plus, it helps that the shares are trading at a discount to par value so that they realize an immediate gain if it does get called, plus dividends collected along the way.

Risks to both the common and preferred stock include higher interest rates, which may raise FRT’s cost of debt and pressure the preferred stock due to its bond-like nature. Plus, FRT’s redevelopment pipeline carries risks from competition in the multifamily space and office properties may have trouble finding tenants should there be a recession and lower office utilization.

Investor Takeaway

Federal Realty Trust stands out as a high-quality, resilient REIT with a remarkable 56-year dividend growth streak, reflected by its strategic presence in high-barrier markets, strong tenant demand, and solid financials.

Despite recent gains, FRT remains attractively valued with a forward P/FFO below its historical average, offering a near 4% yield and potential for continued growth through strategic acquisitions and developments.

While the common stock presents a potentially good long-term investment opportunity, value-minded investors may also consider the Series C preferred stock for its higher yield and cumulative dividend protection, albeit with some interest rate risk.