uschools

Well, it seems as if just about everyone is expecting the Federal Reserve to lower its policy rate of interest next week.

So, we don’t have to worry about that.

The question now seems to be just how big of a change the Federal Reserve is going to put forward…25 basis points…or 50 basis points.

Most of the guessing comes up with 25 basis points…but….

Are the financial markets ready for this?

The stock market has been quite volatile over the past two weeks, making some pretty wide swings.

But, all three of the major indexes are still near historic highs.

The Standard and Poor’s index, closed on Thursday at 5596, just under its historic high of 5,667.

The Dow Jones Industrial Average is at 41,097, just under its historic high of 41,335.

And the NASDAQ closed at 17,570, just under its historic high of 18,647.

If the Fed cuts its policy rate, what can we expect from the stock markets?

At 25 basis points, I think you will get new highs.

At 50 basis points, I think you will get some even higher new highs.

And, so we watch.

The Big Question

Still, to me, the big question is whether the Fed will change what it is doing to its securities portfolio.

The Fed has been under a policy of quantitative tightening since the middle of March 2022…for 30 months…for 2 and 1/2 years.

That’s a long time.

The Fed, in June of this year, reduced the size of its monthly reduction of the portfolio, but now with a change in its policy rate of interest in the agenda…what is the Fed going to do about how it is handling its securities portfolio?

Here is the history.

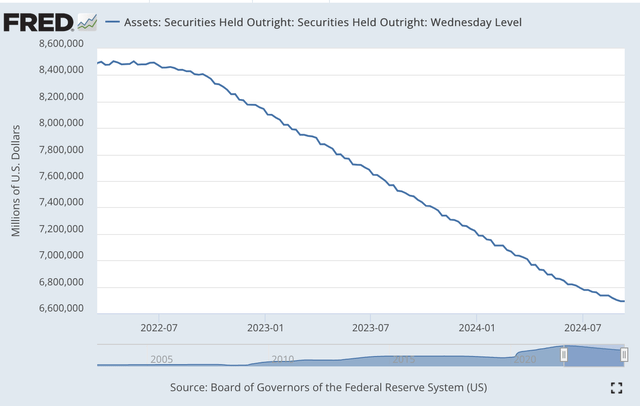

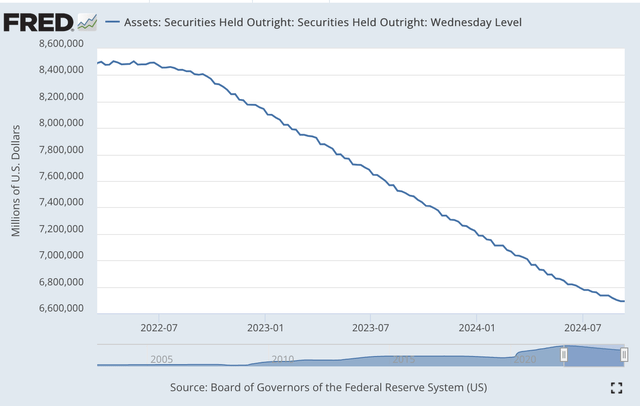

Securities Held Outright (Federal Reserve)

The problem the Fed faces is that it has only reduced the securities portfolio by $1,799.3 billion, or, by $1.8 trillion, since it began the current policy stance.

The run-up in the securities portfolio during the Covid-19 crisis was much greater.

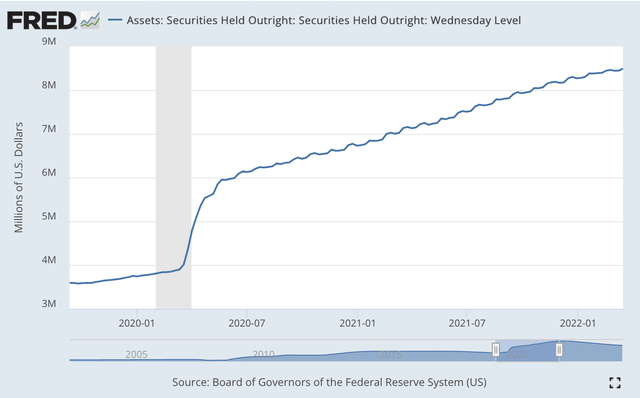

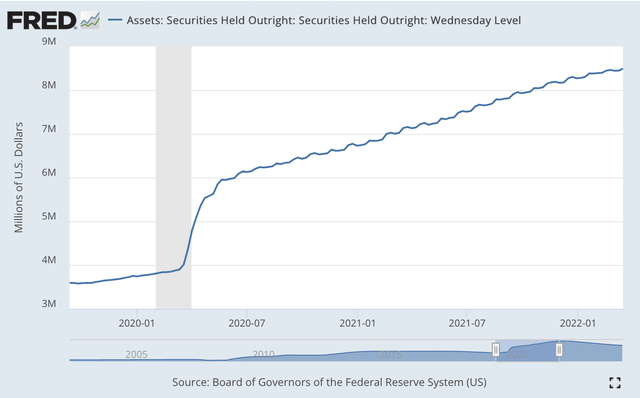

Here is the other side of the story.

Securities Held Outright (Federal Reserve)

In September 2019, the Fed held about $3.5 trillion in securities.

In the middle of March 2022, the Fed held about $8.5 trillion in securities.

This represented an increase in the securities portfolio of $5.0 trillion.

This accumulation came as a part of the Fed’s fourth round of quantitative easing.

So, the Fed has reduced its securities portfolio by $1.8 trillion since the middle of March 2022, but this is just a small part of what the Fed put into the banking system during the Covid-19 pandemic.

The big question to me, therefore, is what is the Federal Reserve going to do now…given that it is going to lower its policy rate of interest.

The Primary Tool

To me, what the Federal Reserve is doing to the securities portfolio is what we should be watching closely.

The management of the securities portfolio is the primary tool of the “new” policy regime that Ben Bernanke introduced during the Great Recession, and this puts the monetary policy of the Federal Reserve on “a quantity” foundation.

The fundamental thing the Fed is now doing to the economy is managing the quantity of securities the Fed has in its securities portfolio.

Thus, movements in the Fed’s policy rate of interest are just a tool that supports the Fed’s fundamental policy of reducing or increasing the quantity of securities that are in the Fed’s securities portfolio.

Thus, we need to look at the focus of the Federal Reserve going forward.

Under this policy program, the U.S. economy grew for 12 years in a row before the Covid-19 pandemic hit.

There was, then, only a very short recession… 2 months as defined by the National Bureau of Economic Research (NBER)…and now the economy is working to get back to the steady pace it moved at before this “tiny” recession.

The current economic expansion has now been going on for more than two years.

So, what does the Federal Reserve do from here?

I’d like to know.

I think that the Fed wants to get back on track for real GDP growth that mimics the 12 years of the past period of economic expansion.

But, how is it going to do that with so much liquidity still in the economy?

The Federal Reserve still has some major issues to deal with.

It appears we are at a turning point as the Fed debates a reduction in its policy rate of interest.

But, what is that turning point going to look like?

Maybe we will hear more about the change in monetary policy after the close of this week’s Federal Open Market Committee.