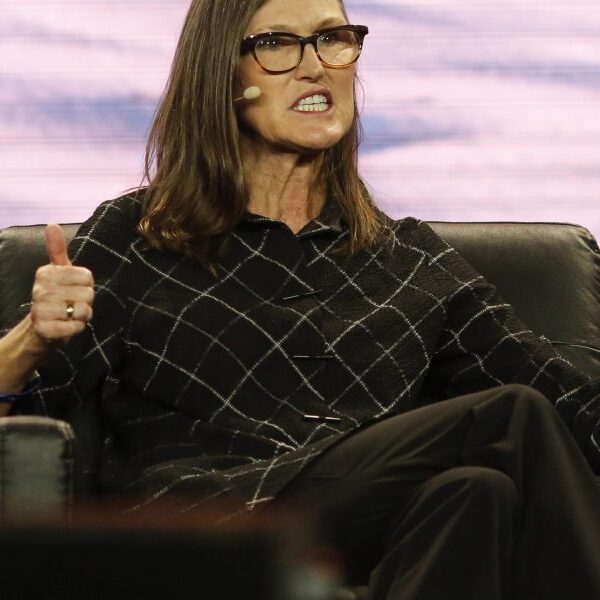

Chicago Federal Reserve Financial institution President Austan Goolsbee speaks on the Council on Overseas Relations in New York, U.S., February 14, 2024.

Workers | Reuters

“If you take a broad view, inflation got way above where we were comfortable with and it’s down a lot,” he stated.

The primary three readings for this 12 months point out protecting the remaining distance to 2% “may not be as rapid,” he added.

That “stalling” merits further investigation on the path of the financial system earlier than the Fed strikes to chop charges, stated Goolsbee, who is a nonvoting member this 12 months of the rate-setting Federal Open Market Committee.

He described himself as a “proud data dog,” and pointed to what he says is “the first rule of the kennel.”

“If you are unclear, stop walking and start sniffing,” he stated. “And with these numbers, we need to do more sniffing.”

“We want to have confidence that we are on this path to 2[%],” he stated. “That’s the thing we have got to pay attention to.”

Housing inflation is a key space to observe, Goolsbee stated.

“That’s the one that has not behaved as we thought it would,” he stated.

Shelter prices, which make up about one-third of the weighting within the CPI, rose 5.7% in March from a 12 months in the past.

“The market rent inflation is well down, but it hasn’t flowed through into the official measure,” he stated. “If it doesn’t — I still think it will — but if it doesn’t, I think we’re going to have a hard time. It’s definitely going to be more difficult to get to 2% overall if we do not see progress.”