Paulson spoke on Saturday in the US, summary:

-

Suggests further rate cuts may be delayed

-

Inflation seen moderating, growth around 2% in 2026

-

Current policy still slightly restrictive, helping curb inflation

-

Labour market slowing but remains resilient

-

Any further easing likely later in the year, data-dependent

Federal Reserve officials may be in no rush to resume interest-rate cuts, with Philadelphia Fed President Anna Paulson signalling that policymakers are likely to pause while they assess how the US economy evolves following last year’s easing cycle.

Speaking ahead of the 2026 Allied Social Science Associations Annual Meeting in Philadelphia, Paulson said she expects inflation to continue moderating, the labour market to stabilise, and economic growth to run at roughly 2% this year. If those conditions materialise, she said, “some modest further adjustments to the funds rate would likely be appropriate later in the year,” suggesting that any additional easing remains conditional and data-dependent.

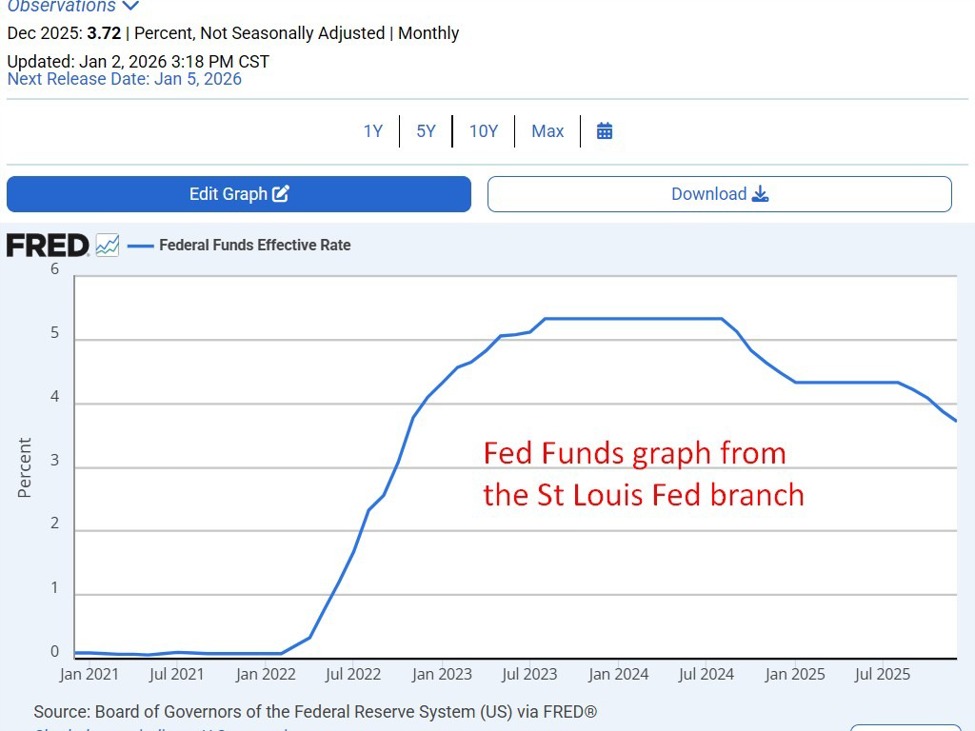

Paulson described the current federal funds rate as “still a little restrictive,” noting that policy is continuing to exert downward pressure on inflation. Her comments point to a Federal Reserve that remains cautious after cutting rates by a total of 75 basis points last year, delivered in three separate 25-basis-point moves. Those reductions left the policy rate in a 3.5%–3.75% range following the December meeting of the Federal Open Market Committee.

The easing campaign reflected a delicate balancing act. Officials sought to keep monetary conditions restrictive enough to bring inflation closer to the 2% target, while avoiding excessive damage to a labour market that has shown signs of cooling. The process was complicated by persistent political pressure from President Donald Trump, who repeatedly pushed for more aggressive cuts, even as some policymakers argued that inflation remained too high to justify easing at all.

At the December meeting, Fed Chair Jerome Powell offered little explicit guidance on the timing of future rate moves, although official projections still imply some degree of further easing in 2026.

Paulson said she holds “cautious optimism” on inflation, arguing there is a reasonable chance price growth ends the year close to the 2% target on a run-rate basis once tariff-related price adjustments work through the system. On employment, she said the labour market is “clearly bending, not breaking,” with slower hiring reflecting both supply- and demand-side factors. She added that developments in employment conditions warrant close monitoring as the year progresses.