A robust rally throughout Wall Road despatched the Dow Jones Industrial Common to a document on Wednesday after the Federal Reserve indicated that the cuts to rates of interest traders crave a lot could also be coming subsequent yr.

The Dow jumped 512 factors, or 1.4%, to prime 37,000 and surpass its prior peak of 36,799.65 set at first of final yr.

Different, extra broadly adopted indexes of U.S. shares additionally leaped. The S&P 500 rose 1.4% and is inside 2% of its personal document. The Nasdaq composite additionally gained 1.4%.

Wall Road loves decrease rates of interest as a result of they’ll calm down the stress on the financial system and goose costs for all types of investments. Markets have been rallying since October amid rising hopes that cuts could also be on the best way.

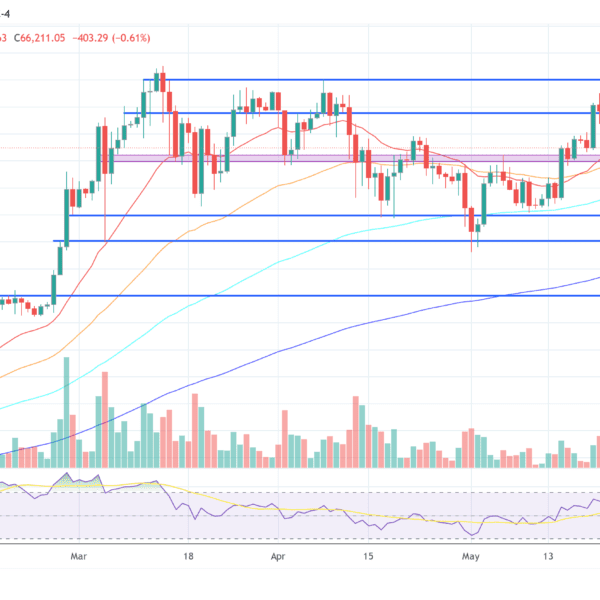

Fee cuts significantly assist investments seen as costly, decrease high quality or that power their traders to attend the longest for large development. A few of Wednesday’s greater winners have been bitcoin, which rose practically 4%, and the Russell 2000 index of small U.S. shares, which jumped 3.5%.

Apple was the strongest power pushing upward on the S&P 500, rising 1.7% to its personal document shut. It and different Huge Tech shares have been among the many greatest causes for the S&P 500’s 22.6% rally this yr.

All the thrill got here because the Federal Reserve held its most important rate of interest regular at a variety of 5.25% to five.50%, as was broadly anticipated. It’s hiked that price up from nearly zero early final yr in hopes of slowing the financial system and hurting funding costs by precisely the correct amount: sufficient to snuff out excessive inflation however not a lot that it causes a painful recession.

With inflation down sharply from its peak two summers in the past and the financial system nonetheless strong regardless of excessive rates of interest, hopes have been rising that the Fed can pull off that excellent touchdown. And in a press convention Wednesday, Fed Chair Jerome Powell mentioned its most important rate of interest is probably going already at or close to its peak.

Whereas acknowledging that inflation remains to be too excessive and the battle in opposition to it’s not over, Powell mentioned Fed officers don’t need to wait too lengthy earlier than chopping the federal funds price, which is at its highest stage since 2001.

“We’re aware of the risk that we would hang on too long” earlier than chopping charges, he mentioned. “We know that’s a risk, and we’re very focused on not making that mistake.”

That’s why Wall Road’s focus was squarely on the projections that the Fed launched displaying the place coverage makers see the federal funds price ending 2024. They confirmed the median official expects it to be at roughly 4.6%.

Whereas that suggests a much less steep reduce than many merchants on Wall Road predict, it’s greater than the median Fed official was predicting three months in the past.

Following the discharge of the projections, merchants on Wall Road upped their bets for price cuts in 2024. A majority of bets now anticipate the federal funds price to finish subsequent yr at a variety of three.75% to 4% or decrease, based on information from CME Group.

Treasury yields tumbled within the bond market on such bets. The yield on the 10-year Treasury dropped to 4.01% from 4.21% late Tuesday. It was above 5% in October, at its highest stage since 2007. The 2-year yield, which strikes extra on expectations for the Fed, sank to 4.43% from 4.73%.

They each had already been down earlier within the morning, after a report confirmed prices at the wholesale level have been simply 0.9% greater in November than a yr earlier. That was softer than economists anticipated.

Such drops in yields and rallies for shares, although, could also be threatening to undo the very future traders are banking on, based on extra cautious traders.

Decrease yields within the bond market make it simpler for U.S. households to get a less expensive mortgage and for U.S. companies to borrow cash to broaden. Rising inventory costs, in the meantime, give stock-owning households extra wealth. All that would put upward stress on inflation, which may ultimately power the Fed to really hike charges once more, warned Sameer Samana, senior international market strategist at Wells Fargo Funding Institute.

He additionally mentioned it’s unlikely the Fed will reduce charges as many instances as merchants predict in 2024 except there’s a recession. He’s anticipating the U.S. financial system to fall right into a reasonable recession early subsequent yr.

“We think it’s going to take a recession to cure that last leg of inflation” and guarantee it falls all the best way all the way down to the Fed’s 2% goal, Samana mentioned.

On Wall Road, Vertex Pharmaceuticals jumped 13.2% for the largest achieve within the S&P 500 after it reported encouraging information from a research for a possible ache therapy for sufferers with diabetic peripheral neuropathy.

That helped offset a 6.7% loss for Pfizer, which gave a revenue forecast for 2024 that was weaker than analysts anticipated. A lot of the shortfall was attributable to expectations for its COVID-19 vaccine and therapy.

Southwest Airlines misplaced 3.8% after it raised its forecast for the way a lot it should spend on gas prices in the course of the finish of 2023.

All instructed, the S&P 500 rose 63.39 factors to 4,707.09. The Dow added 512.30 to 37,090.24, and the Nasdaq gained 200.57 to 14,733.96.