In a major growth main as much as the upcoming resolution on the approval or rejection of the primary spot Bitcoin ETF in the US, FOX reporter Eleanor Terret has make clear a key growth.

In accordance with Terret’s report on X (previously Twitter), the US Securities and Alternate Fee (SEC) will maintain talks in the present day to debate the ultimate feedback on the 19b-4s purposes submitted by Bitcoin ETF issuers.

SEC Consults Exchanges On Bitcoin ETF Purposes

Terret stated that the SEC is presently holding conferences with Nasdaq, CBOE, and NYSE exchanges to handle the submitted 19b-4s purposes by BTC Spot ETF issuers.

The SEC has beforehand engaged in discussions with issuers and exchanges, together with BlackRock and Nasdaq Inventory Market, relating to the proposed rule change to checklist and commerce shares of the iShares Bitcoin Belief.

Whereas these discussions happen amidst Matrixport’s prediction of the potential rejection of the index funds by the SEC, the precise deadline and affirmation of this prediction stay unknown.

Nevertheless, this assembly holds nice significance because it permits issuers to handle software shortcomings and probably achieve approval for Bitcoin ETFs.

Matrixport’s perception is rooted in SEC Chair Gary Gensler’s well-known negative stance towards the trade and an undisclosed requirement that Matrixport believes the candidates presently lack.

Given the sequence of conferences and the involvement of asset managers like BlackRock, it’s unlikely that the SEC’s necessities would stay uncommunicated or unfulfilled.

The end result and implications of this assembly stay unsure. It’s unclear whether or not the exchanges or the SEC will challenge any statements following the discussions, leaving the choice to approve or reject the Bitcoin ETF purposes hanging within the steadiness.

Because the deadline approaches, market members eagerly await additional updates to achieve insights into the stances of the exchanges and the SEC, shaping the trail ahead within the quest for a regulated Bitcoin ETF in the US.

Potential BTC Worth Correction?

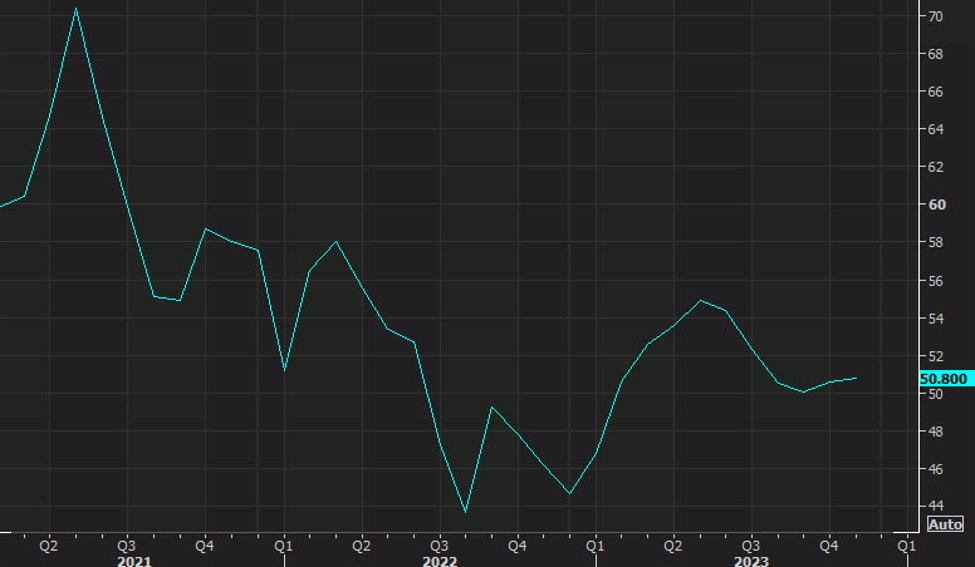

Famend analyst Crypto Con has drawn consideration to the “overheated state” of Bitcoin information, suggesting that the current transfer above $45,000 was “short-lived” and has as soon as once more introduced the cryptocurrency’s valuation into focus.

Whereas numerous indicators had indicated that Bitcoin might have reached its peak in December at $45,000, longer-term time frames might have allowed for a small push that was witnessed just lately.

Regardless of attributing the drop to the information of Matrixport and 10x Analysis that predicted rejection of the Bitcoin ETF purposes, Crypto Con argues that the underlying information had already signaled the chance.

A number of indicators shared by Crypto Con on X have remained overextended, together with the Puell A number of, 2 Week main shifting common convergence divergence (LMACD), month-to-month relative energy index (RSI), 2-week stochastic momentum indicator (SMI), weekly RSI, and weekly directional motion index (DMI).

These indicators counsel a correction of over 30% continues to be anticipated, probably bringing the value all the way down to the low $30,000 vary within the coming months.

Whereas Crypto Con believes this correction to be a probable consequence shortly, he intends to carry onto his Bitcoin and patiently await the “true cycle top.”

Bitcoin has rebounded to the $43,000 degree, recovering from its drop to $40,800 on Wednesday morning.

Featured picture from Shutterstock, chart from TradingView.com