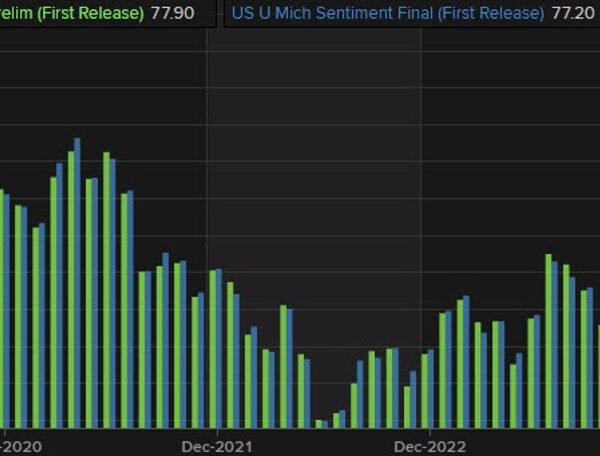

American customers are being pulled in two reverse instructions proper now: by rising costs that threaten consumption on one aspect, and by low unemployment and rising wages which are fueling development on the opposite. However Bank of America predicts that the 2 forces, with the assistance of a push from the Fed, will attain an equilibrium in 2025. Simply what form, although, not even CEO Brian Moynihan is aware of.

In an interview with CNBC on the Bank of America Securities Financial Services Conference Wednesday, Moynihan held forth from the sidelines in Miami on how the pre-pandemic financial equilibrium was upset by inflationary shocks to each shopper costs and wages. Nevertheless it was the timing of those shocks that despatched shopper spending developments particularly out of whack.

“Pricing went up, and wages went up—they just went up in two different cycles,” stated Moynihan. “And so, the wage growth had occurred early in the post-pandemic cycle … added a lot to consumers’ firepower. The problem is [that] then, the pricing [increases] caught up with it. And now, we’re trying to get that back in equilibrium.”

BofA inside analysis information reveals that shopper spending is leveling off, in line with the disinflation path the Federal Reserve is focusing on because it tries to stay a tender touchdown. Moynihan famous that BofA clients’ spending development is presently hovering at between 4% and 5%, decrease than the ten% determine this time final yr.

The dance between shopper value inflation and wage will increase is a key issue that’s generated instability in spending developments. Whereas actual expenditures have risen total because the pandemic, they decreased slightly last spring and again last fall as prices continued to rise and the Fed refrained from starting to cut rates. However pleasure round potential cuts to come back later this yr and persistently strong jobs numbers have added gas to the financial system.

“Yes, prices are up—but wages are up, unemployment’s down, [and] people are earning money,” stated Moynihan. “And so, that’s the tug-of-war that’s going on. And they’ve moved the consumer to a different level of spending and capabilities. Will that hold is going to be an interesting question.”

Financial institution of America is predicting the Fed will begin chopping charges later this yr, the start of a path that may resolve the patron spending tug-of-war by the top of 2025. However the end line it sees doesn’t contain attending to the Fed’s 2% goal charge.

Moynihan stated his crew’s view is that three cuts this yr and 4 cuts subsequent yr would carry the financial system “back into sort of equilibrium at the end of 2025, with a Fed funds rate in the…3-to-3.5ish [percent range.]”

That would spell hassle for the financial system. A departure from the Fed’s long-time 2% charge goal would ship shockwaves throughout the actual property, monetary providers and lending sectors. However Moynihan stated he was assured that customers would adapt to a higher-base-rate financial system, although that course of may take time.

“People [will] get used to mortgage rates of six, seven percent,” stated Moynihan, speaking to his interviewer, Jim Cramer, one other commentator sufficiently old to recollect the housing market of the Nineteen Eighties. “Jim, you well know, because you’re about as old as I am, so we’ve been around a while, that that was what we used to think was a good mortgage rate.”

Mortgage charges soared to over 18% in the mid-1980s because the Federal Reserve ratcheted up rates of interest in an effort to comprise rampant inflation. Mortgage charges aren’t practically that prime right now, however the present housing market—outlined by a surge in financing prices after years of low to adverse development—shows some similarities, as each BofA Analysis and different commentators have flagged.

Moynihan then weighed in on the emergency financial coverage of chopping rates of interest to near-zero after the World Monetary Disaster, which fueled what many commentators known as an “everything bubble,” and the way that out of the blue ended amid Fed chair Jerome Powell’s sequence of hikes in 2022. “It’s just that for 15 years, we had no real rate structure — you know, rate structure in the United States and around the world. And so people get used to lower rates. It’ll take time to do that. That’ll work its way through the system as rates normalize.”