A Japanese 1,000 yen banknote sits on a pile of South Korean gained banknotes for an organized {photograph} at a Woori Financial institution Co. department in Seoul, South Korea.

SeongJoon Cho | Bloomberg through Getty Photos

Financial institution of America is bearish on a slew of Asian currencies and impartial at greatest on others, because the funding financial institution says it’s the begin of a “chaotic era.”

“We are not bullish on any currency in Asia,” Financial institution of America mentioned in a latest report, with many currencies impacted by a delayed Federal Reserve easing cycle and sustained energy within the U.S. dollar.

The funding financial institution singled out the Chinese yuan, South Korean won, Taiwan dollar, Thai baht and Vietnamese dong underneath its bearish class.

Amongst their “neutral” listing of currencies are the Hong Kong dollar, the Indonesian rupiah, the India rupee, the Malaysian ringgit, the Philippine peso and the Singapore dollar.

Chinese language yuan

BofA forecasts the Chinese language yuan to commerce at 7.35 in opposition to the greenback this quarter and weaken to 7.45 within the third and fourth quarters.

The financial institution expects yuan depreciation pressures to maintain into the second half of the yr, as a result of: the delayed Fed easing, China’s disinflationary conduct aggravating yield hole with the U.S. and a weak monetary account on account of a deterioration in international direct funding.

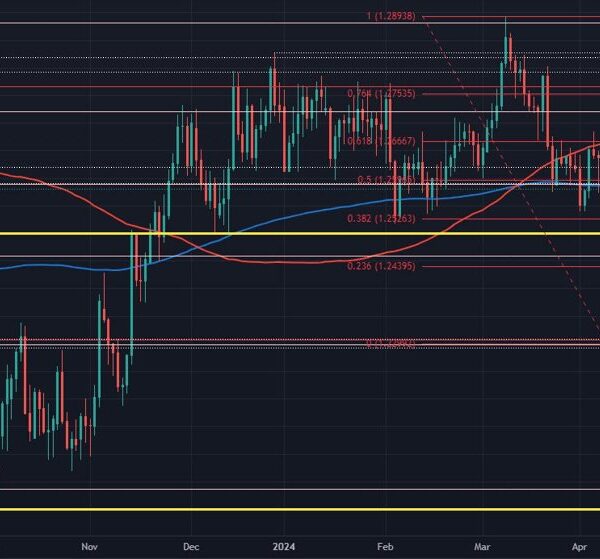

Chinese language onshore yuan for the reason that begin of the yr

Hotter-than-expected U.S. inflation in March pushed again market expectations of a rate cut to September, and lowered the outlook this yr to 2 reductions from three.

The onshore CNY is presently buying and selling at 7.24 per U.S. greenback.

South Korean gained

The outlook for the Korean gained “significantly turned” after the Fed pushed again on the timing of the speed cuts and Center East geopolitical dangers turned a serious headwind, mentioned BofA.

“Year-to-date, we have seen impressive inflows into Korean equities, but these inflows are beginning to reverse as global equities are turning from the two aforementioned risk,” BofA’s economists wrote.

The South Korean gained lately slipped to an 18-month low of 1,389.5 in opposition to the greenback. The Financial institution of Korea chief known as the gained volatility “excessive” and mentioned the central financial institution would intervene if wanted.

The gained was final buying and selling at 1,347.3 in opposition to the U.S. greenback. BofA’s economists mentioned the gained is presently overvalued in contrast with honest worth of 1,417.

Taiwan greenback

BofA additionally stays detrimental on the Taiwan greenback given robust fairness outflows and life insurance coverage corporations’ extra unwinding of non-deliverable ahead hedges. An NDF is a foreign money derivatives contract that establishes a settlement between the prevailing spot fee and a contracted fee.

The Taiwan greenback is presently buying and selling at 32.6 per U.S. greenback.

Vietnamese dong and Thai baht

The Vietnamese dong is buying and selling at 25,450 per greenback, weakening nearly 5% up to now this yr.

Compounding the influence of delayed Fed cuts are Vietnam’s political instability following the second presidential resignation in two years in addition to issue in its property sector, mentioned BofA. These headwinds gasoline home demand for the U.S. greenback and gold, the financial institution mentioned.

“We revise our forecasts in anticipation of further modest VND depreciation pressure to 25,600 by end-2Q and ultimately USD/VND at 25,700 by year-end,” the observe mentioned.

The Thai baht equally stays susceptible to geopolitical tensions through greater oil costs and freight prices, BofA mentioned. It revised its forecast for the foreign money to 37 in opposition to the buck by the tip of the yr.

The funding financial institution didn’t point out the Japanese yen, which has hovered round 34-year lows in opposition to the U.S. greenback. The foreign money has struggled, slipping previous 150, for the reason that Financial institution of Japan raised charges in March.