RiverNorthPhotography

Rates of interest have moved sharply greater this 12 months. The yield on the benchmark 10-year Treasury notice has jumped from 3.8% final December to close 4.7% over current buying and selling days. The two-year notice yield is again at 5% amid robust financial progress information and inflation readings which are above what the Federal Reserve desires to see.

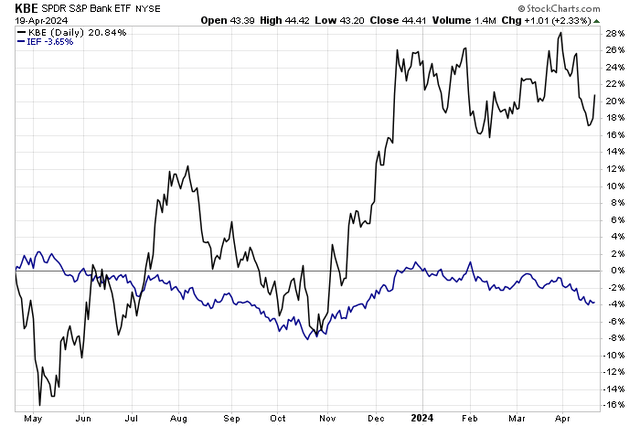

Nonetheless, the SPDR S&P Financial institution ETF (KBE) is up greater than 20%, dividends included, over the previous 12 months. The fund stays considerably beneath a late 2023 peak, however the group has been surprisingly resilient within the face of the bond market selloff. Fears of mismatches between banks’ belongings and liabilities, for now, are muted whereas asset managers are usually benefitting from greater inventory and bond costs.

I’m upgrading The Financial institution of New York Mellon Company (NYSE:BK) from a maintain to a purchase. I used to be cautious on the inventory a few 12 months in the past, however the financial institution has weathered volatility nicely. Shares are attractively valued contemplating the agency’s progress trajectory, in my opinion, whereas the technical state of affairs has improved.

Financial institution Shares Performing Effectively Amid Treasury Promoting

In accordance with Financial institution of America World Analysis, BNY Mellon is a worldwide firm devoted to serving to its shoppers handle and repair their monetary belongings all through the funding life cycle. The three segments (Securities Providers, Market & Wealth Providers, and Funding & Wealth Administration) provide a complete set of capabilities and experience throughout the funding lifecycle, enabling the Firm to offer options to buy-side and sell-side market members, in addition to main institutional and wealth administration shoppers globally.

Earlier this month, BK reported a powerful set of Q1 numbers. First-quarter non-GAAP EPS of $1.29 beat analysts’ estimates by a dime, whereas income of $4.5 billion, up 3% from a 12 months in the past, additionally topped expectations. Stronger fee revenue and curiosity revenue helped the agency, although credit score prices have been elevated attributable to its industrial actual property publicity.

Nonetheless, the administration staff reiterated its FY 2024 steerage and sees web curiosity revenue declining 10% year-on-year with flat bills. Who would not love a bit of AI pixie mud? The corporate plans to leverage AI for productiveness, whereas it goals to return capital to shareholders. A key threat is the truth that BK has cyclical publicity, so a downturn in GDP at house would probably hit the inventory.

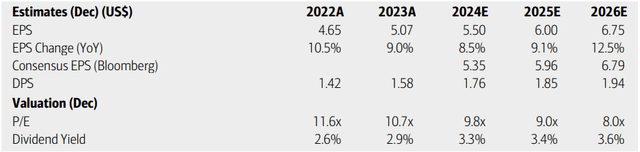

On valuation, analysts at BofA see earnings rising a stable 8.5% this 12 months, with accelerating EPS growth within the out years. Working EPS is seen hitting $6 in 2025, and the Looking for Alpha consensus outlook is about on par with what BofA initiatives.

Dividends, in the meantime, are forecast to rise at a gradual tempo over the following a number of quarters, making for a beautiful yield. A priority I see is a considerably tender income forecast – merely within the 2% to five% vary yearly by 2026.

BK: Earnings, Valuation, Dividend Yield Forecasts

Whereas BK’s present earnings a number of is nothing to get too enthusiastic about, the earnings progress path is what I like about this Asset Administration and Custody Banks trade firm.

If we assume $6 of 2025 EPS and apply the inventory’s 5-year historic non-GAAP ahead P/E of 10.7, then shares ought to commerce close to $64. The PEG ratio can also be to a budget facet. On a e book worth foundation, although, shares should not overly low cost at the moment.

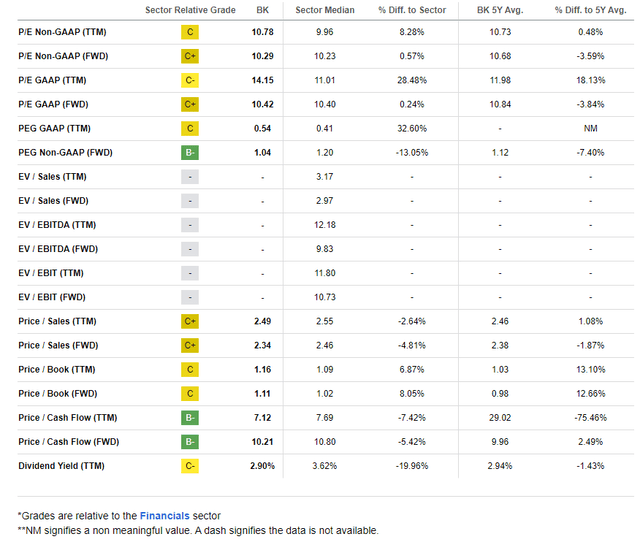

BK: Compelling Valuation Contemplating the Development Path

Compared to its peers, BK sports activities a valuation grade roughly on par with the trade norm. Its progress forecast is kind of optimistic, nevertheless, and BK’s profitability metrics are very robust.

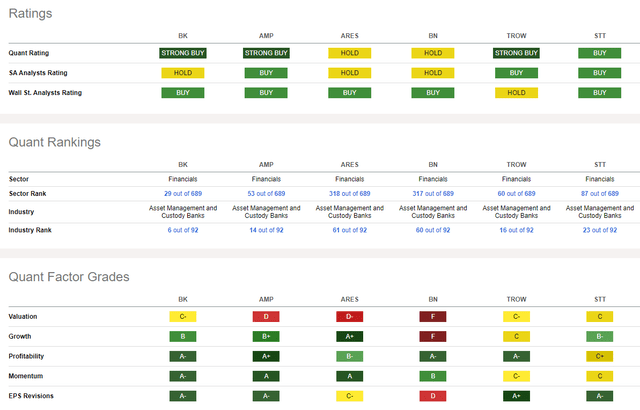

With wholesome share-price momentum over the previous a number of months and a slew of EPS upgrades over the previous three months, there are technical and elementary tailwinds at the moment.

Competitor Evaluation

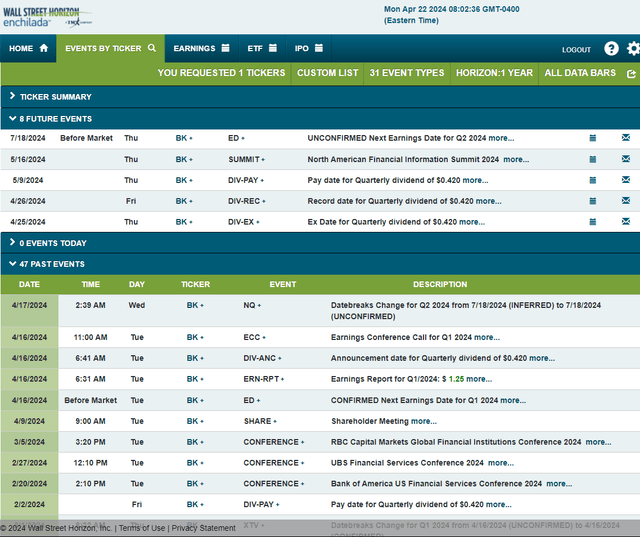

Trying forward, company occasion information offered by Wall Road Horizon present an unconfirmed Q2 2024 earnings date of Thursday, July 18 BMO.

The inventory trades ex a $0.42 dividend this Thursday and BK’s administration staff is slated to current on the North American Monetary Info Summit 2024 throughout the center of subsequent month.

Company Occasion Danger Calendar

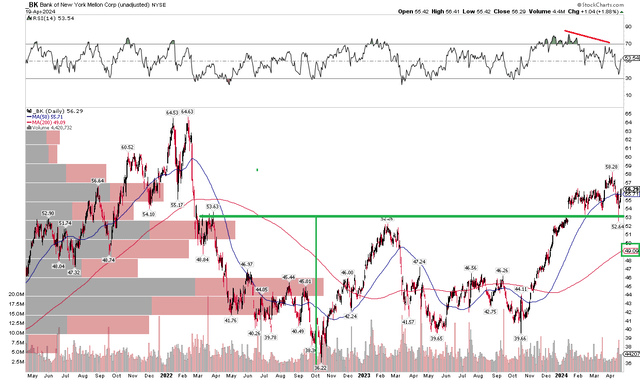

The Technical Take

With a sturdy progress backdrop and a few elementary tailwinds, BK’s chart has improved from a number of months in the past. Discover within the graph under that shares lately broke out above key resistance within the low to mid-$50s vary. What was regarding, nevertheless, was a bearish RSI divergence with value, as evidenced by a decrease excessive within the RSI momentum oscillator on the prime of the chart. It is doable that it was resolved with the filling of a value hole final week, when shares touched $52.64 on an intraday foundation.

Larger image, check out the long-term 200-day transferring common – it’s positively sloped, suggesting that the bulls are in cost. Furthermore, primarily based on the $17 vary from early 2022 by final December, a bullish upside measured transfer value goal to close $70 is in play. That may be above the double-top excessive from early 2022 simply shy of $65. Assist is close to $52.

Total, the technical view on this asset supervisor/financial institution inventory is optimistic, although the bearish RSI divergence nonetheless bears watching.

BK: Shares Above Key Assist, Rising 200dma

The Backside Line

I’m upgrading BK from a maintain to a purchase. Shares are up sharply from a 12 months in the past, when heavy pessimism was priced into something associated to a standard financial institution, however broader upside momentum within the asset administration house has helped convey shares greater. The expansion outlook has additionally turned extra sanguine together with the chart state of affairs.