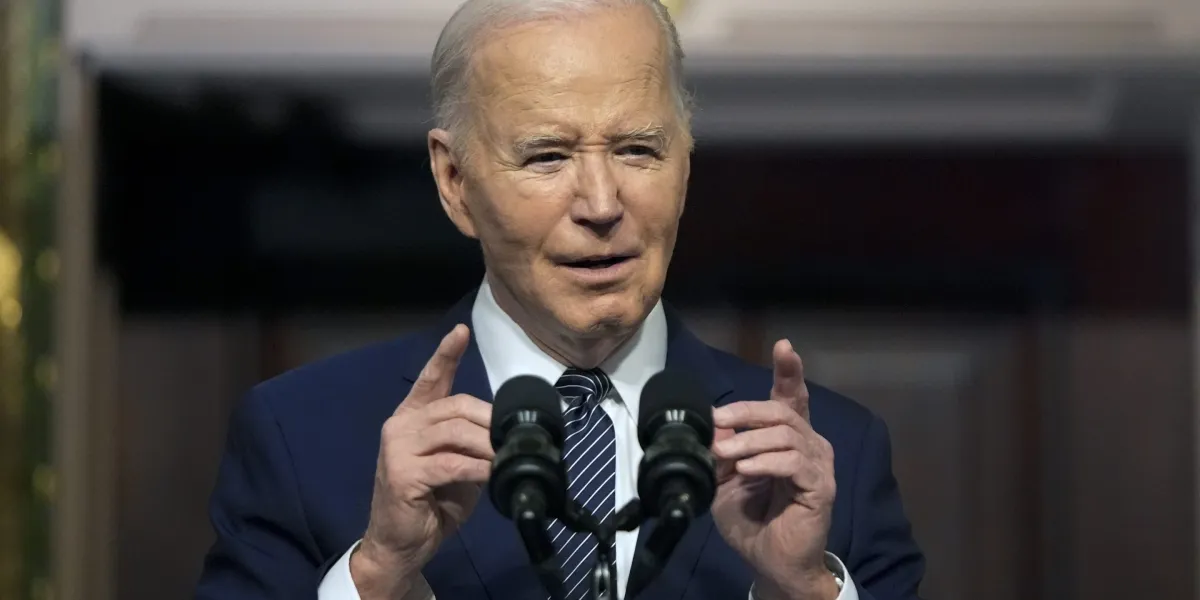

President Joe Biden will announce his newest effort to broaden pupil mortgage reduction subsequent week for brand spanking new classes of debtors, based on three individuals conversant in the plans, practically a 12 months after the Supreme Court foiled his administration’s first try and cancel debt for hundreds of thousands who attended faculty.

Biden will element the plan Monday in Madison, Wisconsin, the place the flagship campus of the College of Wisconsin is situated. The precise federal rules — outlining who would qualify to get their pupil mortgage debt decreased or eradicated — usually are not anticipated to be launched then, mentioned the individuals, who had been granted anonymity to element a proposal not but made public.

A lot of the specifics that Biden will focus on Monday have lengthy been telegraphed via a negotiated rulemaking course of on the Department of Education, which has labored for months to hash out the brand new classes of debtors. The president introduced instantly after the Supreme Court docket choice that Training Secretary Miguel Cardona would undertake the method as a result of he would have the facility beneath the Larger Training Act to waive or compromise pupil mortgage debt in particular instances.

Nonetheless, the trouble seeks to make good on Biden’s promise after the Supreme Court docket struck down his preliminary plan in June, a $400 billion proposal to cancel or cut back federal pupil mortgage debt {that a} majority of justices mentioned required congressional approval. Biden known as that call a “mistake” and “wrong.”

And the recent announcement on pupil mortgage reduction, an important concern for youthful voters, may assist energize components of Biden’s political coalition who have become disillusioned over his job efficiency — individuals whose assist the president might want to defeat presumptive Republican presidential candidate Donald Trump this 12 months.

The plan that Biden will element is about to increase federal pupil mortgage reduction to new yet-targeted classes of debtors via the Larger Training Act, which administration officers consider places it on a stronger authorized footing than the sweeping proposal that was killed by a 6-3 court docket majority final 12 months. The deliberate announcement from Biden was first reported by the Wall Avenue Journal.

“This new path is legally sound,” Biden mentioned in June. “It’s going to take longer, but, in my view, it’s the best path that remains to providing for as many borrowers as possible with debt relief.”

Biden’s newest try at cancellation is anticipated to be smaller and extra focused than his unique plan, which might have canceled as much as $20,000 in loans for greater than 40 million debtors. Particulars of the brand new plan have come into focus in latest months because the Training Division introduced its concepts to a panel of out of doors negotiators with an curiosity in increased training, starting from college students to mortgage servicers.

“President Biden’s expected additional executive action will greatly reduce the burden of student loans for millions of Americans,” Senate Majority Chief Chuck Schumer, D-N.Y., mentioned Friday. “There is always more work to be done to alleviate the burden of student loan debt. And we will not stop until crippling student loan debt is a thing of the past.”

By means of that course of, the company laid out 5 classes of debtors who could be eligible to get some or all of their federal loans canceled. The plan is concentrated on serving to these with the best want for reduction, together with many who would possibly in any other case by no means repay their loans.

Amongst these focused for assist are people whose unpaid curiosity has snowballed past the dimensions of the unique mortgage. The proposal would reset their balances again to the preliminary steadiness by erasing as much as $10,000 or $20,000 in curiosity, relying on a borrower’s earnings.

Debtors paying down their pupil loans for many years would get all remaining debt erased beneath the division’s plan. Loans used for a borrower’s undergraduate training could be canceled if they’d been in compensation for at the very least 20 years. For different varieties of federal loans, it’s 25 years.

The plan would routinely cancel loans for many who went to for-profit faculty packages deemed “low-value.” Debtors could be eligible for cancellation if, whereas they attended this system, the common federal pupil mortgage cost amongst graduates was too excessive in comparison with their common wage.

Those that are eligible for different varieties of cancellation however haven’t utilized would routinely get reduction. It will apply to Public Service Mortgage Forgiveness and Borrower Protection to Compensation, packages which have been round for years however require infamously tough paperwork.

Underneath strain from advocates, the division additionally added a class for these dealing with “hardship.” It will supply cancellation to debtors thought-about extremely more likely to be in default inside two years. Further debtors could be eligible for reduction beneath a wide-ranging definition of economic hardship.

A collection of hearings to craft the rule wrapped up in February, and the draft is now beneath overview. Earlier than it may be finalized, the Training Division might want to concern a proper proposal and open it to a public remark interval.

The most recent try at cancellation joins different focused initiatives, together with these geared toward public service staff and low-income debtors. By means of these efforts, the Biden administration says it has canceled $144 billion in pupil loans for nearly 4 million Individuals.