Finom, a European challenger financial institution aimed toward SMEs and freelancers, has raised €50 million ($54 million) in a Sequence B fairness spherical of funding.

Based out of the Netherlands in 2019, Finom lets companies open up a web-based checking account in minutes and obtain an IBAN (Worldwide Financial institution Account Quantity) to help cross-border transactions. On high of that, prospects additionally obtain bodily or digital financial institution playing cards, expense administration instruments, and integration help for accounting software program.

In fact, the Dutch startup is one in all quite a few gamers in an area that features the likes of Wise, Qonto, and Revolut, however Finom’s fundraise additional highlights the demand for SME monetary companies in a market that’s nonetheless considerably dominated by big banks — in current months we’ve seen challenger banks such as Atom Bank and Monument attract important investments, whereas SME lenders akin to Iwoca have also closed sizeable new funding lines.

“The number one problem [we solve for SMEs] is always unreasonable banking — serving SMEs is considered ‘uninteresting’ for the traditional banks, as compliance risks are high, while lending opportunities are quite limited too, meaning that the product for SMEs is much worse even compared to the digital banks that we use everyday,” Finom co-founder and co-CEO Yakov Novikov instructed TechCrunch by e-mail. “But at the same time, the level of needs and complexity of SMEs is much higher.”

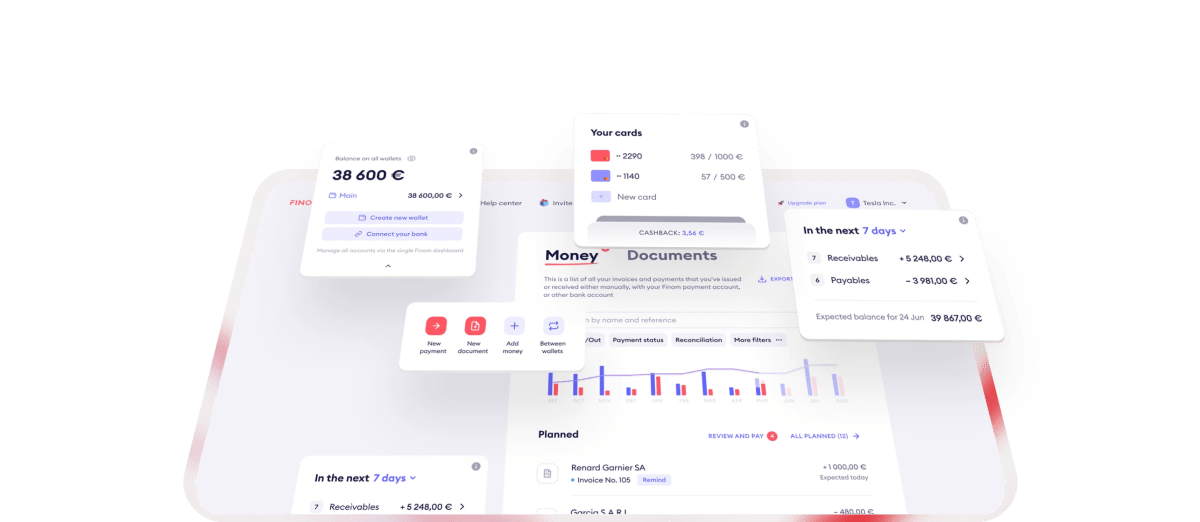

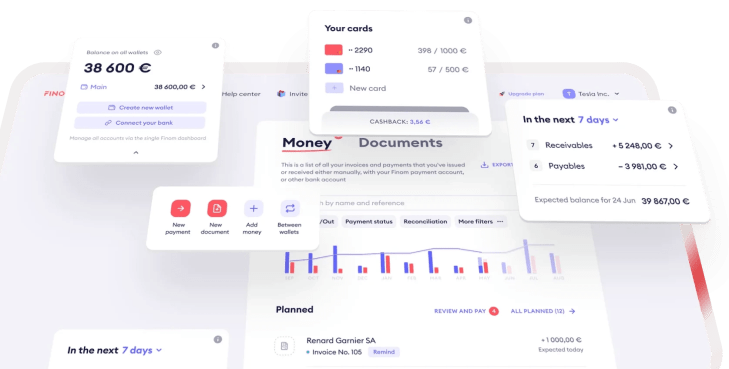

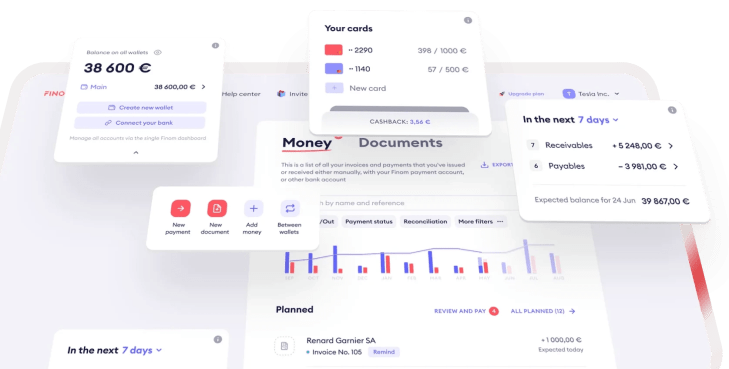

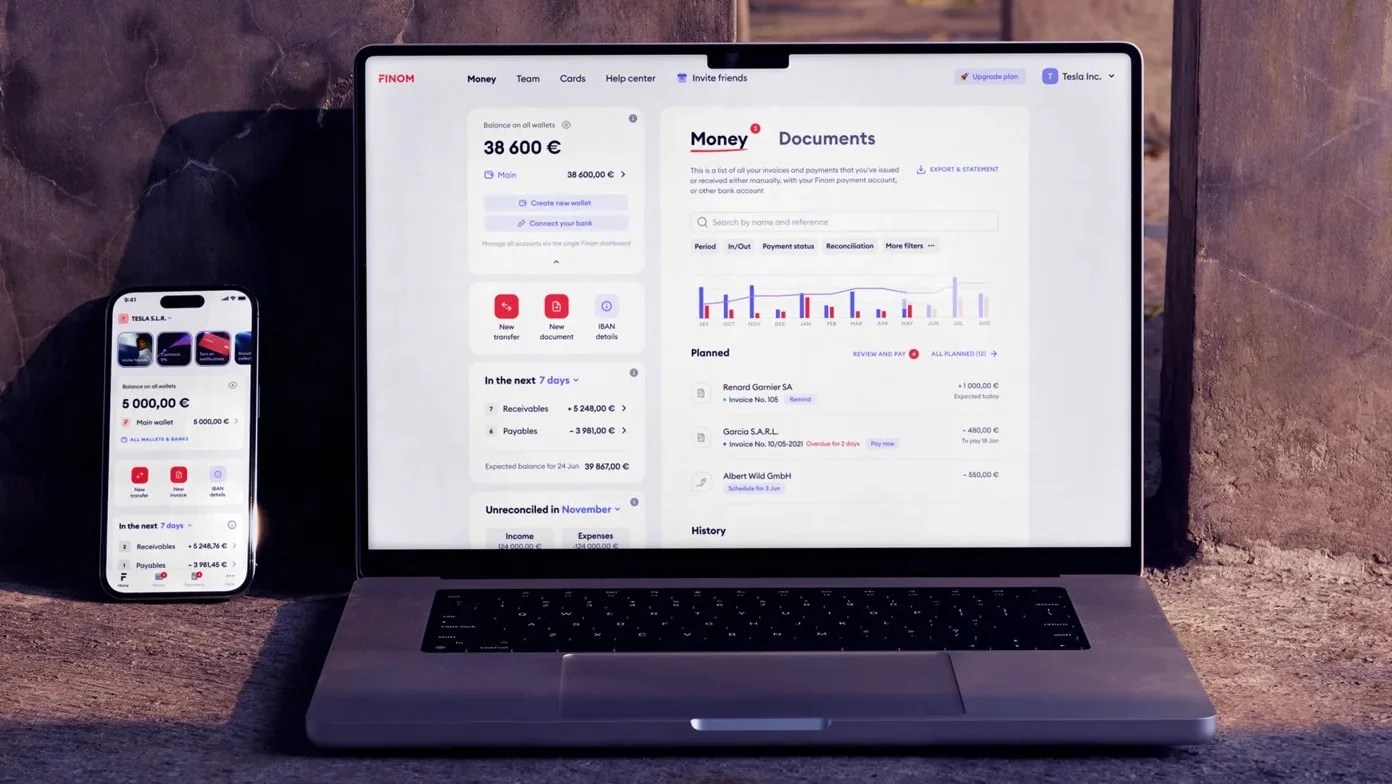

Finom on the internet Picture Credit: Finom

Finom touts its core promoting level as being a “fully integrated” product spanning banking, funds, invoicing, expense administration, accounting, and tangential companies akin to enterprise registration.

“This consolidation of services not only saves our clients hours each week, but also significantly reduces their costs by eliminating the need for separate services,” Novikov mentioned.

Present me the cash

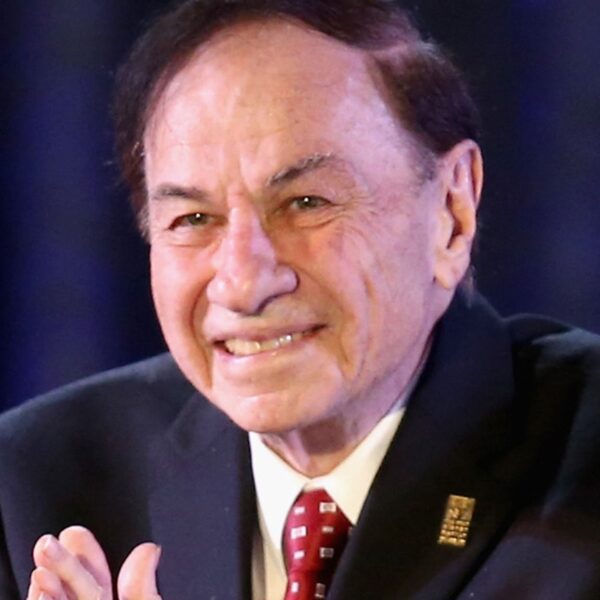

Finom founders: Andrey Petrov, Yakov Novikov, Oleg Laguta, Kos Stiskin Picture Credit: Finom

Finom had beforehand raised round €50 million, including a couple of seed tranches in 2020 and a hitherto undisclosed €33 million ($35 million) Sequence A spherical it closed in early 2022.

Whereas Finom is mostly banded collectively different startups difficult the established banking incumbents, it technically isn’t a financial institution — it holds what is named a Digital Cash Establishment (EMI) licence which permits it to supply companies just like what a financial institution presents, however it might probably’t supply issues like lending. Finom secured its EMI licence in its home Netherlands market, however this enables it to function throughout the complete European Union (EU).

With one other €50 million within the financial institution, the startup is well-financed to gear up its growth efforts because it seems to be to focus on the complete Eurozone by subsequent 12 months. On the time of writing, Finom claims some 85,000 prospects in Germany, Spain, France, Italy, and the Netherlands, and whereas it’s technically out there throughout the entire EU it should start localization efforts for added markets within the coming months.

The Sequence B spherical was co-led by new investor Northzone and current investor Basic Catalyst, which has beforehand backed the likes of AirBnb, Stripe, and Snap. Different individuals within the spherical embrace Goal International, Cogito Capital, Entrée Capital, FJLabs, and S16vc.