Nadzeya Haroshka

Shares of First American Financial (NYSE:FAF) have been a poor performer over the past year, missing out on the market rally as elevated interest rates have limited mortgage activity, reducing demand for title insurance. I last covered FAF in May, rating shares a “hold.” Given the recent decline in rates, shares have moderately outperformed, rising 7% while the market has gained 1%. With new financials and a much different macro picture than even a month ago, now is a good time to revisit First American.

In the company’s second quarter, First American earned $1.27, which beat estimates by $0.10 even as revenue declined by 2% to $1.6 billion, largely aided by favorable prior-year reserve adjustments. The company continues to struggle with weak mortgage activity, as high-interest rates have reduced affordability and greatly constrained refinancing activity. Macro headwinds have “suppressed demand,” according to management, which is clearly supported by the data.

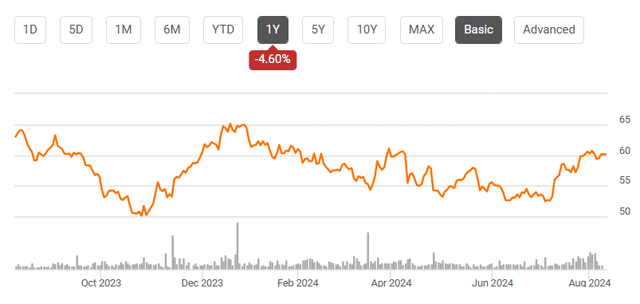

The business is no longer really deteriorating, but it is also not showing clear evidence of a turn either. As you can see below, mortgage applications plunged as interest rates rose, which is why the title business has faced pressure and why FAF stock has underperformed. While mortgage applications are now bouncing along their bottom, there has been no upward recovery just yet.

Mortgage Bankers Association

Within its primary title business, the company is seeing some benefit from higher home prices. Title insurance is paid as a percentage of mortgage balances, typically, so higher prices tend to lead to higher mortgages and thus higher title premiums. As a consequence, First American earned $3,818 per direct title order, up from $3,640 last year. Offsetting somewhat higher prices, volumes remain quite low.

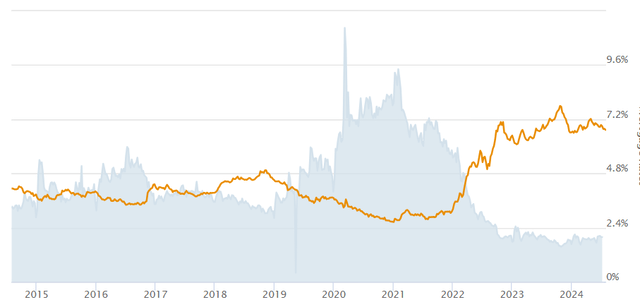

In Q2, purchases were 81% of orders. With mortgage rates spending much of the quarter around 7%, there are simply very few loans where it makes sense to refinance, and so this activity is very muted. Purchase orders rose 0.5%, while refinances rose by over 6%; defaults and other orders were quite weak.

Additionally, commercial activity continues to be soft. Commercial orders fell to 25,300 from 25,700, though revenue per order rose 1% to $11,700. Accordingly, commercial revenues fell by 1% to $177 million. One minor positive was that Commercial refinance activity improved in Q2. Because of concerns about commercial real estate, some properties have struggled to refinance and roll over maturing debt, but some of these pressures may be easing. Still, lackluster Q2 orders means Q3 will be tough for commercial revenues.

Total closed orders were up less than 1%. Moreover, the company has 169,600 total open orders, down slightly from 174,600 last year, which will be a headwind for revenue in the third quarter.

While management still expects “modest revenue growth,” First American emphasized results will come down to whether commercial revenue improves in Q4. With weak open orders in Q2, there is unlikely to be a quick ramp in Q3, which is why Q4 will be pivotal as to whether revenue ends up higher or lower than last year.

Despite lower revenue, there was $486 million of personnel costs, up $1 million from last year, given wage inflation. As such, the title unit’s pretax margin of 11.9% was down from 12.6% last year, as it continues to lose some operating leverage. One other headwind was that title insurance investment income was $126 million, down 11% or $16 million from last year.

FAF continues to face a headwind from deposit sorting. It collects escrow payments, which it earns interest on. Over the past year, borrowers have opted for escrow accounts that pay interest, reducing FAF’s net margin. Because of lower deposits, it has $9.9 billion of cash and investments from $11.6 billion at year-end. On 29% of escrow accounts, it no longer earns any economics. Encouragingly, this is down slightly from 30% in Q1, so the worst of this pressure may have passed.

One other item I am monitoring is insured losses. Title insurance typically has very little losses, given US property records are very well-kept. As such, losses are typically below 5%. However, paid title claims rose $11 million to $46 million. That comes after a weaker Q1 as well, with $94 million in losses YTD from $78 million last year.

Despite this, FAF took just $35 million of provisions, assuming a 3.75% loss rate and benefitting from $9 million of prior-year favorable revisions. Given substantially higher claims, it is somewhat surprising that the company made a favorable prior year reserve withdrawal. It also set aside $11 million less than it paid out, allowing total reserves to fall. If claims continue to run over $40 million, FAF may need to take additional reserves, which would be a headwind for profitability.

On the flip side, underwriting has improved in its small home warranty unit. Home warranty revenue was flat at $107 million, but margins rose to 15.2% from 12.9% last year. As a result, pre-tax income rose to $17 million from $14 million. The company faced a 45.8% claim loss rate from 49.2% in 2023. While frequency rose, severity was down. Inflation of construction-related items increased insurance severity as repairs became more expensive. With premium rates higher and inflation moderating, this pressure should be in the rearview mirror, and I expect this higher level of profitability to persist.

At the consolidated level, investment income was $126 million, though the corporate entity took $20 million of realized losses on investments. Excluding gains and losses, net investment income rose by $4 million to $130 million. FAF also maintains a strong balance sheet, with just 22.5% debt-to-capital. Alongside its 3.5% dividend yield, it did $41 million of repurchases in Q2 and $15 million of buybacks quarter to date. Its share count is down fractionally over the past year as a result.

More recently, mortgage rates have fallen and are now about 6.5%. This has helped lift FAF stock as investors hope it leads to increased home-buying and more refinancing activity. Generally speaking, rates need to fall 1% to make a refinancing worth it, so I would expect more of an acceleration if rates fell to the 6-6.25% area. Lower rates should increase home affordability; unless they are accompanied by increased stock market volatility (as seen this week), which can weigh on consumer sentiment.

On the earnings call in late July, management said that purchase orders fell 3% in July, so it was not seeing much of a benefit yet. Of course, rates fell more subsequent to that call, and so that commentary may already be dated. With shares up over 10% from their low, investors are clearly pricing in the prospect of increased mortgage activity. One offset to consider is that management expects investment income of $120 million in H2 due to lower balances and lower rates.

At an incremental 20% margin, it will need to boost title volumes by $30 million or 2% to offset this $6 million headwind. Additionally, this headwind assumes 3 Fed rate cuts; if there were 4 (i.e. one 50bp cut), the headwind could be a bit larger. In other words, the first 2% of growth just offsets lost investment income, and only future growth beyond that would leave FAF in a net positive position.

Given I do not expect the US to enter a recession, I am of the view that interest rates are unlikely to fall more quickly than currently priced, though they will likely fall more than I previously thought. As such, I believe optimism in shares may be a bit overdone, especially given further margin degradation and higher claims payments in Q2.

I previously expected $3.75-$4.25 in EPS. While volumes are likely to be a bit stronger, margins and investment income are a bit weaker, so I now see results in the $3.85-$4.10 range for this year. At just under $4 of EPS at the midpoint, FAF is now over 15x earnings. This is an expensive multiple, with most insurers like Chubb (CB) at 12x.

First America’s larger rival Fidelity National (FNF) trades at less than 12x title earnings, and it has shown better margin activity and cost control. As such, I cannot justify FAF’s premium, especially when I do not view FNF as particularly attractive. With the potential for interest rates to be less beneficial than hoped and FAF trading at a premium to FNF, I would use the recent rally to sell shares. I would wait for closer to 12x earnings or $50 to buy.

At current levels, we likely need to see mortgage rates drop below 6% to lead to enough refi activity to justify valuation. That makes FAF relatively unattractive in my view.