Althom

Earnings of First Commonwealth Monetary Company (NYSE:FCF) will probably change little or no this 12 months. Subdued mortgage progress will probably assist elevate earnings, whereas a commiserate improve in bills will restrain earnings progress. In the meantime, the margin will probably stay unchanged from the top of final 12 months. Total, I’m anticipating the corporate to report earnings of $1.54 per share for 2024, nearly unchanged from final 12 months. The year-end goal value suggests a excessive upside from the present market value. Therefore, I’m adopting a purchase ranking on First Commonwealth Monetary Company.

Final Yr’s Mortgage Progress Efficiency Can Be Repeated This Yr

First Commonwealth Monetary acquired Centric Financial Corporation in February 2023. Other than this acquisition, the natural mortgage progress was additionally fairly spectacular final 12 months. Together with the acquisition, the mortgage portfolio grew by 17.4%, and excluding the acquisition (which added $949.2 million of loans), the mortgage portfolio grew by 4.9% in 2023.

Administration talked about within the final conference call that it expects mortgage progress to be within the “low to mid-single-digits” vary. Contemplating the natural progress witnessed in 2023, administration’s goal for 2024 appears achievable.

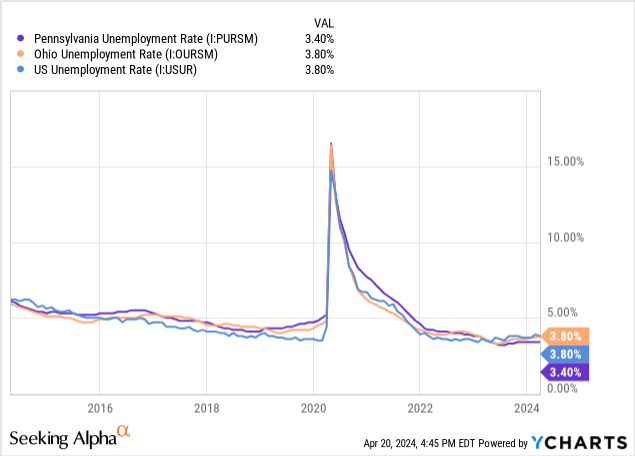

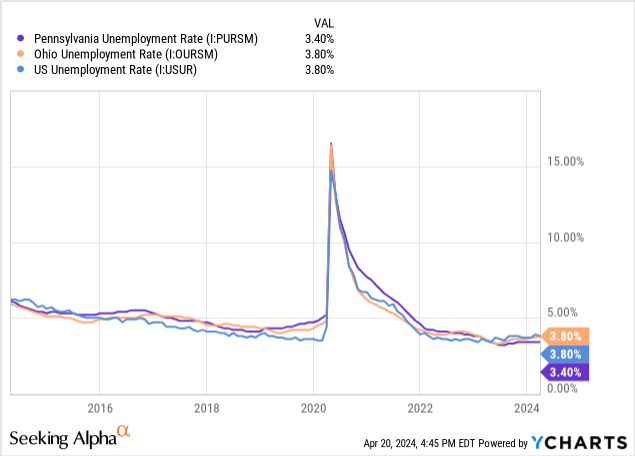

One other favorable issue is the regional enterprise setting. FCF operates in Pennsylvania and Ohio, each of which at present have robust job markets signifying a sturdy working setting. The unemployment charges of each states have improved relative to the nationwide common in latest months, as proven beneath.

Contemplating these components, I’m anticipating the corporate to attain a mortgage progress charge of 4.9% once more in 2024. As there have been no M&A bulletins up to now, I’m not assuming any acquired progress this 12 months.

Additional, I’m anticipating different stability sheet gadgets to develop in step with loans. The next desk reveals my stability sheet estimates.

| Monetary Place | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Web Loans | 6,138 | 6,660 | 6,747 | 7,539 | 8,851 | 9,284 |

| Progress of Web Loans | NA | 8.5% | 1.3% | 11.7% | 17.4% | 4.9% |

| Different Incomes Belongings | 1,292 | 1,495 | 2,443 | 1,678 | 1,893 | 1,931 |

| Deposits | 6,678 | 7,439 | 7,982 | 8,005 | 9,192 | 9,642 |

| Borrowings and Sub-Debt | 436 | 351 | 321 | 554 | 785 | 800 |

| Widespread fairness | 1,056 | 1,069 | 1,109 | 1,052 | 1,314 | 1,340 |

| E book Worth Per Share ($) | 10.7 | 10.9 | 11.6 | 11.2 | 12.9 | 13.2 |

| Tangible BVPS ($) | 7.5 | 7.7 | 8.3 | 7.9 | 9.1 | 9.4 |

| Supply: SEC Filings, Earnings Releases, Creator’s Estimates(In USD million except in any other case specified) | ||||||

Margin to Stabilize This Yr

The typical internet curiosity margin was 23 foundation factors greater in 2024 in comparison with 2023, and 32 foundation factors greater in 2023 in comparison with 2022. As rates of interest have peaked, they usually’re prone to decline this 12 months, I believe the margin will now not pattern upward.

Roughly 51% of the full mortgage portfolio is variable, as talked about within the final earnings presentation. Due to this fact, the typical mortgage yield shall be fast to re-price after each charge reduce. Sadly, FCF’s deposits are additionally fast to re-price. Deposits with variable charges (i.e. interest-bearing-transaction and saving accounts) made up 60% of whole deposits on the finish of December 2023.

Administration talked about within the final convention name that for the primary half of 2024, “the continued upward repricing of the loan portfolio is expected to roughly match the increase in the bank’s cost of funds.”

In consequence, I’m anticipating the margin to stay nearly unchanged this 12 months from the top of final 12 months.

Anticipating Earnings to Stay Unchanged

Other than the stability sheet and internet curiosity margin assumptions mentioned above, I’ve used the next assumptions to reach at my earnings estimate for 2024.

- I’m assuming non-interest bills will develop in step with the income, in order that the effectivity ratio stays nearly unchanged this 12 months. (Notice: the effectivity ratio is calculated as non-interest bills divided by the sum of internet curiosity revenue and non-interest revenue). My non-interest expense estimate can be in step with administration’s steerage. Administration talked about within the final convention name that it expects non-interest bills to run at about $68 million to $69 million 1 / 4 in 2024.

- I’m assuming the non-interest revenue will develop on the final five-year common this 12 months.

- I’m anticipating the provisions expense for mortgage losses to proceed eventually 12 months’s charge. The final five-year common is just not applicable on this case as a result of provisions had been irregular due to the pandemic.

Primarily based on the above assumptions, I’ve arrived at an earnings estimate of $1.54 per share for 2024, down 0.4% year-over-year. The next desk reveals my earnings estimate.

| Revenue Assertion | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Web curiosity revenue | 270 | 268 | 279 | 312 | 386 | 403 |

| Provision for mortgage losses | 15 | 57 | (1) | 21 | 15 | 16 |

| Non-interest revenue | 85 | 94 | 107 | 99 | 97 | 98 |

| Non-interest expense | 210 | 216 | 214 | 230 | 270 | 276 |

| Web revenue – Widespread Sh. | 105 | 73 | 138 | 128 | 157 | 156 |

| EPS – Diluted ($) | 1.07 | 0.75 | 1.44 | 1.37 | 1.54 | 1.54 |

| Supply: SEC Filings, Earnings Releases, Creator’s Estimates(In USD million except in any other case specified) | ||||||

First Commonwealth is scheduled to announce its first-quarter outcomes on April 24, 2024. Primarily based on the assumptions mentioned above, I’m anticipating the corporate to announce earnings of $0.37 per share for the quarter.

Dangers Seem Subdued

First Commonwealth’s threat degree seems low. The next are the one main sources of threat, they usually appear to be beneath management.

- Publicity to Workplace Loans – Workplace property loans accounted for five.3% of the full mortgage portfolio on the finish of final 12 months, as talked about within the presentation. In my view, this share isn’t excessive sufficient to be a supply of concern.

- Uninsured Deposits – Whole out there liquidity was 2.2 occasions the uninsured or unsecured deposits on the finish of December 2023, as talked about within the presentation. Due to this fact, uninsured deposits don’t current a lot of a menace to the corporate to stay in operation.

- Unrealized Losses – The unrealized mark-to-market losses on the Out there-for-Sale securities portfolio totaled $125.6 million on the finish of December 2023, which is simply 10% of the full fairness ebook worth.

Adopting a Purchase Score

First Commonwealth is providing a dividend yield of three.8% on the present quarterly dividend charge of $0.125 per share. The earnings and dividend estimates counsel a payout ratio of 33% for 2024, which is beneath the five-year common of 39%. Due to this fact, the dividend seems protected.

I’m utilizing the historic price-to-tangible ebook (“P/TB”) and price-to-earnings (“P/E”) multiples to worth First Commonwealth Monetary. The inventory has traded at a median P/TB ratio of 1.61 up to now, as proven beneath.

| FY19 | FY20 | FY21 | FY22 | FY23 | Common | |

| T. E book Worth per Share ($) | 7.5 | 7.7 | 8.3 | 7.9 | 9.1 | |

| Common Market Worth ($) | 13.4 | 9.6 | 14.1 | 14.5 | 13.4 | |

| Historic P/TB | 1.79x | 1.24x | 1.70x | 1.85x | 1.47x | 1.61x |

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the typical P/TB a number of with the forecast tangible ebook worth per share of $9.40 offers a goal value of $15.10 for the top of 2024. This value goal implies a 14.3% upside from the April 19 closing value. The next desk reveals the sensitivity of the goal value to the P/TB ratio.

| P/TB A number of | 1.41x | 1.51x | 1.61x | 1.71x | 1.81x |

| TBVPS – Dec 2024 ($) | 9.4 | 9.4 | 9.4 | 9.4 | 9.4 |

| Goal Worth ($) | 13.2 | 14.1 | 15.1 | 16.0 | 17.0 |

| Market Worth ($) | 13.2 | 13.2 | 13.2 | 13.2 | 13.2 |

| Upside/(Draw back) | 0.1% | 7.2% | 14.3% | 21.4% | 28.4% |

| Supply: Creator’s Estimates |

The inventory has traded at a median P/E ratio of round 10.9x up to now, as proven beneath.

| FY19 | FY20 | FY21 | FY22 | FY23 | Common | |

| Earnings per Share ($) | 1.07 | 0.75 | 1.44 | 1.37 | 1.54 | |

| Common Market Worth ($) | 13.4 | 9.6 | 14.1 | 14.5 | 13.4 | |

| Historic P/E | 12.5x | 12.7x | 9.8x | 10.7x | 8.7x | 10.9x |

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the typical P/E a number of with the forecast earnings per share of $1.54 offers a goal value of $16.70 for the top of 2024. This value goal implies a 26.5% upside from the April 19 closing value. The next desk reveals the sensitivity of the goal value to the P/E ratio.

| P/E A number of | 8.9x | 9.9x | 10.9x | 11.9x | 12.9x |

| EPS 2024 ($) | 1.54 | 1.54 | 1.54 | 1.54 | 1.54 |

| Goal Worth ($) | 13.6 | 15.2 | 16.7 | 18.2 | 19.8 |

| Market Worth ($) | 13.2 | 13.2 | 13.2 | 13.2 | 13.2 |

| Upside/(Draw back) | 3.3% | 14.9% | 26.5% | 38.2% | 49.8% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies offers a mixed goal value of $15.90, which means a 20.4% upside from the present market value. Including the ahead dividend yield offers a complete anticipated return of 24.2%. Therefore, I’m adopting a purchase ranking on First Commonwealth Monetary Company.