Fisker quickly misplaced observe of hundreds of thousands of {dollars} in buyer funds because it scaled up deliveries, resulting in an inner audit that began in December and took months to finish, TechCrunch has discovered.

The EV startup was finally in a position to observe down a majority of these funds or request new ones from prospects whose cost strategies had expired. However the disarray, which was described to TechCrunch by three individuals aware of the interior cost disaster, took workers and sources away from Fisker’s gross sales crew at a time when the corporate was trying to save lots of itself by restructuring its business model.

Fisker struggled to maintain tabs on these transactions, which included down funds and in some circumstances, the total worth of the automobiles, due to lax inner procedures for preserving observe of them, in accordance with the individuals. In just a few circumstances, it delivered automobiles with out accumulating any type of cost in any respect, they mentioned.

“Checks were not cashed in a timely manner or just lost altogether,” one of many individuals instructed TechCrunch. “We were often scrambling to find checks, credit card receipts and any wired funds a few months after a vehicle was sold.”

Alongside the interior audit, exterior auditor PwC was asking Fisker for extra documentation about its car gross sales as a part of the method of placing collectively the corporate’s annual monetary report, in accordance with two of the individuals. Fisker was usually unable to supply passable documentation, resulting in extra requests from PwC.

“Paperwork being collected wasn’t always being collected in full, or sent to the same places,” one other one of many individuals mentioned.

These sources requested anonymity as a result of they weren’t licensed to speak to the press about inner issues.

This inner confusion had put the corporate ready the place it couldn’t precisely say how a lot income it had generated, in accordance with the individuals, who famous it is without doubt one of the causes Fisker has but to file its annual monetary report for 2023.

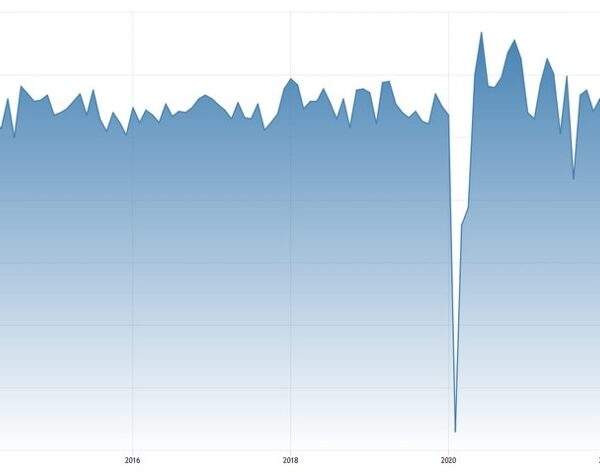

Monitoring down the funds might wind up providing little solace to the startup, which is on the point of chapter. Fisker has paused production of its solely car, the Ocean SUV, after operating into hassle meeting internal sales goals and struggling to support customers coping with quite a lot of high quality issues. It has alerted investors that it could not be capable of proceed operations and not using a contemporary infusion of money.

This week, the New York Inventory Alternate suspended the trading of Fisker shares and delisted the corporate, growing the probability that it gained’t be capable of elevate cash to outlive. The corporate gutted prices — by as a lot as 39% — on its remaining stock Wednesday morning.

Representatives for Fisker and PwC didn’t reply to requests for remark.

Crimson flags raised

Fisker has warned traders since final yr about issues with its inner accounting practices. In November, the corporate reported that it had found a number of “material weaknesses” in its inner monetary reporting.

The corporate initially mentioned it lacked “a sufficient number of professionals with an appropriate level of accounting knowledge, training and experience to appropriately analyze, record and disclose accounting matters timely and accurately.”

That assertion adopted the resignation of two chief accounting officers inside a month. “Specifically, there are insufficient controls to ensure that the accounting department is consistently provided with complete and adequate support, documentation and information, and that matters are resolved in a timely and effective manner,” the corporate wrote on the time.

In that very same submitting, Fisker revealed a second materials weak point involving the “risks of material misstatement over the accounting for inventory and related income statement accounts.”

On February 29, Fisker admitted in a press launch that it recognized a further materials weak point “in revenue and the related balance sheet accounts.”

This authorized jargon was a means for Fisker to confess what sources instructed TechCrunch: that it merely didn’t have the individuals or processes in place to correctly assemble its books.

Fisker’s poor inner procedures have created problems past preserving observe of funds.

The corporate has additionally struggled to maintain up with making the required funds to numerous state DMVs when organising new prospects, in accordance with the individuals.

This has resulted in not less than dozens of shoppers spending months with non permanent license plates. Some house owners have needed to trouble the corporate for multiple sets of non permanent plates, as they maintain expiring. The identical has been true for some house owners who’ve been stuck waiting for his or her title and registration.

Fisker employed contractors in February to assist resolve the title and registration issues, however the backlog was immense, in accordance with the individuals. One of many individuals mentioned that the crew was engaged on amending paperwork on orders stretching way back to August 2023.

“There was no infrastructure in place prior to spinning up the wheels of the sales machine,” one of many individuals mentioned.