Because the world waits for $65 billion funds tech big Stripe to go public, a wave of smaller startups continues to roll into the market to select up extra funds enterprise. In one of many newest developments, Danish firm Flatpay, which builds cost options for small and medium bodily retailers like retailers, eating places and salons, has raised €45 million ($47 million) led by Daybreak Capital.

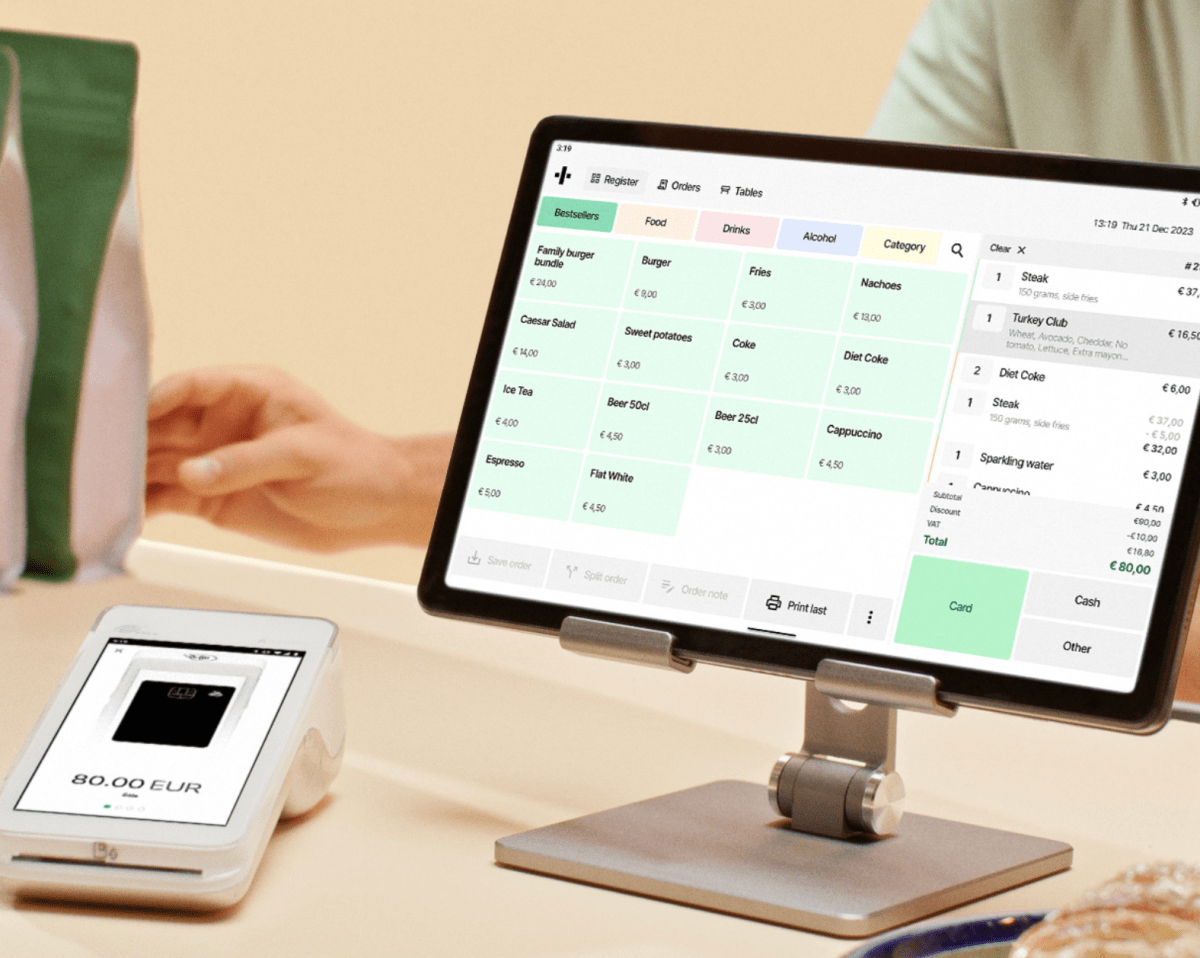

Flatpay had raised slightly below $21 million earlier than this newest Sequence B, and with this new funding, it’s now valued at properly over $100 million. The corporate plans to make use of the cash to develop into new markets in Europe and to construct out extra merchandise alongside the point-of-sale and card terminals that it sells right now. A few of these merchandise would possibly contain AI however solely as an enabler of sure options, moderately than a core service, mentioned Flatpay’s CEO Sander Janca-Jensen.

“We have been able to raise money without mentioning the AI buzz word,” he mentioned. “It seems to be rare these days.”

That €45 million is a powerful Sequence B within the present market in Europe, particularly when you think about the scale of the startup. Based in 2022, Flatpay presently has simply 7,000 prospects throughout Denmark, Finland and Germany.

Even with its revenues and buyer base each rising at a month-to-month price of 15%, Flatpay’s enterprise is only a drop within the service provider ocean.

There are more than 24 million SMBs in Europe; point-of-sale terminals within the area number more than 17 million; and there usually are not simply dozens however a whole lot of different funds providers — together with Stripe, Adyen, Sumup and PayPal, in addition to smaller gamers like SilkPay — all concentrating on the identical prospects as Flatpay.

However buyers suppose there may be a number of potential within the startup, sufficient to wager early and powerful, even within the present financial local weather.

Janca-Jensen, who co-founded the corporate with Rasmus Busk, Rasmus Hellmund Carlsen and Peter Lüth, mentioned the hole Flatpay noticed out there was an absence of actually easy options for retailers that need the comfort that expertise can deliver, with out the more durable facets that come together with it, reminiscent of troubleshooting, understanding the intricacies of fees, and integrating merchandise into their enterprise circulation.

The startup’s strategy to addressing that hole is available in 3 ways, he mentioned. On the client facet, Flatpay works with an outlined dimension of buyer: solely retailers that course of over €100,000 yearly, and the shoppers can’t be multiple-location chains or franchises. Janca-Jensen mentioned that it frequently rejects prospects in the event that they don’t meet these parameters.

On the expertise facet, it has matched its goal buyer dimension with the unit economics of its cost options to provide you with very fundamental, flat charges (therefore the startup’s identify) of 0.99% for terminal transactions and 1.49% for POS purchases. Flatpay then doesn’t set a minimal cost for single transactions, and it doesn’t cost charges if prospects are paying with worldwide playing cards. Janca-Jensen admitted that its mannequin signifies that Flatpay generally loses cash on transactions, nevertheless it total lowers the bar for utilization and encourages extra spend and total income for the corporate.

Maybe most apparently, on the gross sales facet, regardless of its deal with streamlined expertise, Flatpay solely sells by way of dwell gross sales visits. No on-line gross sales (though there are specialists who will assist organize these in-person gross sales visits and deal with assist), no digital visits, and no plans to introduce both.

Janca-Jensen mentioned he and his co-founders developed a keenness for direct discipline gross sales after they have been promoting dwelling alarm methods in a earlier life.

As with funds {hardware} and software program, safety is usually a arduous promote to prospects. Flatpay discovered that the one approach it might reliably seal offers was by promoting in particular person. And the one approach that salespeople can promote in particular person is by understanding the merchandise rather well. “You have to get salespeople to understand the product enough to explain it well to buyers. It sets high standards for how simple your product must be,” mentioned Janca-Jensen. “We like that challenge.”

Round half of Flatpay’s 200 workers are on the gross sales facet, he mentioned, cut up between those that assist organize gross sales visits and deal with assist; and people who go to prospects in particular person. Usually, they’re recruited from different retail roles moderately than software program gross sales.

“We steer clear of SaaS account executives and fintech people,” he mentioned. In his opinion, SaaS gross sales are really easy that individuals who work in that space are “too lazy and complacent” to make the grade for discipline gross sales.

To this point, within the three markets the place Flatpay operates, the intention has been to recruit very native salespeople who perceive the nuances of their respective markets. That appears to lift a number of questions on how properly this will scale long run, however Janca-Jensen brushes that concern apart, and buyers are equally bullish.

“The field sales model, when done well, works. You can localize and roll out teams in a cost-efficient way to explain on a local basis why a product makes sense,” mentioned Josh Bell, a normal companion at Daybreak who focuses on fintech.

He identified that iZettle — one other firm Daybreak backed — was additionally an early mover in utilizing discipline gross sales to promote its fancy new tech to non-technical prospects. “They were a winner, but even they never did it as well as Flatpay does this. Payments is huge, and Flatplay has touched just at a fraction of the opportunity.”

Denmark’s Seed Capital additionally participated on this spherical, together with different unnamed buyers.