Viktoriia Hnatiuk/iStock via Getty Images

Flow Traders (OTCPK:FLTLF) is a specialized trading company based in Europe, but its business model and volatile earnings profile doesn’t seem to offer much value for long-term investors right now.

Business Overview

Flow Traders is a European financial services company, focused on providing liquidity for Exchange-Traded Products (ETPs). It was founded in 2004 and is based in the Netherlands, being listed since 2015. Its free-float is about 68% of total shares and its shares trade in the U.S. on the over-the-counter market, while its current market value is about $920 million, being a relatively small-sized company by this measure.

The company is based in Amsterdam, but has throughout its history expanded its operations across the globe, having nowadays offices in the Americas, Europe, and Asia, and has about 600 employees.

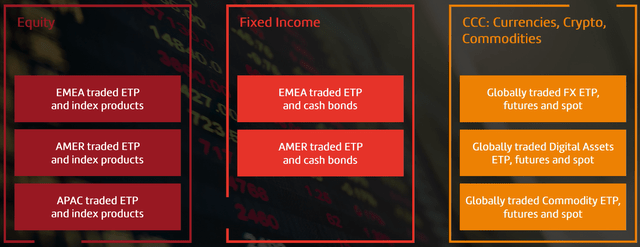

Flow Traders operates as a trading firm in the global financial markets, being specialized in ETPs. Its operations started mainly in Equities, but it has expanded its capabilities into fixed income, commodities, foreign exchange, and more recently to digital assets. Its main role is to provide liquidity in these asset classes to investors in all market environments, thus its business is a combination of brokerage and market maker.

This means its comparable companies include both brokerage firms and investment banks, as the company’s operations overlap different players across the financial services industry.

Its trading operations are based on three hubs, namely in Amsterdam, Hong Kong, and New York, having access to more than 180 trading avenues in some 40 countries. Flow Traders provides liquidity for more than 6,500 ETPs globally, both on- and off-exchange, for institutional customers including banks, asset managers, hedge funds, family offices, beyond others. Off-exchange, it provides liquidity on a request-for-quote basis, across several asset classes and derivatives products, including options and futures.

As a liquidity provider, Flow Traders do not have a directional opinion in the market, and generally does not assume market risk. It trades from its own capital and does not hold assets under management from its customers, does not provide financial advice, and does not have consumer clients. Moreover, it does not develop products of its own, trading ETPs from other providers, such as BlackRock (BLK) or Deutsche Bank (DB) for instance.

Therefore, its trading income does not depend on the direction of market prices, making a profit between the small price differences that are realized in buying and selling related assets. While this business model is similar to brokerage firms, Flow Traders make a profit mainly from trading and not from trading fees, which means being able to offer best execution is key to the sustainability of its business model.

Its growth strategy has been focused mainly on organic growth, through trading more products and covering more asset classes, while it has also benefited from ETP’s AuM growth, as more investors have allocated capital to these products over the past few years. Going forward, this strategy is not expected to change much, as Flow Traders should continue to focus on improving its trading capabilities and gain market share of the ETP market.

Additionally, the company also created a venture capital initiative to invest its own capital in start-ups, in the financial markets and digital assets industries, which potentially can boost its growth in the future through innovation, showing that its strategy is clearly more biased to organic growth rather than acquisitions. It aims to invest in strategic minority investments in more than 20 companies with an investment horizon of about 10 years, aiming to generate more revenue streams and further expand its operations to new markets and segments, which should be complementary to its core business.

Financial Overview

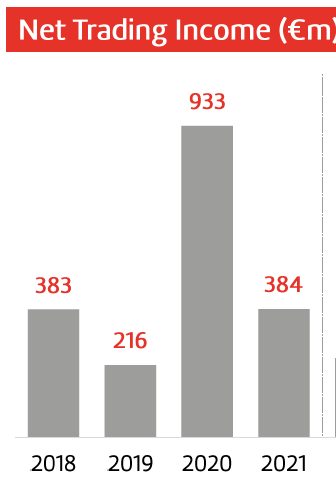

Regarding its financial performance, while Flow Traders has a positive track record over the past decade, its financial results can be volatile on an annual basis because its business tends to benefit from periods of increased volatility, such as 2020 due to the pandemic or 2022 due to the Ukraine war and higher than usual interest rate volatility.

Nevertheless, Flow Traders has been able to report higher net trading income (its measure most similar to revenue) over the past few years and report an EBITDA margin of about 50% through several market cycles. Its long-term goal is to reach annual net trading income above €1 billion, a level that was close in 2020 due to unusually high trading activity, but in more recent years its net trading income was much lower than its target.

Trading Income (Flow Traders)

Indeed, in 2023, Flow Traders’ total income was €304 million, a decline of 34% YoY, due to much more subdued customer activity as capital markets showed less volatility compared to the previous year. Its net trading income was €300 million, while other income was close to €4 million, representing unrealized gains in strategic investments within its venture capital unit. The majority of its revenue was generated in Europe, while the U.S. and Asia had smaller contributions.

On the cost side, its operating expenses increased by 1.5% YoY to €178 million, which is a relatively good outcome considering the general inflationary environment and wage growth pressures. Moreover, the company continues to invest in technology. Thus its moderated cost increase can be considered positive considering this backdrop. On the other hand, Flow Traders’ cost base is largely fixed and there isn’t much expense related to trading activity, which means its profitability declined considerably over the last year.

Indeed, its EBITDA was €67.5 million in 2023, a decline of 62% YoY, due to the combination of lower revenue and higher costs. Its EBITDA margin was only 22%, compared to 39% in the previous year, showing that is business can be quite cyclical and report large profitability swings in a relatively short period of time. Its net profit was only €59 million in 2023, representing a decline of 60% YoY, and its net profit margin was 19.5%.

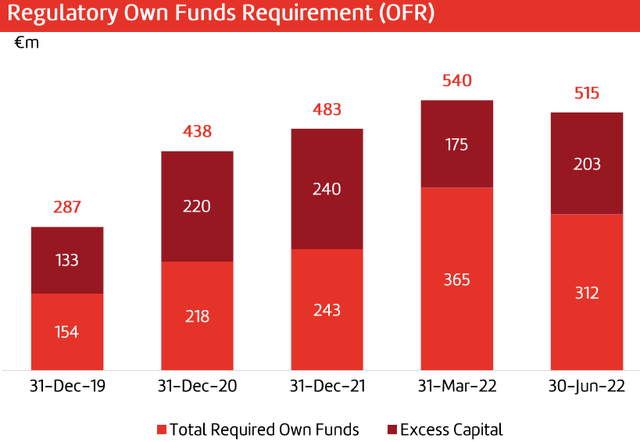

While Flow Traders is not a bank or a financial institution that needs to hold capital on a regulated basis, there are some capital constraints related to its business model. Prime brokers require the company to hold some minimum capital levels against market trades, representing therefore a capital requirement to some extent. Historically, Flow Traders capital position has been above required by prime brokers, which is a conservative position and allows it to not need to retain much of its annual earnings.

Due to this conservative balance sheet position, Flow Traders’ dividend policy is to pay at least some 50% of annual earnings to shareholders, through two instalments. As the company’s earnings are quite volatile and the company does not have a progressive dividend policy, this means its annual dividend is also volatile and follows its earnings path.

Indeed, its total dividend related to 2023 earnings was €0.45 per share, a decline of 70% YoY, showing that Flow Traders’ dividend can swing widely on an annual basis. At its current share price, it offers a dividend yield of about 2.4%, which is not particularly impressive in the European financial sector.

Going forward, Flow Traders only give guidance related to its operating expenses, which are expected to be relatively flat in 2024 compared to the previous year, as the company expects to reduce a little bit its overhead, but cost savings from this should be offset by investments in technology. Regarding revenues, this is largely outside of its management control and is quite hard to forecast, thus there is little visibility regarding its top-line and earnings growth over the next few years.

Regarding its valuation, considering the Flow Traders business is quite cyclical and its financial performance can be volatile, not surprisingly its shares trade at a relatively low valuation multiple. Indeed, Flow Traders is currently trading at some 10x forward earnings, which is a level similar to its historical average over the past five years, thus its shares appear to be fairly valued right now.

Conclusion

Flow Traders is a specialized trading company providing liquidity for ETPs and other off-exchange products, including digital assets, but this seems to be a niche market segment and the company’s growth prospects aren’t impressive over the long term. Moreover, its earnings profile is quite volatile and there is low visibility regarding its future performance, thus Flow Traders doesn’t seem to be a compelling play for long-term investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.