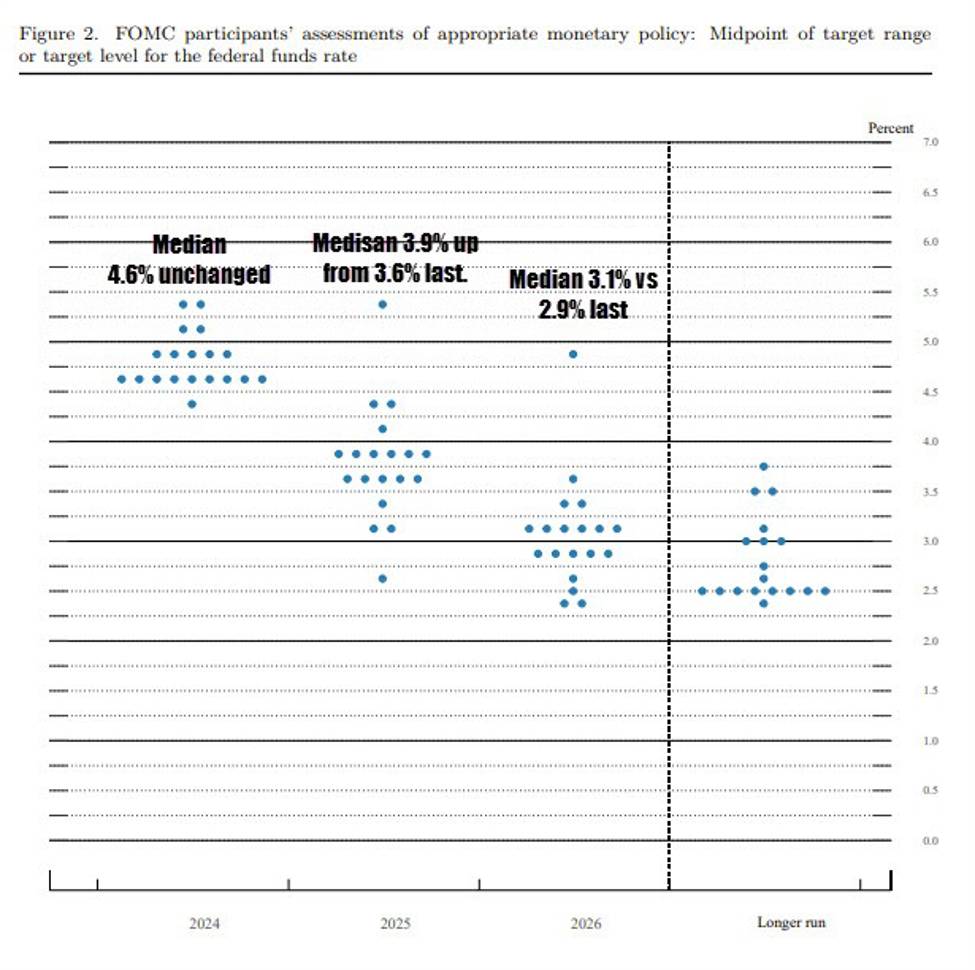

The FOMC dot plot from December 2024 confirmed the median price on the finish of 2024 at 4.6%. Within the March report:

- For 2024, the median fed funds goal price is now 4.6% vs 4.6% in December

- For 2025, the median fed funds goal price is now 3.9% vs 3.6% in December

- For 2026, the median fed funds goal price is now 3.1% vs 2.9% in December

Beneath is the brand new dot plot from March 2024:

For comparability, the dot plot from December 2023 confirmed the next:

The Dot plot from December 2023

Relating to the central tendencies for GDP, Unemployment and PCE inflation (headline and core) beneath is the desk with comparisons from December:

Fed Central Tendencies from March 2024

Highlights from the central tendencies:

- PCE inflation for 2024 unchanged at 2.4%

- Core PCE inflation for 2024 moved increased from 2.4% to 2.6%

- Unemployment for 2024 moved decrease from 4.1% to 4.0%

- GDP for 2024 moved increased from 1.4% to 2.1%

The USD has moved decrease.

- EURUSD moved from 1.08652 to the present price of 1.0876

- USDJPY moved from 151.59 to the present price of 151.48

- GBPUSD moved from 1.2719 to the present price of 1.2740

- USDCHF moved from 0.8906 to the present price of 0.8894

- USDCAD moved from 1.3550 to the present price of 1.3530

within the US inventory market

- S&P index moved from 5174.17 to 5196.17

- NASDAQ index moved from 16158.70 to 16254.59

- Dow moved from 39107 to 39245

US yields moved decrease:

- 2year yield, 4.672% moved to 4.634%

- 5-year yield 4.283% moved to 4.258%

- 10 yr yield 4.280% moved to 4.276%

- 30-year yield 4.431% moved to 4.448%

About 80 foundation factors of a cuts are priced out there from 75 foundation factors earlier than the discharge