Saddle up and prepare to the FOMC choice at 2 pm ET. As a reminder, there will not be an up to date dot plot launched with this choice however Federal Reserve Chairman Jerome Powell will maintain his normal press convention at 2:30 pm ET.

As a reminder, right here is the most-recent FOMC choice and I’ve highlighted parts that could possibly be altered:

Current indicators recommend that progress of financial exercise has slowed

from its robust tempo within the third quarter. Job beneficial properties have moderated

since earlier within the 12 months however stay robust, and the unemployment fee

has remained low. Inflation has eased over the previous 12 months however stays

elevated.

The U.S. banking system is sound and resilient. Tighter monetary and

credit score circumstances for households and companies are prone to weigh on

financial exercise, hiring, and inflation. The extent of those results

stays unsure. The Committee stays extremely attentive to inflation

dangers.

The Committee seeks to realize most employment and inflation at

the speed of two % over the longer run. In assist of those targets,

the Committee determined to keep up the goal vary for the federal funds

fee at 5-1/4 to 5-1/2 %. The Committee will proceed to evaluate

further data and its implications for financial coverage. In

figuring out the extent of any further coverage firming which may be

acceptable to return inflation to 2 % over time, the Committee

will keep in mind the cumulative tightening of financial coverage, the

lags with which financial coverage impacts financial exercise and

inflation, and financial and monetary developments. As well as, the

Committee will proceed decreasing its holdings of Treasury securities and

company debt and company mortgage-backed securities, as described in its

beforehand introduced plans. The Committee is strongly dedicated to

returning inflation to its 2 % goal.

In assessing the suitable stance of financial coverage, the Committee

will proceed to observe the implications of incoming data for

the financial outlook. The Committee could be ready to regulate the

stance of financial coverage as acceptable if dangers emerge that would

impede the attainment of the Committee’s targets. The Committee’s

assessments will keep in mind a variety of data,

together with readings on labor market circumstances, inflation pressures and

inflation expectations, and monetary and worldwide developments.

In the event you bear in mind the prior assertion, it added the phrase “any” to “the extent of any further coverage firming which may be

acceptable” in an indication that the Fed thought it might be done. In this edition, expect them to remove the hiking bias altogether. Expect it to be replaced with something like “In figuring out adjustments to financial coverage to keep up 2 % inflation over time…” or something neutral.

A surprise would be if they embrace an outright dovish stance where they say “in figuring out when coverage easing is perhaps acceptable” or something along those lines. That would lead to US dollar selling but with the March meeting already at 62% (on a big move from 40% earlier today), I’m not sure it’s that material.

In the first paragraphs, the characterizations of economic activity and inflation will also be important. The Fed may want to flag that it expects growth to slow this year and there’s a chance they could remove the line that inflation “stays elevated”.

Finally, the simplest way to take a more-neutral stance would be to change the line saying “the Committee stays extremely attentive to inflation

dangers” to something like “the Committee stays attentive to inflation and employment

dangers”.

Powell press convention

This will be a tricky one for Powell.

He may be asked to make the case for premature easing despite jobs and growth indicators that are still strong. The rational is that monetary policy works with a lag and even with a few rates cuts, they will still be restrictive.

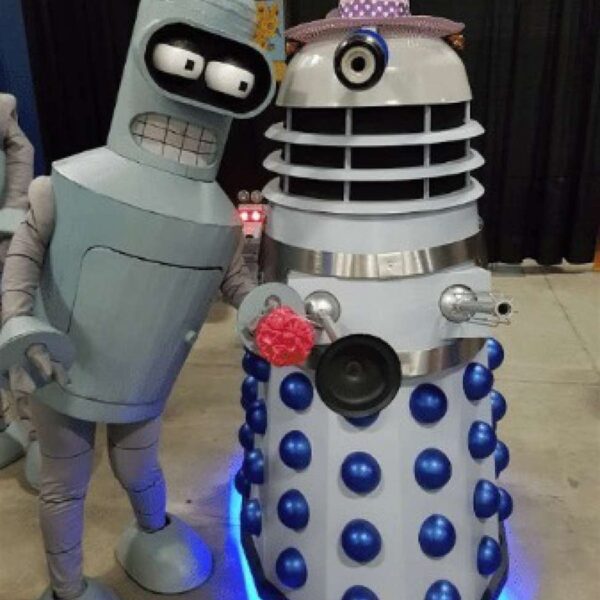

In the past few FOMC decisions, he’s surprised by highlighting potential downside risks from keeping rates too high and crushing growth. That was a surprise after many months of saying they would stridently complete the job on inflation. It led to memes like this:

How he strikes that balance today –and the conclusions that the market draws from it about the path of policy in the next two years — will be critical for the market response.

Because it stands, the market is pricing in 146 bps in fee cuts this 12 months.